- U.S. 10-year Treasury yields have climbed to 16-year highs as investors digest the Federal Reserve's higher-for-longer rate mantra.

- As such, I used the InvestingPro stock screener to search for top-quality stocks that offer growth potential in a higher-yield environment.

- Below is a list of five names that are expected to provide some of the highest returns based on the InvestingPro models.

As U.S. Treasury yields climb to 16-year highs amidst expectations that the Federal Reserve will maintain higher interest rates for an extended period, investors are exploring strategies to weather the volatile financial landscape.

The yield on the U.S. 10-Year notes rose as high as 4.566% on Tuesday, a level not seen since October 2007, before pulling back to 4.51% at time of writing.

Looking ahead, I expect the 10-year yield to establish a new, higher, range in the weeks ahead, potentially topping the 5% handle in response to the Fed's hawkish longer-term rate outlook.

While rising yields can present challenges, they also create opportunities, especially in specific sectors and stocks known for their resilience and income potential.

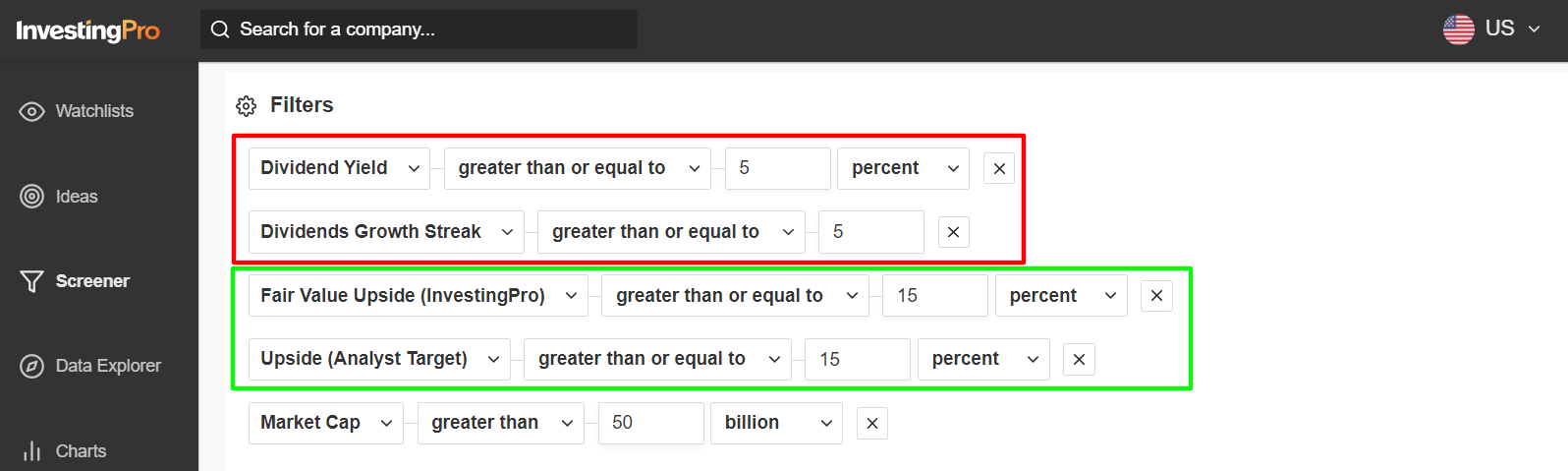

Amid the current backdrop, I used the InvestingPro stock screener to identify top-quality stocks that offer growth potential in a higher-yield environment.

Source: InvestingPro

I first scanned for stocks with a dividend payout yield of at least 5% and a dividend growth streak greater than or equal to five years.

I then filtered for companies with potential upside of at least 15% based on both InvestingPro ‘Fair Value’ models as well as Wall St. analyst price targets.

And those companies with a market cap of $50 billion and above made my watchlist.

Once the criteria were applied, I was left with a total of just five companies.

