Tiffany & Co (NYSE:TIF) will report its Q3 earnings results before the opening bell on Tuesday. Let’s take a look at current expectations and what could lead to a spike or drop tomorrow.

The New York-based jewelry and specialty retailer will deliver its earnings release prior to 7am eastern time, with a conference call to follow at 8:30am. Wall Street is looking for EPS of $0.67 on revenues of of $922.5 million, both of which would be down significantly from the same period last year. In fact, that estimate of just $0.67 would mark the lowest quarterly EPS number from TIF since the third quarter of 2012.

As for guidance, analysts are expecting full-year 2017 EPS of $3.68 and $4 billion in revenue. Recently, Tiffany forecast 2017 EPS to range from $3.60 to $3.67, so it’ll be interesting to see if the company updates its outlook this time around.

While many analysts remain skeptical of Tiffany’s turnaround prospects for next year, at least one Wall Street voice has spoken up recently with a bullish view. From Forbes:

[A] Cowen and Co. analyst sees growth on the 2017 horizon while acknowledging “unprecedented changes and unknowns” ahead, according to a recent report. Cowen calls the stock a “beat-and-raise story” for 2017. “No one can easily recreate Tiffany’s diamond supply-chain relationships, owned polishing facilities, environmental controls, emotional product innovation and brand position,” the report said.

Stay tuned tomorrow morning when we’ll have full coverage of Tiffany’s report, which could also give investors some wider insight into the luxury items market as a whole.

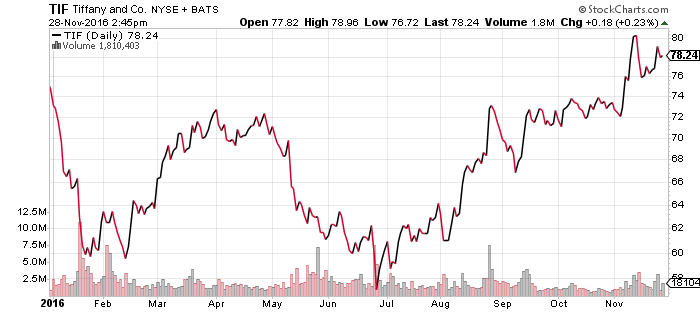

Tiffany shares rose $0.23 (+0.29%) to $78.29 in Monday afternoon trading. Year-to-date, TIF has gained 2.49%, versus an 8.38% rise in the benchmark S&P 500 index during the same period.