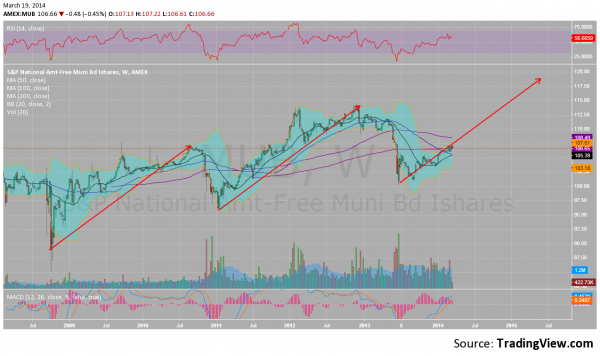

Municipal bonds have been in the news recently and rocked with the troubles in Puerto Rico. That was until Vladdy Putsman decided he wanted a new vacation island home with views of the Black Sea on all sides. Whether this stopped any bleeding in municipals due to the bleeding in the 51st State or not it allows you to take a look without all the noise. And on the weekly view it looks quite attractive. Take a look.

The chart above shows a few simple reasons to consider getting into municipal bonds right now. The rising red arrows show the upward path of municipals since the 2009 lows. There are several things to note. First each move has lasted about 2 years. From that measure the current move could extend into mid 2015. Second each move has been the same magnitude, $18, and retraced 61.8% or more before moving back higher. This would target about 119 on this leg. It is not a 100% move over 2 months, but 11.5% over a little more than a year is not such a bad thing is it?

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.