The Cryptocurrency world is full of clashes and rivalries but none is quite as prominent as the fight between Ripple Labs and Stellar Lumens.

Both were founded in the city of San Francisco by the same man who founded the infamous Mt. Gox exchange, Mr. Jed McCaleb.

After several ideological disputes with Ripple, Jed left to start Stellar. There's a great in-depth article on observer.com that tells the entire tale.

Steller has been praised by the crypto-community for being less corporate and more decentralized than her older sister. The economics also work a bit different. Ripple has a fixed supply of 100 Billion tokens, most of which are held by the owners of Ripple, including Jed.

Today's Highlights

Some Stocks Perspective

Inflation Print Today

Bitcoin's Integration

Please note: All data, figures & graphs are valid as of February 14th. All trading carries risk. Only risk capital you can afford to lose.

The Big Number

Stock markets are looking rather flat this morning as we await some big news this afternoon.

Precisely one hour before the opening bell on Wall Street the US government will announce the inflation figures for the month of January. This specific print represents an excellent opportunity for those who like to trade the news and here's why...

Over the last two weeks, the global stock markets have been selling off big time. Many analysts claim that we should have expected this as a "technical correction" because over the entire course of 2017 the markets have been going in a single direction.

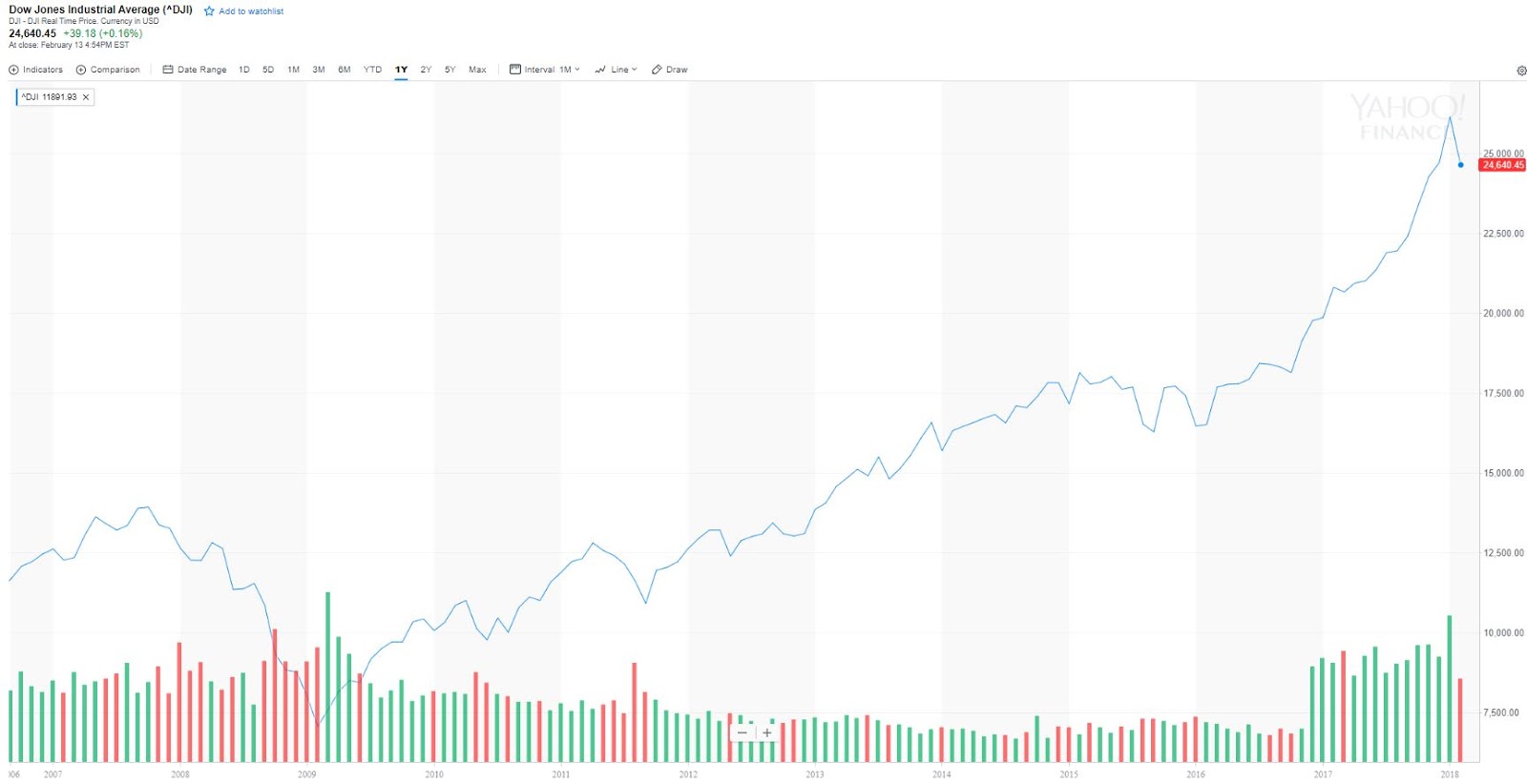

These three charts show the Dow Jones, the CHINA 50 and the Dax 30 over the last year and a half.

Indeed, things have been a bit one-sided for a lot longer than that. Over the past decade, the central banks of the world have been overcompensating for the 2008 financial crisis by injecting more and more money into the economy and further supporting it by artificially keeping the interest rates at record low levels.

The poor stock markets have been eating this cheap money without question like veal being prepared for slaughter.

Here's a chart of the Dow Jones showing the dip through the financial crisis. Notice the large leap up in price and volumes over the last year.

What does this have to do with inflation?

Oh right, excuse my rambling.

Many analysts believe that the pullback over the last two weeks is being caused by expectations that the Federal Reserve is about to tighten up their monetary policy.

Since low interest rates are a key driver of the upward momentum, many feel that if the rates start to go up, the markets will need to come down.

...and the key thing that the Fed is watching when deciding on those rates is the inflation data.

If inflation starts to go up faster than expected the main tool that the Fed has to slow it down is to raise the interest rates.

Analysts are forecasting January's CPI inflation number to be 0.3% and the Core CPI to be 0.2%.

Of course, if we see any numbers bigger than that it could startle investors and might drive up the US Dollar, which would benefit from larger interest rates.

What about Crypto?

During the announcement, I will personally be watching the crypto-markets for any potential reaction.

In this chart, we can see that there has been a rather tight correlation between Bitcoin and the Dow Jones over the last month.

Of course, we know that both have been rising uncontrollably over the entire course of 2017. However, Bitcoin has already seen a very serious pullback of 71% while the Dow's recent low was only 13% from the peak.

In my view, the crypto pullback has already shaken out a large part of the speculation money and what we have now are more of the hard core holders, most of whom probably wouldn't sell even if we see $1000 again.

Whereas the stock market is still chalk full of speculation money, most of which has been focused on short term gains for far too long.

Any reaction to the CPI print in the crypto markets would be a clear sign that liquidity in this new market is rising and that old-school investors are starting to get onboard.

Stellar has a slightly more complex system that includes a built-in inflation metric and has regular auctions and giveaways

When it comes down to it, the success of both projects will depend largely on their adoption by bigger financial firms. Stellar is gaining momentum in this regard and as of October is involved in a deal with IBM (NYSE:IBM) to improve the global payments system.

As an investor, we can't really know exactly how the future will play out, which is why it pays to diversify your portfolio, not only with different cryptocurrencies but with all types of assets for long-term growth.

eToro is very proud to add Stellar Lumens as the 8th cryptocurrency on the world's number one social trading network.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.