Tech has been a market leader for many years as it has been much stronger than the broad market and small caps. Is this trend about to change? Whether it does or not, Tech does face a key Power of the Pattern test.

Below looks at the Nasdaq 100 over the past four years.

The trend remains up in tech. The rally off the 2016 lows now has the Nasdaq testing the top of this rising channel at (1). A 2-year rising support test is in play this week at (2), creating a tight jam between resistance and support. Tech bulls would prefer to see this rising support line hold.

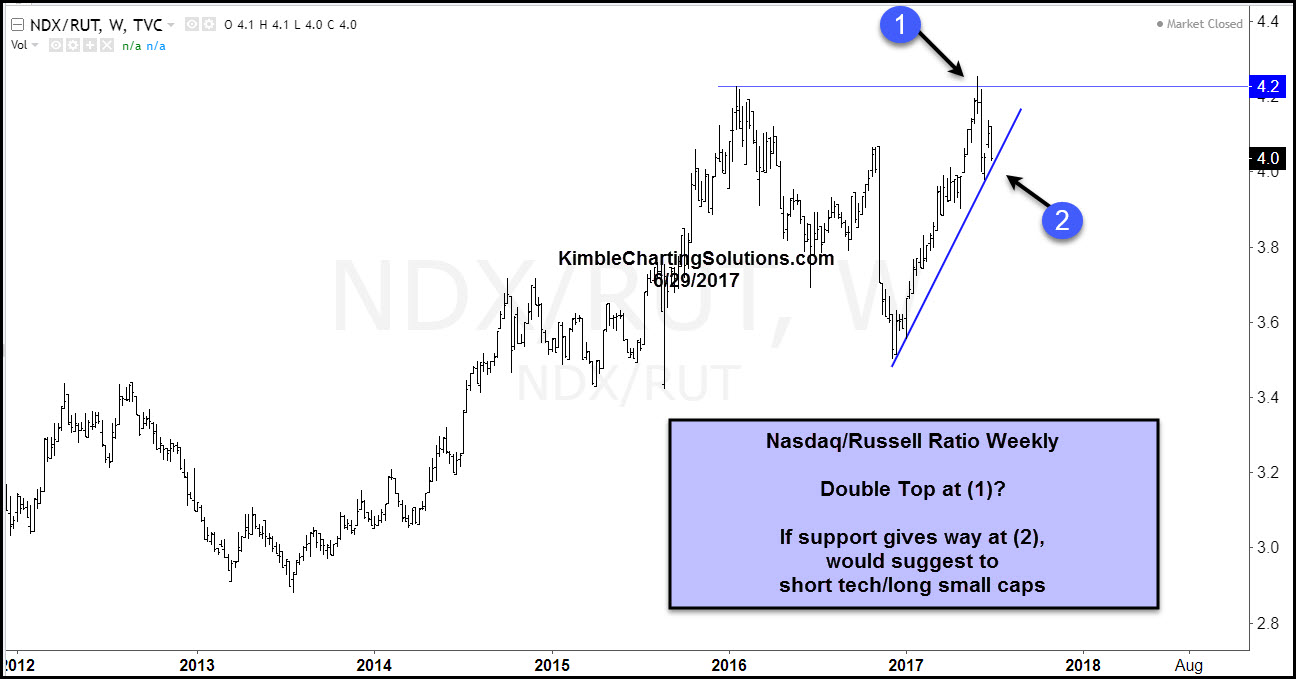

Tech has been stronger than small caps for years. The ratio between it and the Russell 2000 could be creating a double top at (1). A seven-month rising support test in play at (2). If the ratio breaks support, it would show that small caps are reflecting strength over tech.