Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, May 17th:

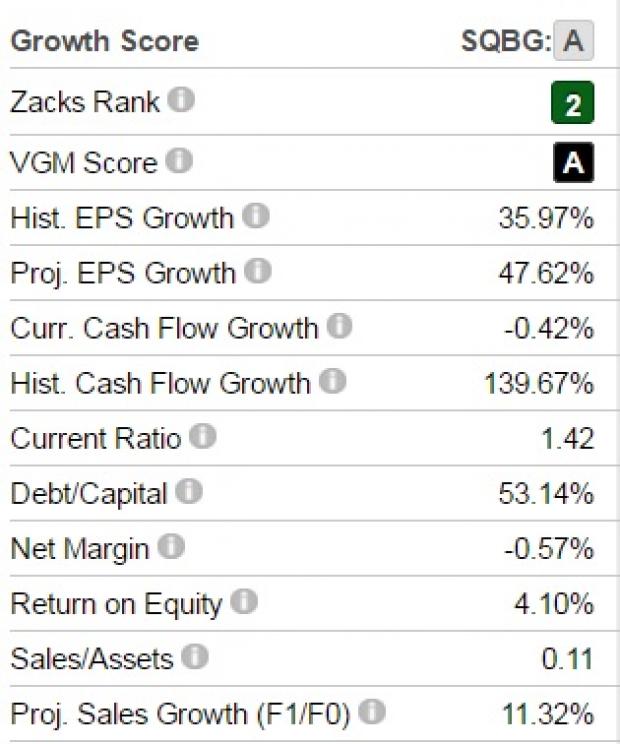

Sequential Brands Group, Inc. (SQBG): This apparel company, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4% over the last 60 days.

Sequential Brands Group has a PEG ratio 0.45, compared with 1.17 for the industry. The company possesses a Growth Score of A.

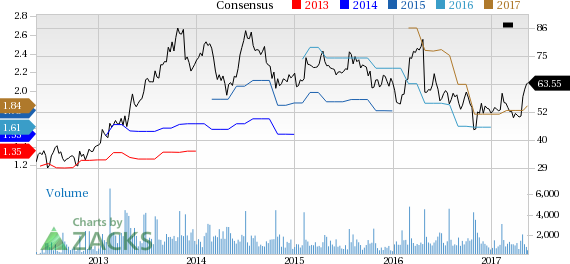

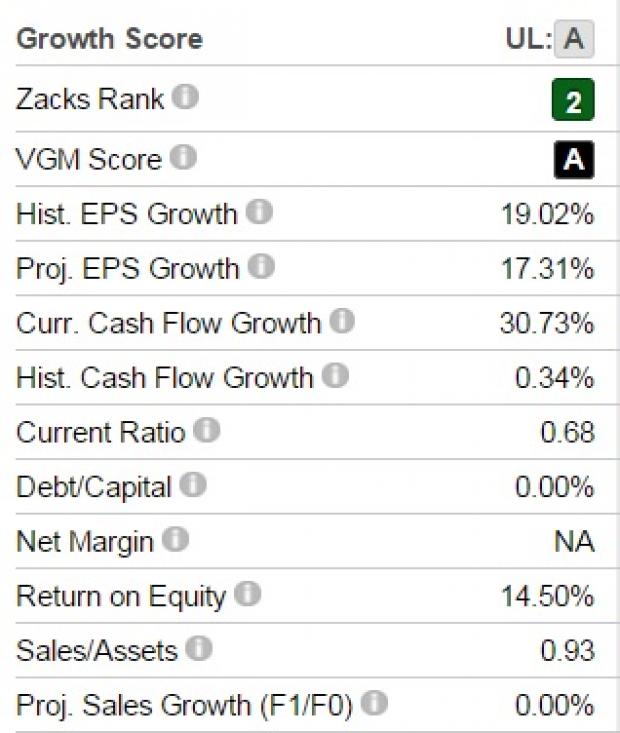

Unilever (LON:ULVR) PLC(UL): This cosmetics company, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings rising 8% over the last 60 days.

Unilever has a PEG ratio 1.83, compared with 2.36 for the industry. The company possesses a Growth Score of A.

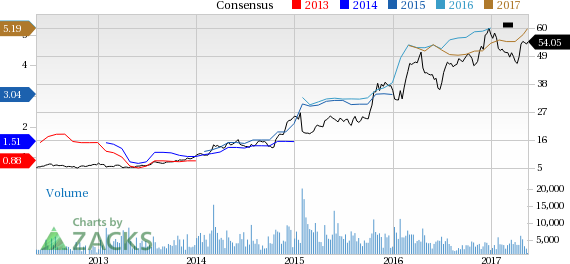

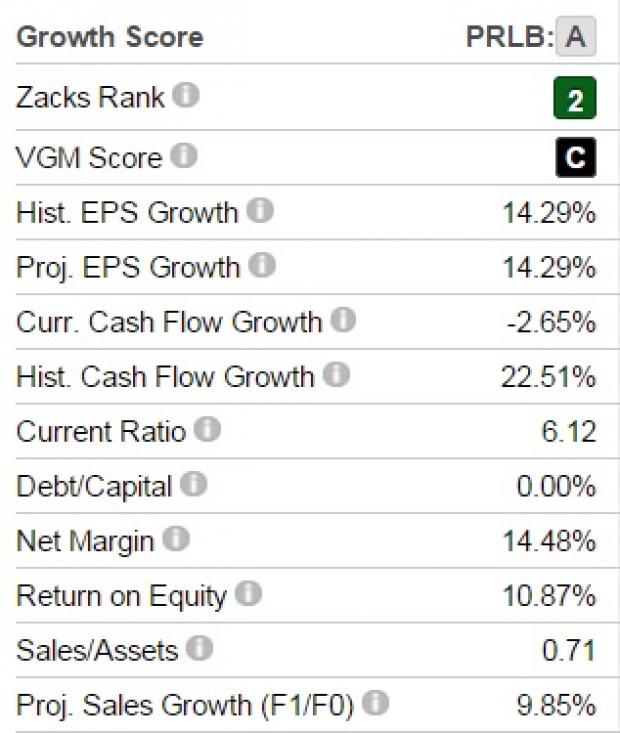

Proto Labs, Inc. (PRLB): This e-commerce enabled digital manufacturer, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.8% over the last 60 days.

Proto Labs has a PEG ratio 1.84, compared with 2.82 for the industry. The company possesses a Growth Score of A.

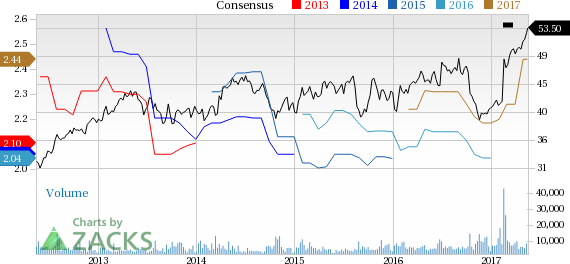

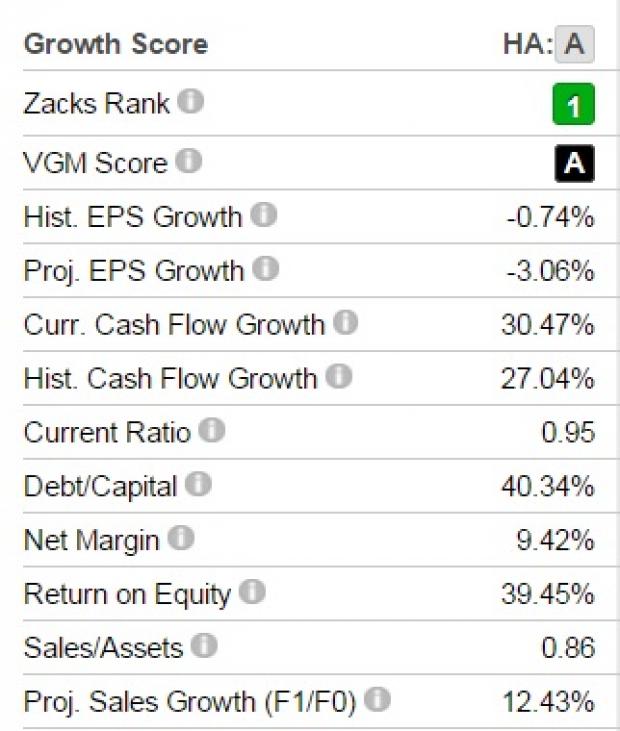

Hawaiian Holdings, Inc. (HA): This airline company, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings rising 8.8% over the last 60 days.

Hawaiian Holdings has a PEG ratio 0.63, compared with 1.05 for the industry. The company possesses a Growth Score of A.

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here

Sell These Stocks. Now.

Just released, today's 220 Zacks Rank #5 Strong Sells demand urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. These sinister companies because many appear to be sound investments. However, from 1988 through 2016, stocks from our Strong Sell list have actually performed 6X worse than the S&P 500. See today's Zacks "Strong Sells" absolutely free >>

Unilever PLC (UL): Free Stock Analysis Report

Sequential Brands Group, Inc. (SQBG): Free Stock Analysis Report

Proto Labs, Inc. (PRLB): Free Stock Analysis Report

Hawaiian Holdings, Inc. (HA): Free Stock Analysis Report

Original post

Zacks Investment Research