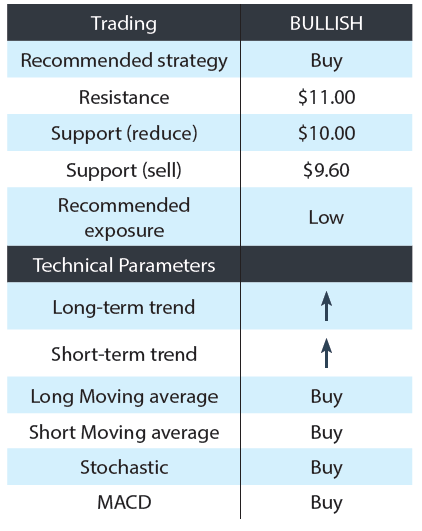

Light positions

The solid resistance breakout at $ 10.00 reais marks a continuation of the current uptrend (BULLISH) after a brief period of lateral consolidation.

This move opens a new trading with a stop reduction below $ 10.00 and a total stop loss of $ 9.60.

Ideal position point = as closer as to $ 10,00 is better.

We designed an initial target of $ 10.50 and a secondary target of $ 11.00 reais.

We recommend light positions in this operation due to the NEUTRAL scenario for the IBOV.

Disclaimer : This report has been produced to provide information only and does not constitute, and should not be considered as an o! er to buy or sell any “ nancial instrument. Also, it should not be considered a solicitation of an o! er to buy or sell any “ nancial product or instrument, or to participate in any particular trading strategy in any jurisdiction. The analyst does not make any express or implied assurance as to the completeness, reliability or accuracy of such information. The information herein is believed to be reliable as of the date on which this report was issued and has been obtained from public sources believed to be reliable. Opinions, estimates, and projections expressed herein constitute the current judgment of the analyst and are subject to change without notice and the analyst or Benndorf Research has no obligation to update or modify this report and inform the reader accordingly. The analyst responsible for signing this report in junction with the article 17 of CVM´s Instruction n°483/10 and certi” es that the views expressed herein accurately and exclusively re$ ect his personal opinions and were prepared independently and autonomously. Also in junction with CVM´s requirements, the analyst certi” es that no part of his compensation was, is, or will be directly or indirectly correlated to the pricing of any of the securities exposed herein; therefore he is not in any position of a con$ ict of interest. The “ nancial instruments discussed in this report may not be suitable for all investors.

This report does not take into account the investor´s objectives, “ nancial circumstances or particular needs, therefore anyone wishing to purchase or trade the “ nancial instruments or equities discussed should do so based on his or her own assumptions. Investors should obtain independent “ nancial advice based on their own particular circumstances before making an investment decision. The reader of this report should be ware and take into consideration the variation of exchange rates if the “ nancial instrument discussed herein is denominated in a currency other than the investor´s currency. Changes in exchange rates may adversely a! ect the price or value of the instrument and the investor assumes all foreign exchange risks. The prices of “ nancial instruments may vary, and therefore their value may rise or fall, either directly or indirectly. Past performance does not necessarily indicate future results, and no representation or warranty, express or implied, is made regarding future performance. The analyst responsible for this report or Benndorf Research is not liable whatsoever for any direct, indirect or consequential losses from the use of this report or its content and the user undertakes to exempt the analyst and Benndorf Research from any claims, complaints and/or demands.

This report may not be reproduced or redistributed to any other person, in whole or in part, for any purpose, without the prior written consent