Summary

Junk bonds (1) appear to be fairly valued relative to treasuries, (2) their underlying default levels are not ticking higher and (3) based on their short history, they will not likely lose value or markedly underperform equities once rates start to rise. Moreover, (4) investors have shown some panic in selling off the asset class over the past month.

* * *

Jeff Gundlach is the new Bond King. Last year, when the consensus overwhelmingly expected U.S. 10-Year yields to rise over 3%, he said they would instead fall under 2%. In the event, they fell to 1.65%

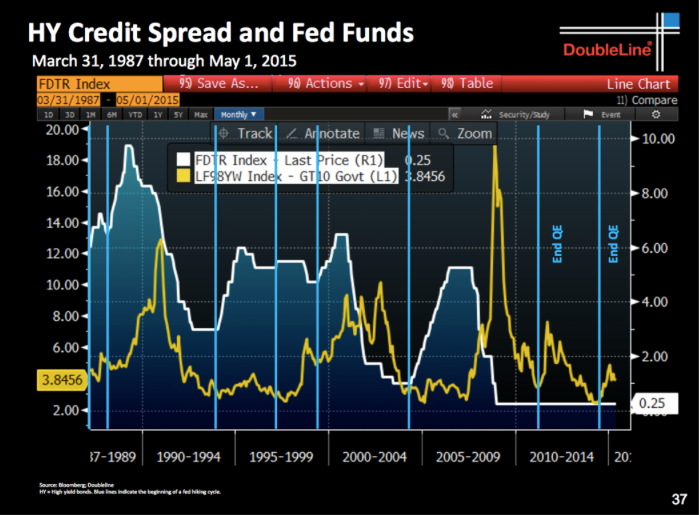

So he should be closely listened to when he says that investors should sell their junk bonds "on the day of the first rate hike." In the past 30 years, every time the Fed has raised rates (white line), the spread between junk and 10-year treasuries has narrowed (yellow line). This means junk bonds are losing relative value (chart from Double Line.).

Does this mean that investors holding junk bonds are going to be crushed when the Fed starts raising rates? Probably not.

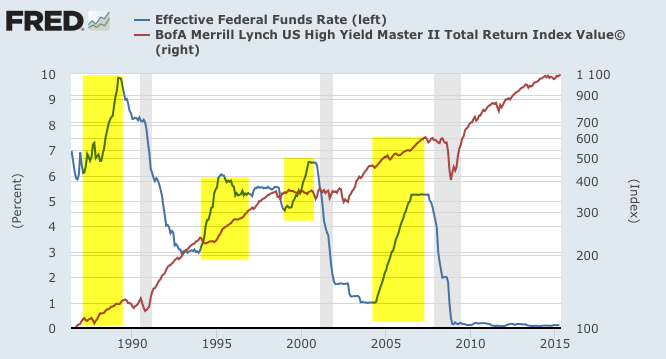

Shown below are the four most recent periods (yellow shading) when the Fed raised rates (blue line). The total return for the benchmark High Yield Index rose each time (red line). Investors continued to make money.

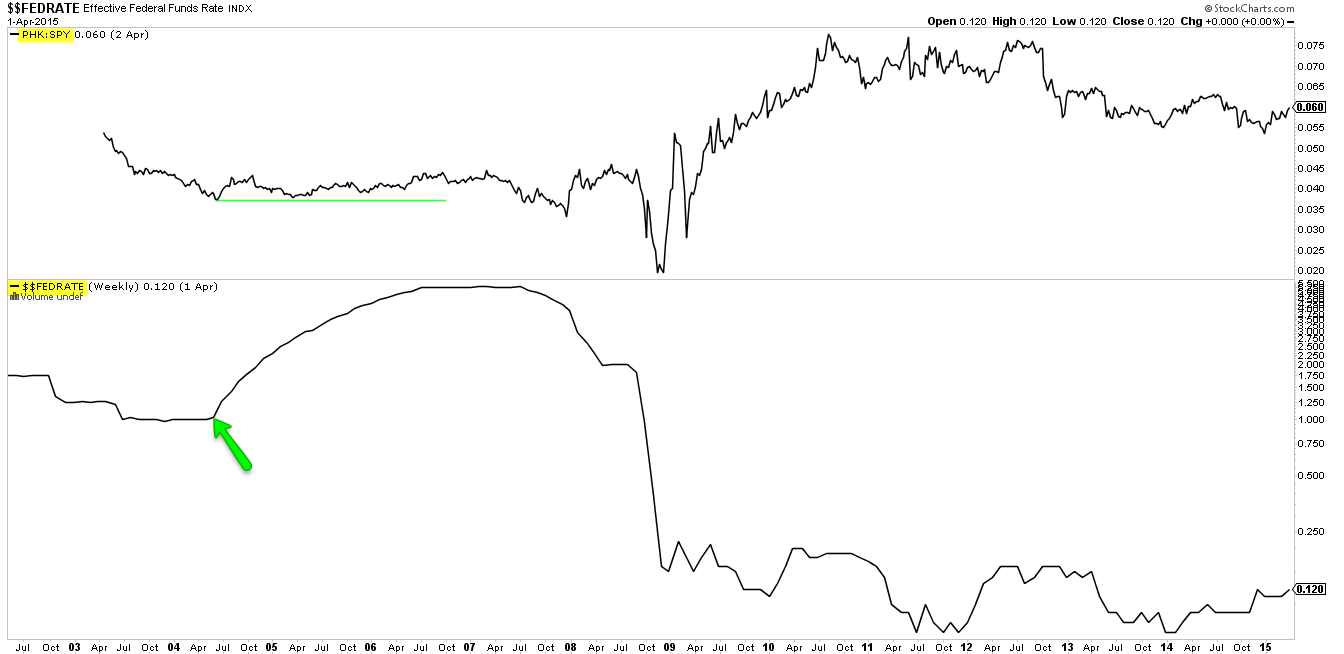

The two main junk bond ETFs ((ARCA:HYG) and (ARCA:JNK)) roughly track this same index. They were not in existence the last time the Fed raised rates, but Pimco's main high-yield debt fund (PHK) was. After the Fed raised rates in 2004 (arrow; lower panel), this fund outperformed the S&P 500 over the next 1, 2 and 3 years (top panel). This period was before the fund was managed by Bill Gross; during this time, the premium to NAV remained relatively minor and stable.

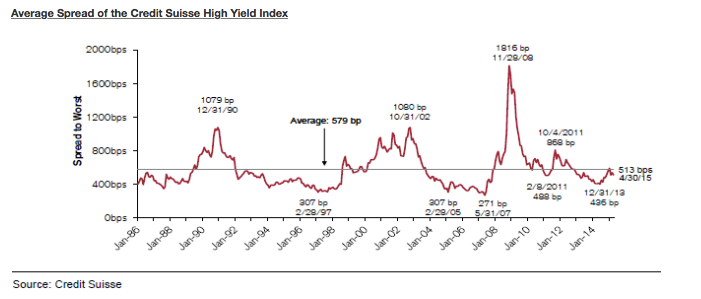

High yield does not appear to be overvalued at present. The current spread to treasuries is near the 30-year historical median of 520 basis points (chart from Credit Suisse (SIX:CSGN)).

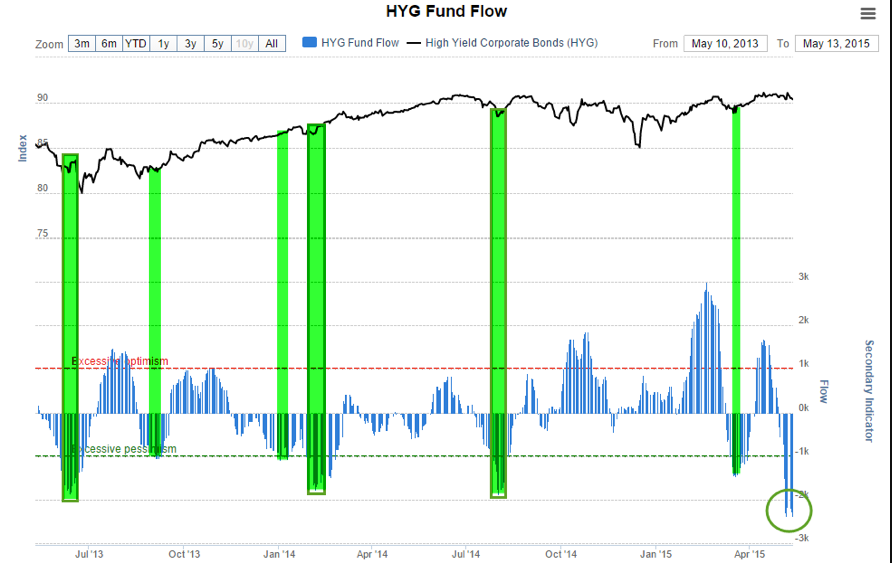

Of further interest is that talk of junk bonds being at risk has become widespread, with investors redeeming their shares in junk bond ETFs. 20-day outflows (lower panel) have reached what in the past has been an extreme from which prices rose over the next month or longer (upper panel; chart from Sentimentrader).

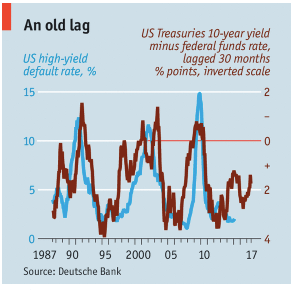

This outflow does not appear to fundamentally driven: default rates on junk are near their historic lows (blue line; chart from the Economist).

Admittedly, current treasury rates are at a historic low. It's early but it is certainly possible that the more than 30-year secular trend toward lower rates is coming to an end. Junk bonds came of age during this period, so there is no history to guide what might happen during a period of sustained higher rates.

But based on the available data, junk bonds (1) appear to be fairly valued relative to treasuries, (2) their underlying default levels are not ticking higher and (3) based on their short history, they will not likely lose value or markedly underperform equities once rates start to rise. Moreover, (4) investors have shown some panic in selling off the asset class over the past month.