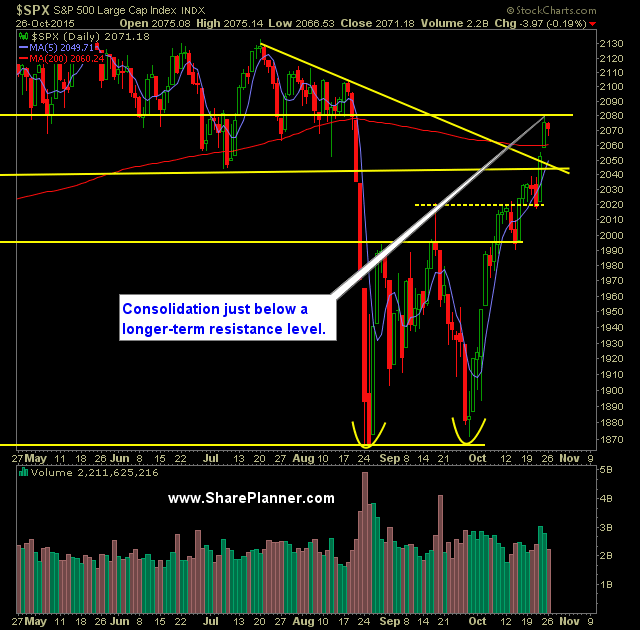

Technical Outlook:

- SPX 2079-80 offering some resistance with price consolidating just underneath.

- Support for now appears to remain solid above the 200-day moving average.

- Opening/Closing prices of the past two trading sessions continue to remain tightly bound to each other.

- Volume was extremely light on SPDR S&P 500 (N:SPY) yesterday, and well under half of what we have seen the last two trading sessions.

- This is FOMC week. While I don't expect them to raise rates, the market may continue in a holding pattern until an announcement comes out.

- VIX rallied for a second straight day, finishing 5.7% higher at 15.29.

- After a hard rally on SPX 30 minute chart, nice bull flag pattern forming.

- Despite the rally of the past two days and the week prior, the T2108 (% of stocks trading above the 40-day moving average) has completely flat-lined. I am watching for a downside break at this point below 55% (currently at 65%). The flat-lining indicator is a major divergence against this market rally.

- Ultimately, price on SPX is entering a range that has notoriously been difficult trading for most and one that vacillates consistently within a narrow range.

- 10-day moving average continues to be a strong barometer of market direction - a close below it would represent a significant market reversal.

- The Fed has never raised interest rates at a point where the market was trading lower on the year. Currently, SPX is trading in positive territory heading into Wednesday's announcement.

My Trades:

- Did not add any new swing positions yesterday.

- Sold N:MFC yesterday at 16.81 - flat trade.

- 20% Long / 80% Cash

- Remain long: N:DIS at $105.88, N:MSI at $70.66

- Will look to add 1-2 new long positions today on continued market strength.

Chart for SPX: