The second-quarter reporting cycle seems to have started off on a solid note, with a slew of positive surprises coming in on both the earnings and revenue fronts. Also, earnings and revenue growth have bettered expectations.

As of Jul 25, 128 companies on the S&P 500 index reported their quarterly numbers, per the Earnings Outlook. Of these, 77.3% delivered positive earnings surprises, while 70.3% surpassed the top-line expectations. In fact, total earnings for these companies were up 7% from the year-ago quarter, while revenues increased 4.2%.

Total second-quarter earnings for the S&P 500 companies are projected to rise 7.2% from the year-ago period, with total revenue increase of 4.5%, according to the Earnings Trends of Jul 19. While this looks encouraging, we note that the earnings and revenue growth pace is still tracking below the first quarter 2017 level. Thus, with this initial growth picture we cannot conclude that the second-quarter earnings cycle is going to be outstanding.

The performance of the index is not restricted to a single sector, and of the 16 Zacks sectors, six are expected to witness an earnings decline in the second quarter. Of these, Autos and Conglomerates are likely to be the major drags.

Tobacco Stocks form part of the Consumer Staples sector. The second-quarter earnings’ numbers for the sector looks decent, with year-over-year earnings growth of 3.9% and revenues increase of 1.5%. In fact, the sector is currently placed at top 13% of the Zacks Classified sectors (2 out of 16).

Conversely, we observed that the Consumer Staples sector has lagged the broader market in the last one year. While the sector gained 2.4%, the S&P 500 index advanced 14.3%.

Let’s see what awaits the following Tobacco stocks that are queued up for second-quarter earnings releases on Jul 27.

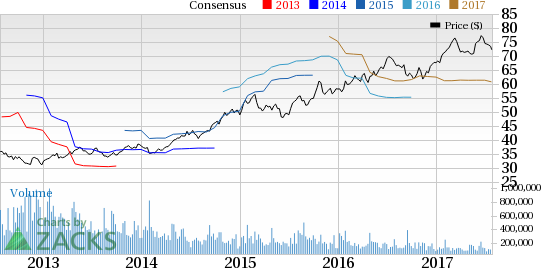

Leading tobacco maker, Altria Group, Inc. (NYSE:MO) is scheduled to report before the market opens. We note that the company’s earnings have lagged the Zacks Consensus Estimate by 1.4% in the first quarter, but delivered an average positive earnings surprise of 0.7% in the trailing four quarters.

Our proven model does not conclusively show earnings beat for Altria this quarter. This is because a company needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Altria has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 86 cents. Moreover, the company carries a Zacks Rank #4 (Sell), which further makes surprise prediction difficult.

In fact, Altria has been witnessing declining demand for cigarettes due to the ongoing anti-tobacco campaigns, government restrictions and higher cigarette prices in response to rising taxes on it. Additionally, consumers’ preference for e-cigarettes or substitutes for cigarettes are largely affecting the cigarette volume. (Read more: Will Declining Volumes Hurt Altria's Earnings in Q2?)

Another company, which is expected to report tomorrow, is Vector Group Ltd. (NYSE:VGR) that manufactures and sells cigarettes. The company’s earnings have missed the Zacks Consensus Estimate in two of the last four quarters. However, it has pulled off an average positive earnings surprise of 2.2% in the trailing four quarters.

The company is unlikely to beat earnings estimates this quarter, as it has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 18 cents. Although the company’s Zacks Rank #3 increases the predictive power of ESP, we need a positive Earnings ESP in order to be confident about an earnings surprise. You can see the complete list of today’s Zacks #1 Rank stocks here.

We note that Vector Group’s earnings estimates have been largely stable ahead of the earnings release.

Tobacco Industry’s Headwinds

The tobacco industry has been facing many challenges, which have been weighing upon the companies’ performance. Furthermore, the restrictions imposed on tobacco companies are lowering cigarette consumption. Also, the U.S. Food and Drug Administration (FDA) have made it mandatory for tobacco companies to use precautionary labels on cigarette packets to dissuade customers from smoking. These regulations adversely impact the company’s top line and, in turn, its overall profitability.

Recently, tobacco giant, Philip Morris International Inc. (NYSE:PM) , reported another dismal quarter with its second-quarter 2017 results, wherein both its top line and bottom line lagged expectations. Moreover, the company lowered its earnings guidance for 2017 due to higher impact of unfavorable currency. (Read more: Philip Morris Earnings & Sales Miss Estimates in Q2)

So, let’s wait and see whether the afore-mentioned companies are able to outweigh these headwinds and put up a good show this quarter.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. SeeZacks' 3 Best Stocks to Play This Trend >>

Altria Group (MO): Free Stock Analysis Report

Philip Morris International Inc (PM): Free Stock Analysis Report

Vector Group Ltd. (VGR): Free Stock Analysis Report

Original post

Zacks Investment Research