Technical Outlook:

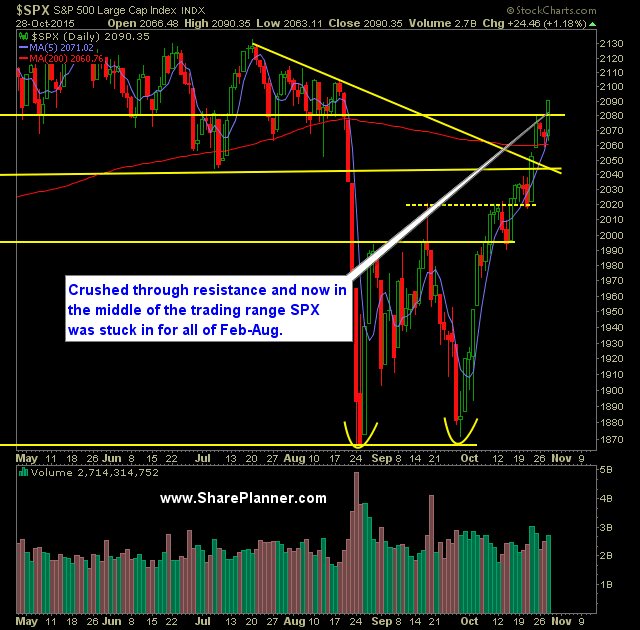

- Following the FOMC statement yesterday, in which they did not raise rates, SPX managed to rally over 1.1% to close at 2090 and at new rally highs.

- Market now setup for a possible test of all-time highs, when less then a month ago it was trading at 1871. Kind of insane really.

- Despite the FOMC meeting yesterday,N:SPY still failed to register above average volume. I can't remember the last time I ever saw that.

- Some pundits think that the Fed has opened the door to a rate hike in December. I'm not buying it.

- Bull flag on the 30 minute chart was confirmed with a breakout yesterday afternoon.

- This market is a perfect example of how an overbought market can stay overbought far longer than one might expect.

- VIX dropped another 7.1% down to 14.33. I expect at some point for VIX to test the 11-12 range before ultimately seeing any real selling pressures.

- T2108 (% of stocks trading above the 40-day moving average) is still trading in a consolidated range. closing 16% higher at 64%. A close above 70% would push it out of this range.

- Seasonally, this is the strongest time for the stock market, so a major rally like what we are seeing is no big surprise and not at all uncommon.

- Support for now appears to remain solid above the 200-day moving average.

- Ultimately, price on SPX is entering a range that has notoriously been difficult trading for most and one that vacillates consistently within a narrow range.

- 10-day moving average continues to be a strong barometer of market direction - a close below it would represent a short-term reversal.

My Trades:

- Added two new long positions yesterday.

- Did not close out any positions yesterday.

- 40% Long / 10% Short / 50% Cash

- Remain long: N:DIS at $105.88, N:MSI at $70.66

- Remain short: N:BBY at $34.49.

- Will look to add 1-2 new swing-trades to the portfolio today.

Chart for SPX: