The TJX Companies, Inc. (NYSE:TJX) reported impressive second-quarter fiscal 2018 results, wherein both earnings and revenues surpassed expectations, driven by improved traffic and margin improvements, as well as higher market share at each of its four divisions. Following the results, the company raised its fiscal 2018 earnings guidance. Shares increased around 2.0% in the pre-market trading.

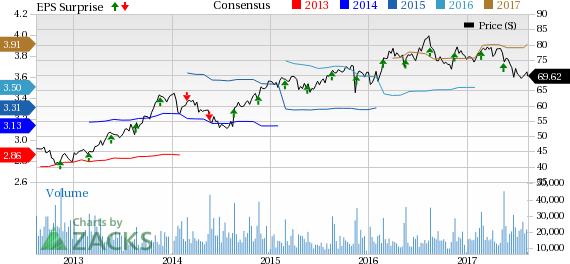

In the reported quarter, adjusted earnings of 85 cents per share surpassed the Zacks Consensus Estimate of 84 cents by 1.2%. Earnings also exceeded management’s guidance of 81–83 cents per share. The bottom line grew 1.2% year over year, backed by higher consumer traffic and improved margins. Currency hurt earnings by 4%, as management had expected. However, it compares unfavorably with the 3-cent positive impact it had on earnings in the preceding quarter.

Quarterly Details

Net sales increased 6% year over year to $8.358 billion, backed by an increase in comps and improved traffic. The figure missed the Zacks Consensus Estimate of $8.329 billion by 0.3%. Currency headwinds negatively impacted sales by 1 percentage points (pp).

TJX Companies' consolidated comps grew 3%, higher than the preceding quarter’s comps growth of 1%, but lower than the 4% comps growth in the year-ago quarter. Comps growth in the quarter was also higher than the management’s guidance of 1–2% growth. Higher comps at HomeGoods and TJX Canada increased 7% each, while comps increased 2% and 1% in Marmaxx and the International segment, respectively.

Gross margin contracted 0.9 pp year over year to 28.5%. The downside was primarily due to losses related to the company’s inventory hedges. Nevertheless, the company witnessed strong increase in merchandise margins.

However, selling, general and administrative costs, as a percentage of sales, increased 0.1 pp to 17.8% due to increase in wages, as was anticipated by the company. TJX Companies' consolidated pre-tax profit margin contracted 0.9 pp year over year to 10.7% of sales.

Other Financial Updates

During the second quarter, the company repurchased 7.5 million shares for $550 million. For fiscal 2018, the company now expects to repurchase approximately $1.5–$1.8 billion shares, which was earlier expected to be approximately $1.3– $1.8 billion shares. We note that in Feb 2017, the company’s board has approved an additional $1 billion stock repurchase program.

Cash and cash equivalents were $2.45 billion as of Jul 29, 2017, while long-term debt was $2.23 billion. Shareholders’ equity was $4.54 billion as of Jul 29. Cash flow from operations were $1.1 billion at the end of the second quarter, while capital expenditure was $506.9 million, resulting in free cash flow of $596.1 million.

During the quarter, the company increased its store count by 51 stores to a total of 3,913 stores. It had increased square footage by 5% over the same period last year.

Q3 Guidance

TJX Companies issued its guidance for third-quarter fiscal 2018. The company expects earnings in the range of 98 cents to $1.00 per share, while the prior-year adjusted earnings were 91 cents. Wage increases are expected to negatively impact earnings growth by 1%. Currency headwinds are likely to positively impact earnings by 3%, while the change in accounting rules for share-based compensation will have a positive impact on earnings growth by an additional 2%. The company expects comps growth of 1–2%, while last year’s growth.

Fiscal 2018 Guidance Raised

For fiscal 2018, TJX Companies has raised its earnings guidance. The company now projects adjusted earnings per share in the range of $3.78–$3.82, compared with the prior range of $3.71–$3.78. The adjusted guidance (excluding benefit of 11 cents from the 53rd week in fiscal 2018) would represent a 7–8% increase from fiscal 2017 adjusted results of $3.53 per share. While wage increases are expected to negatively impact earnings growth by 2%, the change in accounting rules for share-based compensation will positively impact earnings growth by 2%. Comps are also expected to grow 1–2% for fiscal 2018.

TJX's upbeat performance follows impressive results from retailers including Macy's Inc. (NYSE:M) and Kohl’s Corporation (NYSE:KSS) that reported better-than-expected earnings and sales last week, amid tough retail conditions and a shift to online shopping.

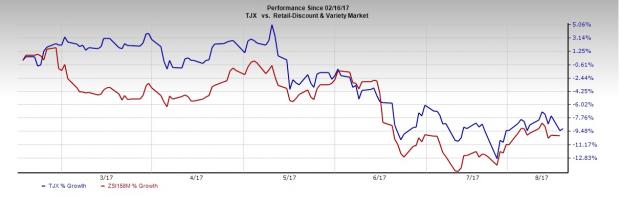

However, we note that shares of TJX Companies have been declining for the past several quarters. In the last six months, the stock has lost 9.1%, almost on par with the industry, which declined 10.0%.

Zacks Rank & Key Picks

TJX Companies currently carries a Zacks Rank #2 (Buy). Another stock with the same rank in the retail space is The Children’s Place, Inc. (NASDAQ:PLCE) . You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. The Children’s Place has an expected long-term earnings growth of 8.0% for the next three to five years.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

TJX Companies, Inc. (The) (TJX): Free Stock Analysis Report

Macy's Inc (M): Free Stock Analysis Report

Kohl's Corporation (KSS): Free Stock Analysis Report

Original post

Zacks Investment Research