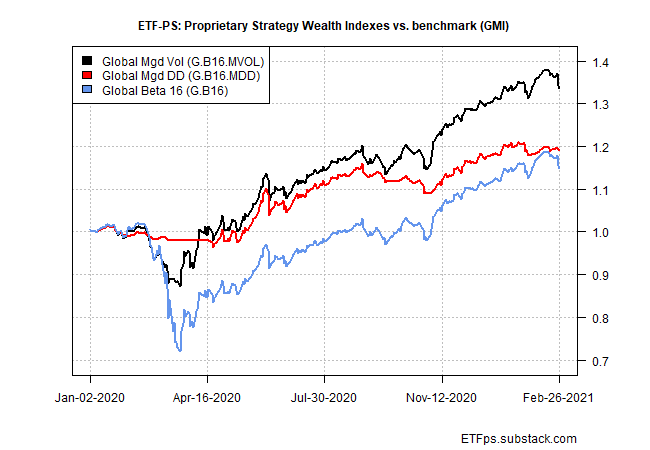

The cautious stance of Global Managed Drawdown (G.B16.MDD) has been excessive in recent months, but the tide finally turned and a defensive posture paid off last week. Whether it continues to pay off is the question.

For now, G.B16.MDD is redeemed, at least slightly. As regular readers know, this strategy has been relatively cautious vs. its counterpart, Global Managed Volatility (G.B16.MVOL). The caution has come at a price as markets have, for the most part, pushed higher. But global markets took a hit last week, as discussed in our Red Ink Everywhere, Except For Broadly Defined Commodities.

Is it now time for G.B16.MDD to shine?

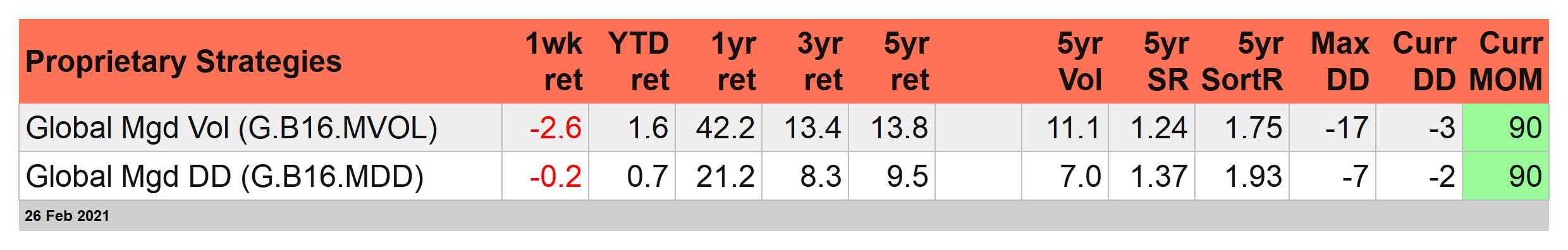

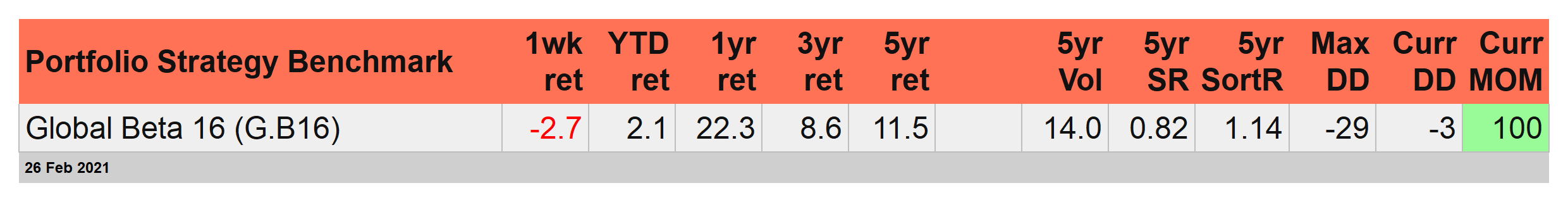

It was last week, albeit by way of G.B16.MDD’s notably lesser weekly loss. The strategy shed a slight 0.2% vs. G.B16.MVOL’s deeper 2.6% slide through last week’s close (Feb.26). Note, too, that the benchmark—Global Beta 16 (G.B16)—for both strategies was off 2.7% for the week.

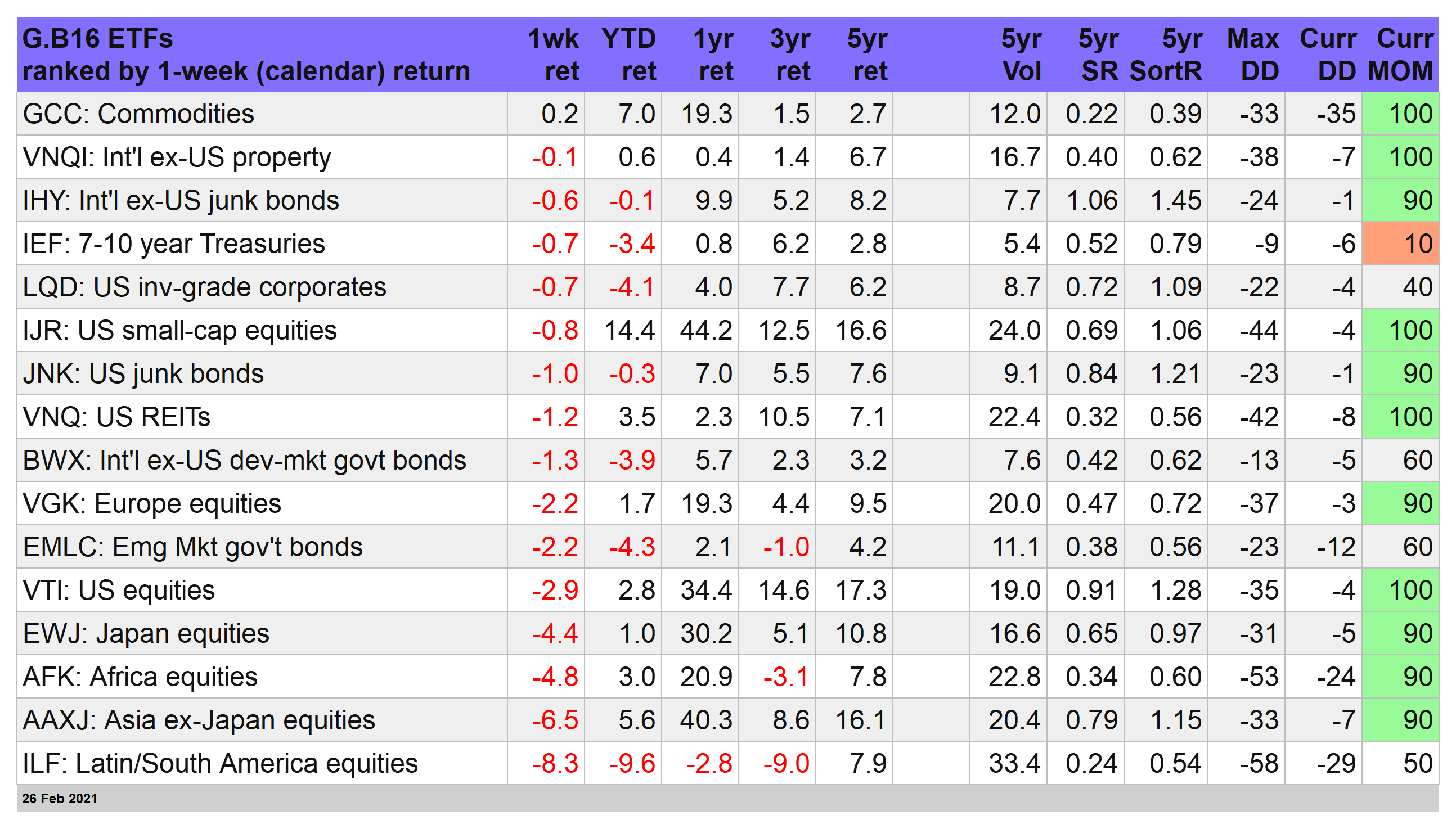

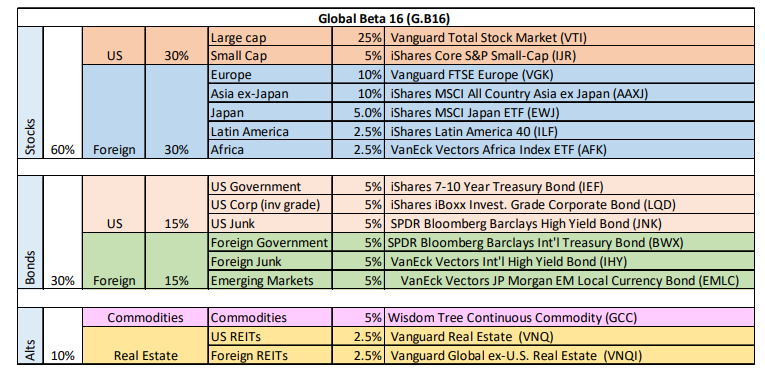

As a reminder, G.B16 represents the opportunity set for both strategy and is always invested in the 16 ETFs that represent the global major asset classes. G.B16.MDD and G.B16.MVOL target the same funds but use different rules for risk-on and risk-off signals to manage exposure to each fund.

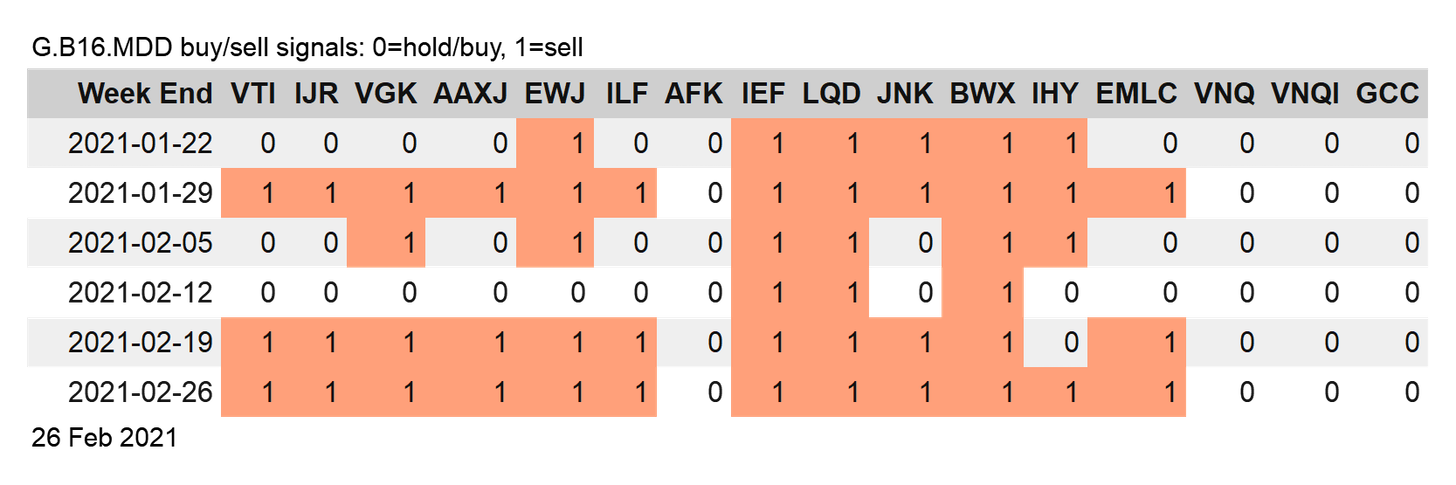

G.B16.MDD’s softer slide last week is a function of its risk-off bias in recent history. At last week’s close, 12 of the 16 funds in G.B16.MDD’s opportunity set were risk-off, with the bucket for VanEck Vectors International High Yield Bond ETF (NYSE:IHY) joining the go-to-cash list at Friday’s close.

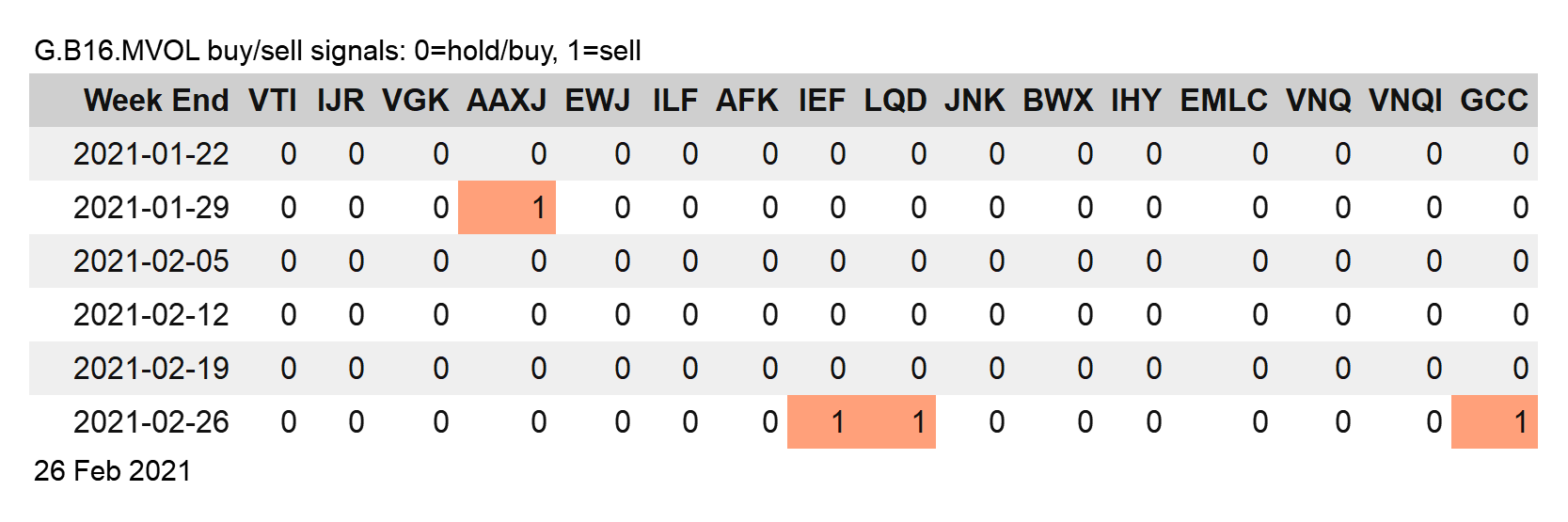

G.B16, by contrast, remains mostly risk-on, although three of its 16 funds shifted to risk-off last week: iShares 7-10 Year Treasury Bond ETF (NYSE:IEF), iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE:LQD) and WisdomTree Continuous Commodity Index Fund (NYSE:GCC).

It’s premature to declare that G.B16.MDD is the superior strategy for recognizing a brewing threat to markets. The latest downturn in markets could be noise. Recall, too, that G.B16.MDD has periodically switched to and from on the risk-off/risk-on front since the coronavirus crisis started last year. So far, the forays into risk-off have been false signals, and relatively costly ones.

It’s unclear if drawdown as a risk-off/risk-on signal via G.B16.MDD can redeem itself against return volatility (G.B16.MVOL), but it seems we’re about to find out. If there’s a catch-up period coming for G.B16.MDD, the strategy has a long road ahead. For the past year, for instance, G.B16.MVOL is well ahead of its counterpart: +42% for the past year vs. 21% for G.B16.MDD.

But let’s not be too hard on G.B16.MDD. Even with the false signals of recent vintage, it’s managed to keep pace with the benchmark (G.B16) with significantly less volatility and so in risk-adjusted terms G.B16.MDD still looks pretty good. And if markets are headed for an extended rough patch, G.B16.MDD looks set to outperform.

Note: Global Minimum Volatility (G.B16.MVOL), a third proprietary strategy, has been retired. A revised version, along with other proprietary strategies, will be rolled out at some point in the near term.