Here are four stocks with buy rank and strong income characteristics for investors to consider today, September 14th:

Vermilion Energy Inc. (VET): This global oil and gas producer has witnessed the Zacks Consensus Estimate for its current year earnings increasing more than 100% over the last 60 days.

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 5.63%, compared with the industry average of 0.00%. Its five-year average dividend yield is 4.89%.

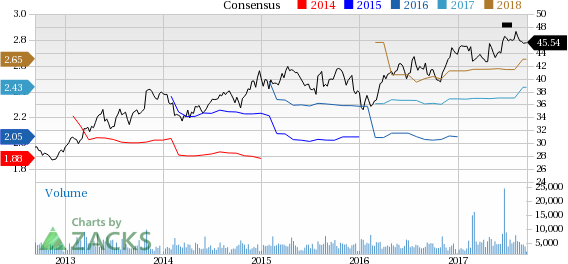

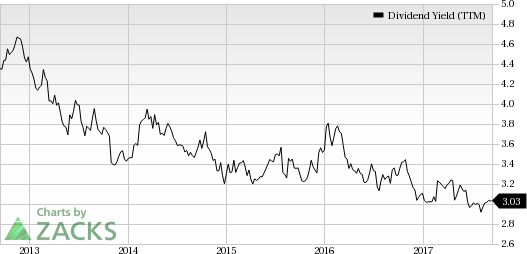

Thomson Reuters Corporation (TRI): This news and information provider for professional markets has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.4% over the last 60 days.

This Zacks Rank #2 (Buy) company has a dividend yield of 3.03%, compared with the industry average of 0.00%. Its five-year average dividend yield is 3.59%.

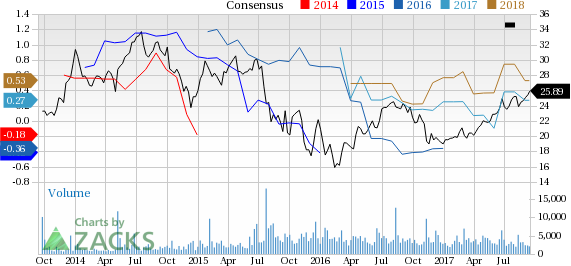

Triton International Limited (TRTN): This company involved in acquisition and leasing of intermodal containers has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.7% over the last 60 days.

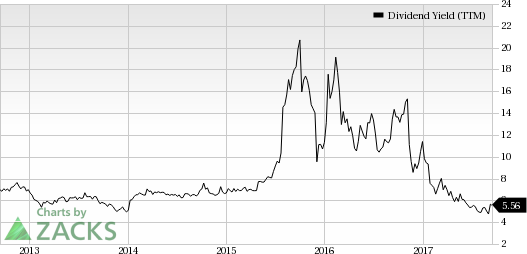

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 5.56%, compared with the industry average of 0.00%. Its five-year average dividend yield is 8.58%.

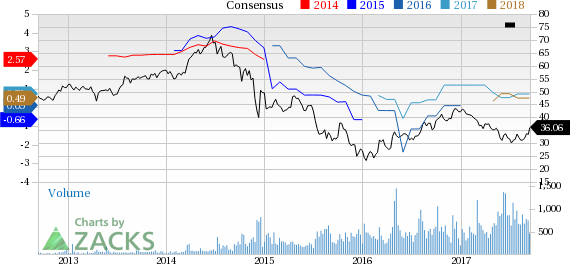

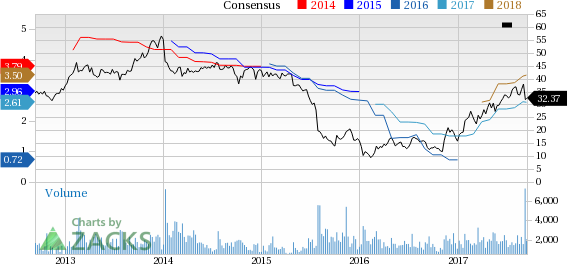

Pattern Energy Group Inc. (PEGI): This independent power company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 28.6% over the last 60 days.

Pattern Energy Group Inc. Price and Consensus

Pattern Energy Group Inc. Price and Consensus | Pattern Energy Group Inc. Quote

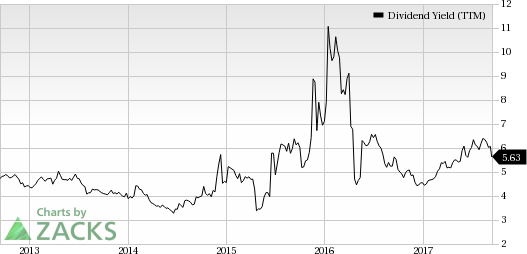

This Zacks Rank #2 (Buy) company has a dividend yield of 6.46%, compared with the industry average of 2.99%. Its five-year average dividend yield is 5.71%.

Pattern Energy Group Inc. Dividend Yield (TTM)

Pattern Energy Group Inc. Dividend Yield (TTM) | Pattern Energy Group Inc. Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Vermilion Energy Inc. (VET): Free Stock Analysis Report

Triton International Limited (TRTN): Free Stock Analysis Report

Thomson Reuters Corp (TRI): Free Stock Analysis Report

Pattern Energy Group Inc. (PEGI): Free Stock Analysis Report

Original post

Zacks Investment Research