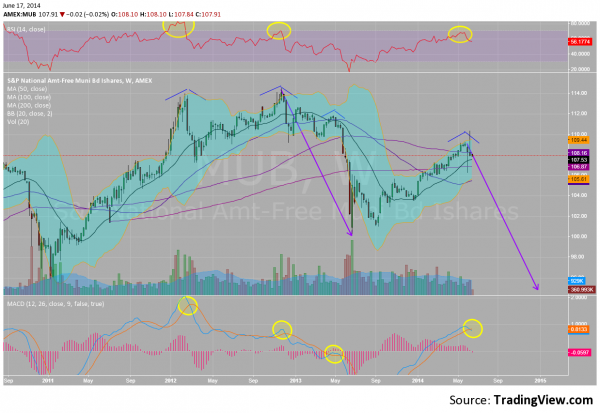

Three months ago I wrote here how there was Room Higher in Muni’s. At the time the Municipal Bond ETF (NYSE:MUB), had already moved off of a floor at 99 up to 106, or 7%. It turns out there was room higher, but if the recent pullback continues, not so much room. There is a lot to take away from the set up in the previous post, the actual reaction and how it sets up today.

Let’s start with the set up and actual reaction from the previous post. The technical read said that it could extend to 119. If the top at 109 holds this was off by a lot. The set up gave a 3% move, not the 11% that looked possible. This is a good lesson in technical analysis. It gives possibilities not certainties. There were reasons described in the post for the 119 target. But there are no guarantees a move will go as far as the target or even trigger. Every technical analyst knows this but not every trader reading technical analysis seems to understand this point. Possibilities, not certainties. Points of reflection not points of inflection. This is also why you use stop losses. There was still value in the initial trade as it moved from 106 to 109, and with a stop loss you would keep some or most of that. This ETF may reverse and continue higher still, to that 119 level or it may continue to fall, no one

knows for sure. But the current chart is showing signs of a reversal back lower. Each of the last 3 times that the MACD has crossed down it has resulted in a pull back in price. The MACD is crossing down now. The last two times the RSI moved from being technically overbought back down lower there has also been a pullback. This is happening now as well. Finally the last two times the price has touched or broken above the upper Bollinger band a pullback has occurred. Looking strictly at the price action the Double Top in February and November 2012 resulted in a pullback to the May 2013 lows. A Measured Move lower equivalent to that move could take the ETF to 95 on this leg. Again, no certainty, but possibility. So what do you do about it? If long it is time to lighten up or get out. If you want to play the short side yo might want to get confirmation below the 200 week SMA at 106.87 before shorting it.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.