Since the first day of 2017 the NASDAQ 100 has been streaming higher. It has closed at new all-time highs nearly every day over that period and moved up over 6%. Will it continue? Quite possibly, there does not seem to be much wrong with the price action. Momentum is getting a bit hot though so perhaps it may take a pause first. What is interesting about that is that the Russell 2000 seems poised to come take its place as the leader.

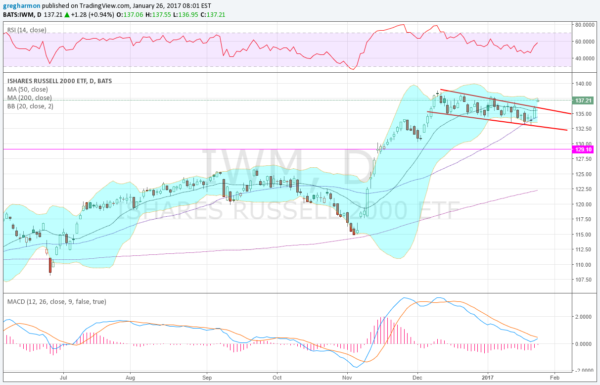

The chart below shows the Russell 2000 ETF (NYSE:IWM). Over that same three weeks, and in fact since early December, the Russell 2000 has been falling. It was down as much as 4% from its high. But that pullback, in what is known as a bull flag, looks to have been nothing more that the small caps digesting the big move higher in November. Wednesday saw the Russell 2000 break that flag to the upside.

Over that retracement the momentum indicators have reset lower. Where the NASDAQ is overheated the Russell 2000 has a lot of upside room in these momentum indicators. Both held in bullish ranges on their pullbacks. The RSI is rising now but still under 60, while the MACD held over zero and is about to cross up. A continued move gives a target of 141.25 initially and then 157. Time to send in the substitutes and let the Nasdaq 100 get some rest.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.