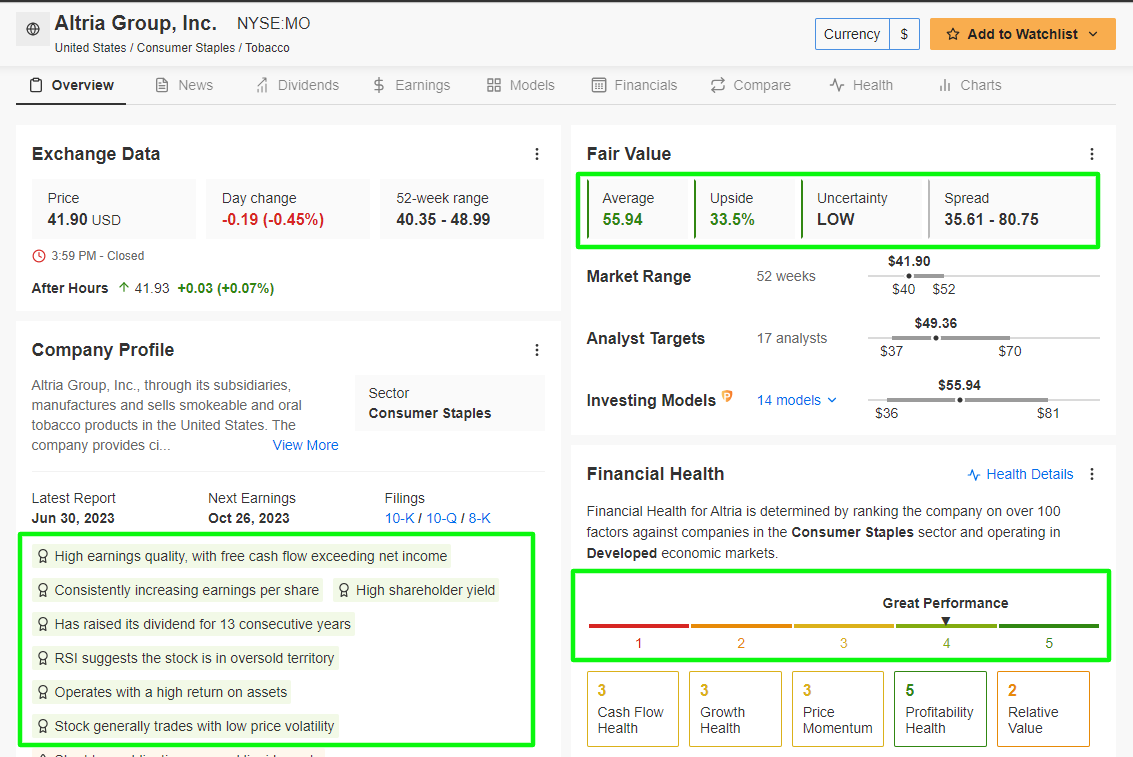

1. Altria Group

Why It's Attractive: Altria's (NYSE:MO) strong dividend history, combined with its substantial dividend yield, has long made it an income investor's favorite.

The cigarette manufacturing company has proven over time that it can provide investors with higher dividend payouts regardless of the economic climate. Indeed, Altria has raised its annual dividend for 54 years running, earning it the prestigious title of ‘Dividend King’.

