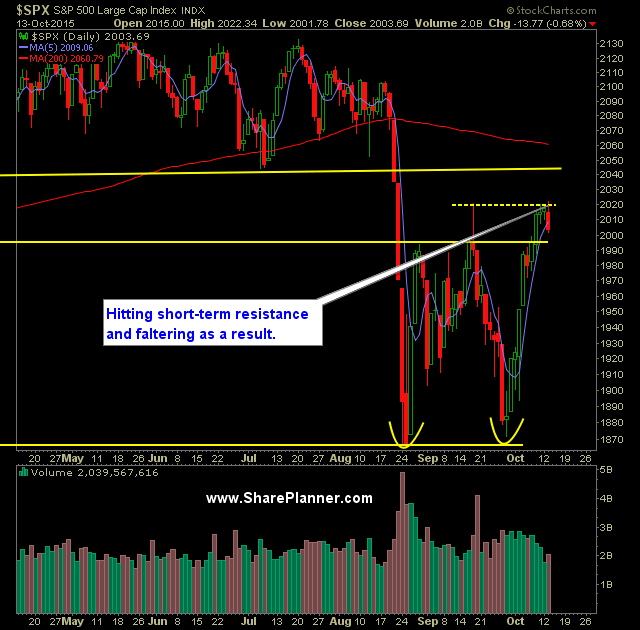

Technical Outlook:

- SPX is faltering as it struggles to break through and close above the highs of 9/17 of 2020.

- 3-day range on the 30-minute SPX chart was broken yesterday on a move below 2006.

- Yesterday represented the biggest sell-off since the entire rally started on 9/29.

- Yesterday was a minor sell-off and doesn't mean the rally is over. However, it is important to wait and see whether the rally has a desire to continue at this point.

- N:SPY volume saw a noticeable pick up in volume from the day before, however, overall it was almost half of what the average volume has been of late.

- The low-volume sell-off on the SPY suggests that this pullback we saw yesterday is being conducted in an orderly manner with no real signs of panic.

- VIX ended its record-tying losing streak of 10 consecutive days, by rallying 9.3% to close at 17.67.

- Ultimately, I wouldn't be surprised if the current rally in equities continues until VIX goes sub-11 again.

- Despite the decline yesterday, T2108 (% of stocks trading above the 40-day moving average) doesn't show any level of panic or concern at this moment with it only declining 8% to 60%.

- Most concerning event to me yesterday was the fact that SPX closed below the 5-day moving average. This MA has offered a great deal of support throughout the current rally. Bulls will need to recapture this MA rather quickly.

- 2059 is the break-even level for the market on the year. It also happens to be where the 200-day moving average is sitting at.

- The Fed has never raised interest rates at a point where the market was trading lower on the year.

My Trades:

- Sold N:EL yesterday at $83.04 for a 3.1% gain.

- Did not add any new swing-trades to the portfolio yesterday.

- 30% Long / 70% Cash

- Remain long: O:SBUX at $58.67, N:DIS at $105.88, O:GOOGL at $676.40

- My focus in trading remains to trade to the long side.

Chart for SPX: