The cable has fallen completely out of favour with investors as it racks up nine straight days of losses. However, it has now found a major level of support, so is it time to catch the falling knife?

The cable's week was notable for the lack of a single day in the green as the selling continued from the previous week. The data was certainly against it last week with the UK's major PMIs returning disappointing results. The services PMI, representing 80% of the economy, fell sharply from 57.4 to 55.6 which is a worry.

The bullish US dollar was dominant in comparison to the pound. A mixed nonfarm result swung in favour of the US dollar as the market focused on the falling unemployment rate (5.1% vs 5.3% prev) and an improved hourly earnings rate. The US dollar gained against the pound despite the headline nonfarm figure missing estimates of 214k to come in at 173k.

The market has cooled considerably on its expectation of a rate move and we may get confirmation when the BoE meets this week. The Bank of England will meet to set interest rates and give their assessment of the economy. With any luck they will clarify their expectation of when rates may begin to rise, if at all. Certainly the market no longer expects it this year and the falling cable attests to that, however, anything the BoE says will need to be decidedly dovish as a fair amount is now priced in.

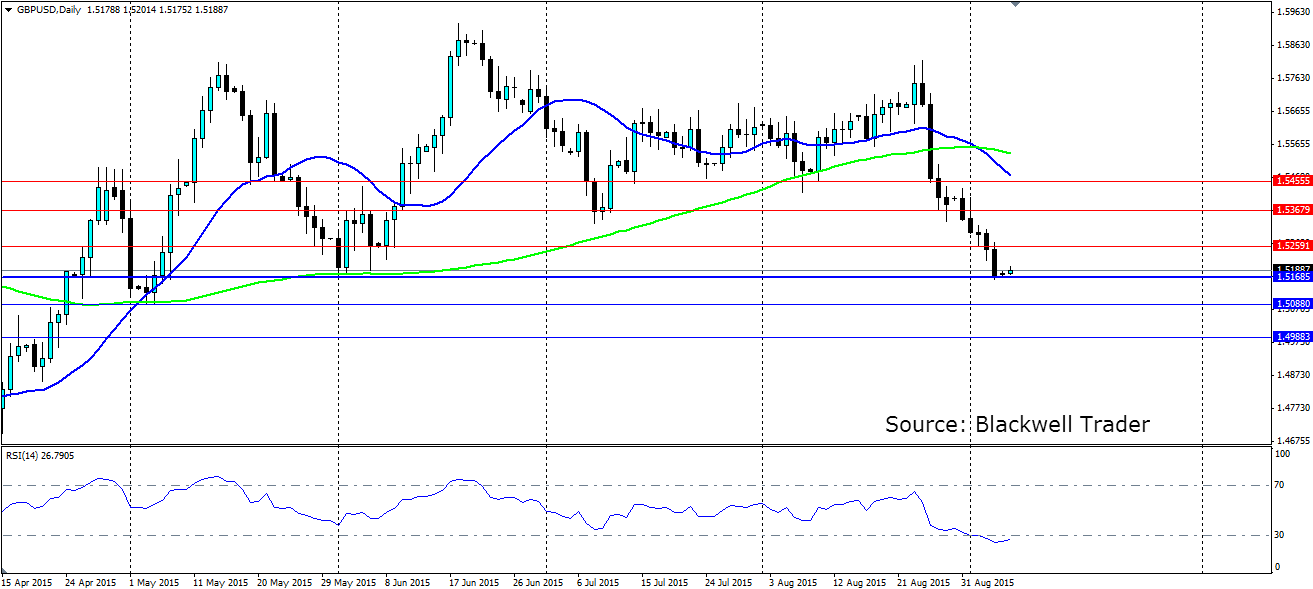

Technicals show the solid slide the cable has suffered over the last nine trading days, amounting to 580 pips. The pair has found solid support at the 1.5168 handle which was a swing point back in May. We believe this may be the line in the sand and a bounce off here is probable. Our bullish assessment is a cautious one, as there is always a risk in trying to catch a falling knife, so be warned.

The RSI has nudged into oversold territory for the first time since March, so we could see the market take that as a sign to cover any short positions. Look for support at the current solid level at 1.5168, with further support at 1.5088 and 1.4988. Resistance can be found at 1.5259, 1.5367 and 1.5455 and any of these levels will act as swing points if a short term bullish trend is to reverse and continue the overall bearish trend.