Source: InvestingPro

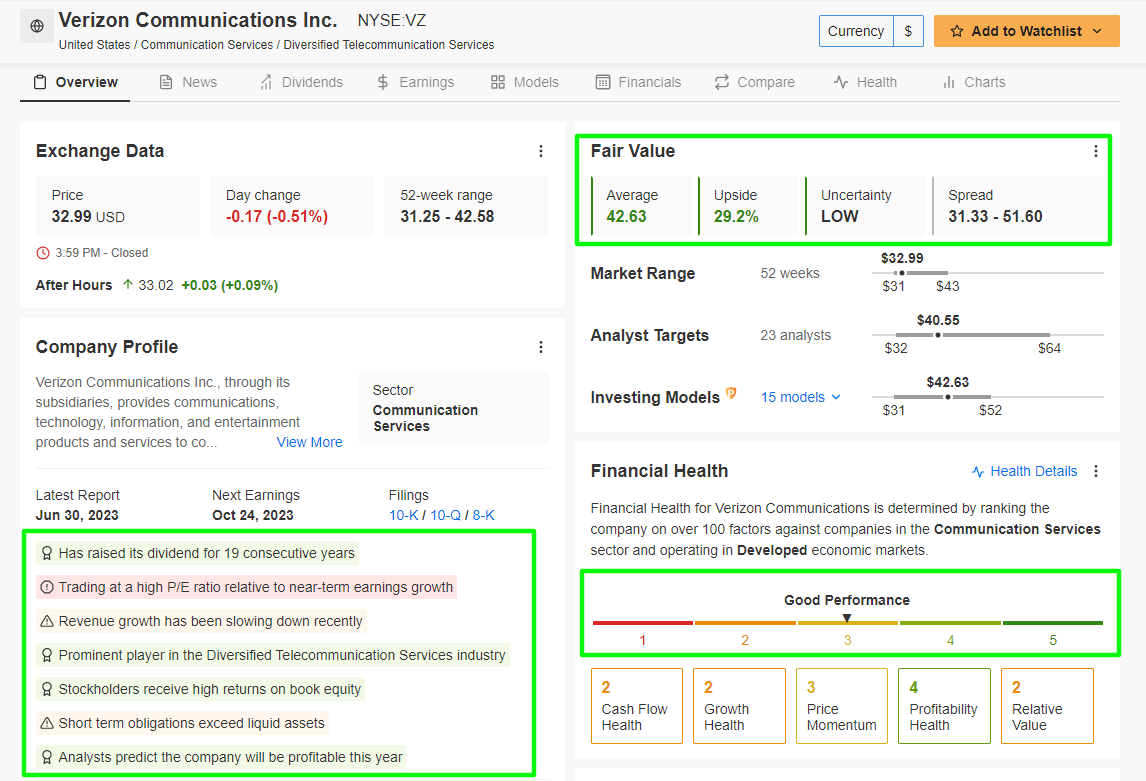

2. Verizon Communications

Why It's Attractive: Verizon (NYSE:VZ)'s steady cash flows and reliable dividend payments make it a popular choice amongst dividend investors. The telecommunications conglomerate is the eighth highest-yielding stock in the S&P 500.

Beyond its sky-high yield, Verizon has an impressive streak of annual dividend increases spanning 19 years, a testament to its stellar performance and its vast reservoir of cash.

Source: InvestingPro

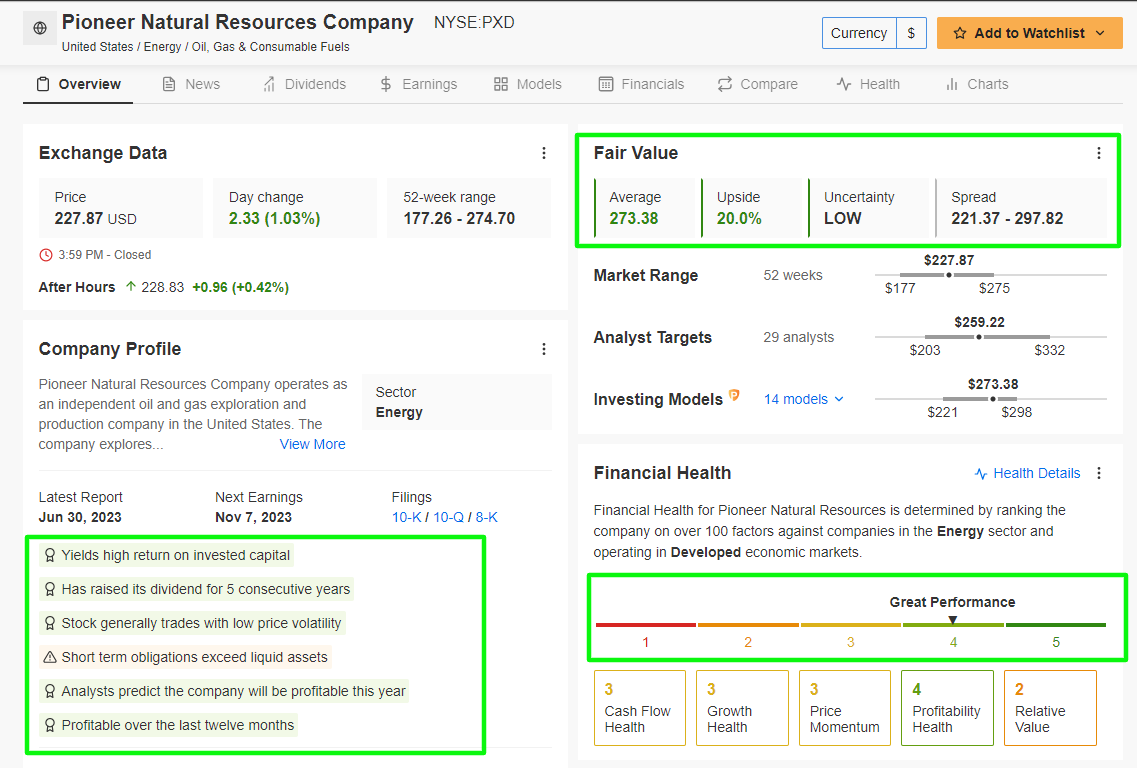

3. Pioneer Natural Resources

Why It's Attractive: Pioneer Natural Resources' (NYSE:PXD) allure stems from its strategic position in the energy sector, particularly its commitment to responsible oil and gas production. As energy prices rise in a higher yield environment, Pioneer's assets are poised to benefit, translating into potential growth for investors.

The Irving, Texas-based onshore energy driller has seen its balance sheet improve rapidly thanks to soaring oil prices, allowing it to grow its dividend payout for the past five years.

Source: InvestingPro

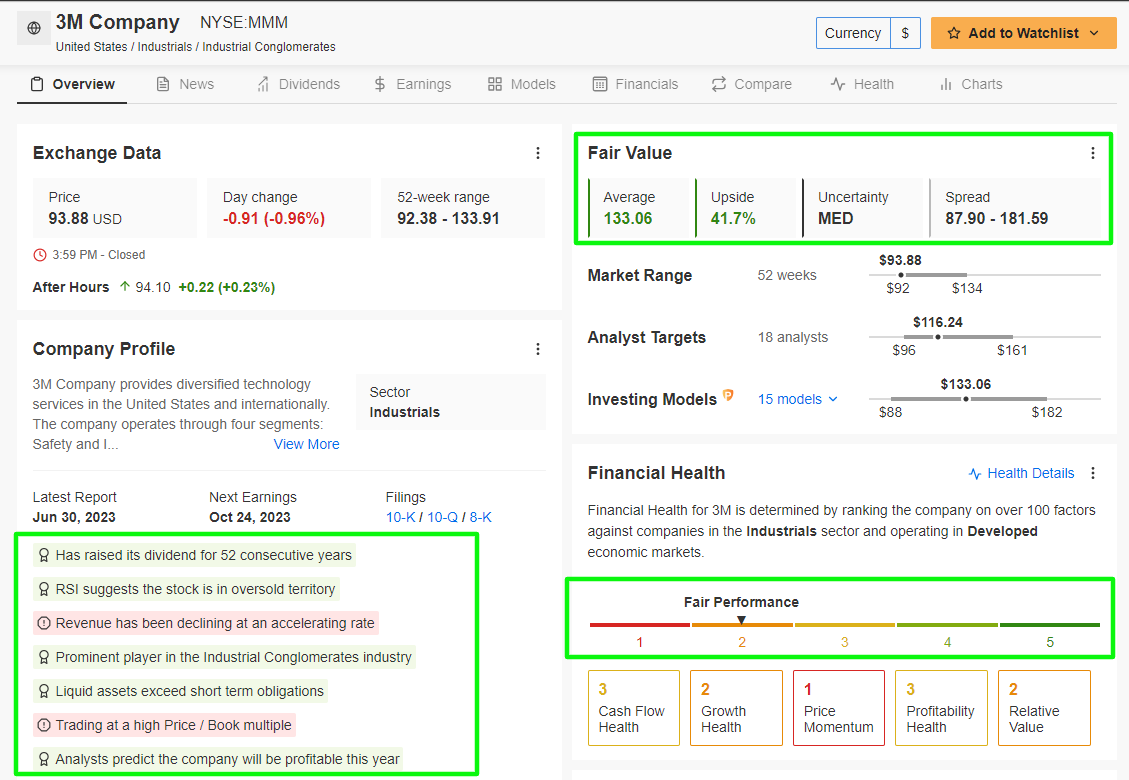

4. 3M Company

Why It's Attractive: 3M (NYSE:MMM) has a resilient business that has successfully weathered plenty of storms in the past. This conglomerate boasts a wide-ranging product portfolio that transcends international boundaries, providing both stability and growth potential, even amid economic uncertainties.

Not only do shares currently yield a market-beating 6.39%, but the industrial giant has raised its annual dividend for a whopping 52 years in a row.

Source: InvestingPro

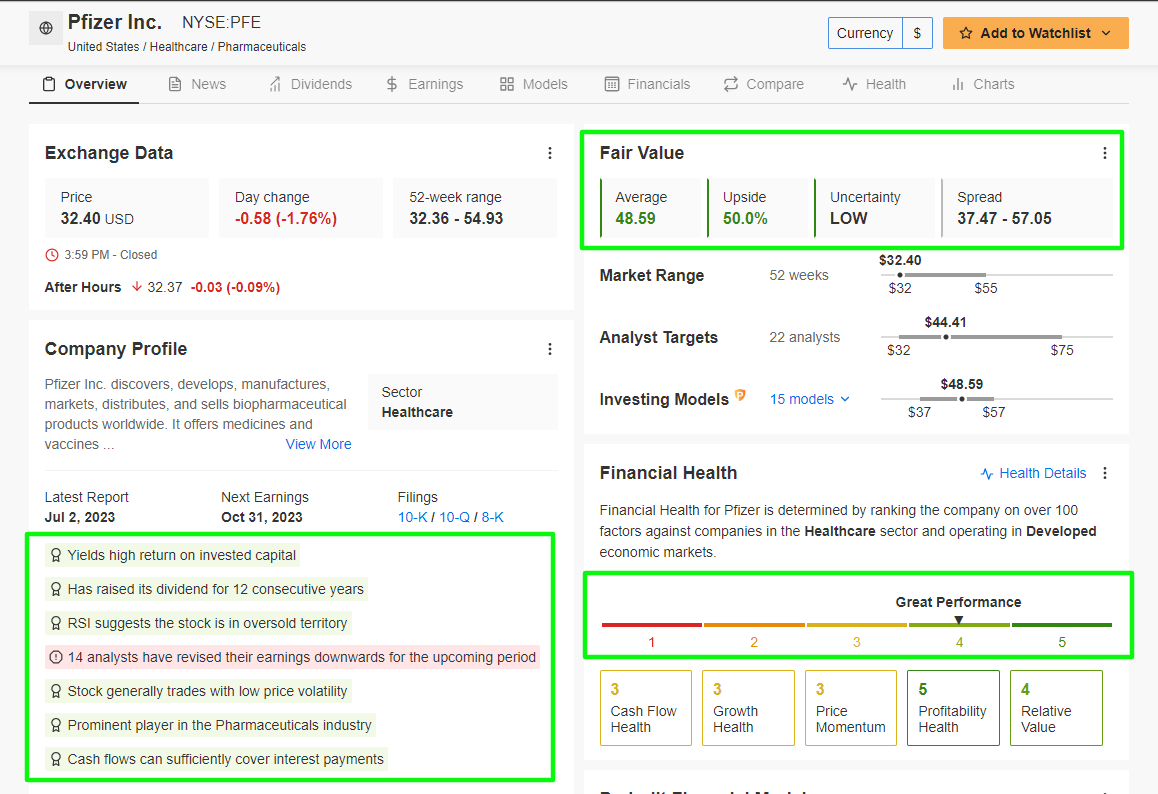

5. Pfizer

Why It's Attractive: Pfizer's (NYSE:PFE) recession-resistant pharmaceuticals business provides stability and growth potential in the healthcare sector.

The company’s consistent cash flows and disciplined financial management enhance its dividend sustainability, making Pfizer a solid option amid the current environment. The ‘Big Pharma’ company has raised its dividend distribution for 12 straight years.

Source: InvestingPro

Looking for more actionable trade ideas to navigate the current market volatility? The InvestingPro stock screener helps you easily identify winning stocks at any given time. Start your 7-day free trial to unlock must-have insights and data!

***

Disclosure: At the time of writing, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM). Additionally, I have a long position on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.