Technical Outlook:

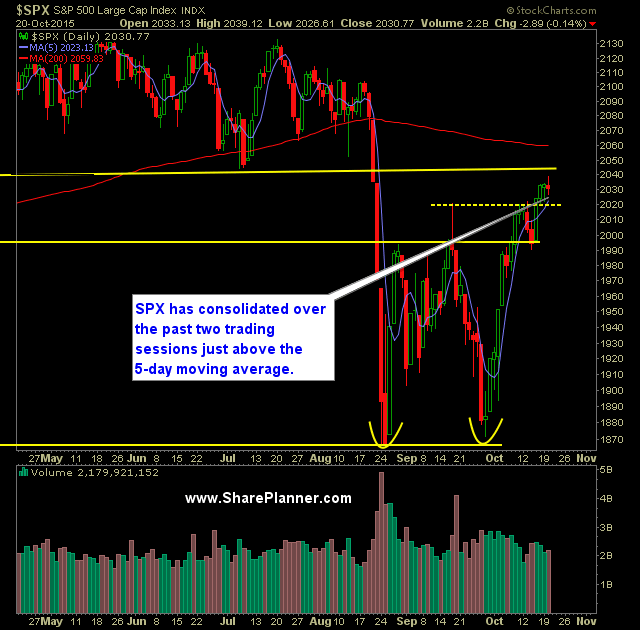

- Quiet day of trading yesterday as SPX consolidated for a second straight day.

- Slight uptick in volume from the day prior, but once again, extremely low overall.

- N:SPY just a shade below major resistance at $204.11, which represents the underside of the February through August trading range of this year.

- SPX testing key downward resistance at 2039 yesterday off of the July highs. A break above this price level is key here.

- VIX bounced 5.1% yesterday to close at 15.75. I still hold on to the theory that VIX will ultimately get back down to the 11-12 area before any significant bounce.

- Dip buyers are continuously coming in strong during recent market opens of late, keeping the market from any hard sell-offs.

- T2108 (% of stocks trading above the 40-day moving average) shows that stocks in general are holding their recent highs

- Essentially there are three resistance levels to watch: 1) Lower channel, range resistance at 2040 as shown below, 2) Declining resistance off of the July highs, which currently sits at 2039, and 3) 200-day moving average which also coincides with SPX's break even level at 2059.

- Continue to watch the 10-day moving average going forward - there has been multiple occasions where SPY has bounced off of this level.

- SPX has undoubtedly cooled off some from its meteoric rise from earlier this month. However, this is expected and quite common even in the strongest of rallies. The upward moves going forward will be more measured and less euphoric.

- On the weekly SPX chart, there is a nice double bottom that has formed and strong upward momentum playing out.

- SPX 30 minute chart has a nice layer of consolidation at its recent highs.

- The Fed has never raised interest rates at a point where the market was trading lower on the year.

My Trades:

- Added one new long position to the portfolio yesterday.

- Sold O:GOOGL yesterday at $684.46 for a 1.2% gain.

- 60% Long / 40% Cash

- Remain long: N:DIS at $105.88, O:FB at $95.09, N:MA at $95.51, N:CVX at $91.28, O:MAR at $74.40.

- My focus in trading remains to trade to the long side.

Chart for SPX: