Asian markets fell on Friday as investors keep a nervous watch on developments in the G20 summit, with trade top of the agenda and a key focus on the much-anticipated meeting between Donald Trump and Xi Jinping.

Equities have enjoyed a largely positive couple of weeks on hopes for progress in the head-to-head between the leaders of the world’s top two economies, though the possibility of failure continues to make dealers nervous.

As heads of the 20 leading economies started the summit in Osaka, Trump said he was hopeful for Saturday’s talks with Xi, saying “I think it will be productive”, adding that “it will be a very exciting day”.

Traders were biding their time, pushing regional markets lower, with Shanghai ending down 0.6 percent while Tokyo and Hong Kong were each off 0.3 percent.

Sydney shed 0.7 percent, Singapore and Seoul slipped 0.2 percent apiece, while Taipei, Manila and Mumbai were also down, though Wellington and Jakarta edged up.

In early trade London added 0.1 percent, Paris was flat and Frankfurt rose 0.4 percent.

While most observers are not expecting a final deal to come out of the Trump-Xi talks, the broad consensus is for some sort of agreement to press on with negotiations, which stalled last month when the US president hiked tariffs on some Chinese goods.

“The Trump-Xi meeting at the G20 is front and centre,” said Neil Wilson, chief market analyst at Markets.com.

“I would think that for Trump and Xi to agree to delay the additional tariffs and for detailed talks to resume would be sufficient to leave investors happy that things are moving, albeit simply kicking the can down the road a little longer so it’s closer to the 2020 White House election for Trump.”

But there remains some uncertainty about how the meeting will go, with the Wall Street Journal reporting that Xi plans to demand the US reverse a ban on doing business with Huawei as a condition for kickstarting talks.

The White House, however, said there were “no preconditions to these talks”.

Hannah Anderson, JP Morgan Asset Management global market strategist, was also cautious.

“We have watched this movie before: China and the US talk, leaks from policymakers on both sides encourage speculation we are close to a deal, things fall apart, the US presses forward with higher tariffs and markets express their displeasure with corrections and higher volatility.”

While the China-US trade row is the major issue, Trump’s spats with Japan and India over tariffs are also in focus.

Earlier Friday the US president said he expected some “very big” deals with the two countries, both of which he has previously blasted for what he calls unfair levies.

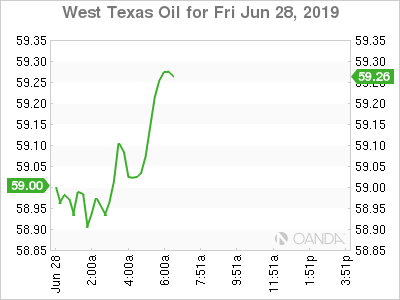

Oil prices were slightly lower but remain supported by this week’s surprise jump in US stockpiles and tensions in the Middle East, while dealers are awaiting next week’s meeting of OPEC and other top producers led by Russia, where they will decide on the future of their output cap.

“Expectations going into the weekend are looking cautiously optimistic for higher oil prices,” said OANDA senior market analyst Edward Moya.

“While some of the rhetoric on Chinese demands on Huawei and Trump’s unpredictability have many sceptical… both sides have political motivations to wrap up a trade deal by the fall and that would require a resumption of a constructive dialogue,” he said.

“Russia is likely to play ball (over the output caps) as they seek to secure further investment and trade deals with the Saudis.”