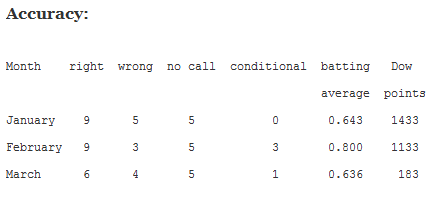

The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Thursday lower.

- ES pivot 2033.08. Holding below is bearish.

- Friday bias lower technically.

- Monthly outlook: bias higher.

- YM futures trader: no trade.

Last night the market was looking toppy to me and tonight it's clear that it did indeed top on Tuesday with the largest move (lower) in three days. This is interesting on several fronts which we will now explore.

The technicals

The Dow: On Monday the Dow finally fell out of a two week-long rising RTC for a bearish setup on an 80 point loss. The indicators are all now clearly marching lower off of extreme overbought levels too This is perhaps to be expected as the Dow is now about as far overextended above its 200 day MA as it's been in a year. In any case with Wendesday's confirmation of two days' worth of reversal signs, this chart now looks plain bearish.

The VIX: Last night I noted a rising VIX and it just kept right on going Wednesday up another 5.43% as it continued to peell away from its lower BB with a green candle that marked a bullish setup on an exi5tt of a descending RTC. Indicators are all now rising off an oversold bottom and the stochastic now has a clear bullish crossover All that adds up to more upside in my book.

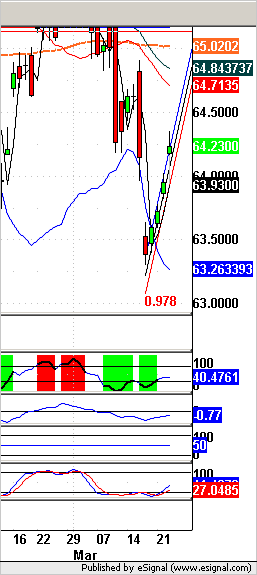

Market index futures: Tonight, all three futures are lower again at 1:05 AM EDT with ES down 0.15%. On Wednesday, ES confirmed Tuesday's tall doji star with a tall red candle back down to 2028.75. That sent the indicators off overbought and gave us a fresh bearish stochastic crossover as well as a bearish setup on a descending RTC exit. The new overnight is continuing lower for a bearish trigger.. That's just 100% bearish here.

ES daily pivot: Tonight the ES daily pivot falls from 2049.58 to 2033.08. That places ES squarely below its new pivot so this indicator is now bearish.

Dollar index: After a small gap up on Monday, the dollar posted a bigger gap up on Tuesday. Then on Wednesday it just took off with a third gap up in a row to end up 0.44%. This chart is worth a look. It now looks like a classic exponential runaway and with the indicators now all off oversold I think the dollar is due for some retracement Real Soon Now.

Euro: And similarly the euro is now in a complementary downtrend with a steep descending RTC, all indicators falling off of overbought, a completed bearish stochastic crossover and no sign of stopping in the new overnight. That makes this chart look just plain bearish.

Transportation: On Monday, the trans put in a doji star reversal warning. On Tuesday that was confirmed with a small red candle below that. And on Wednesday we got the payoff in the form of another 0.69% decline, underperforming the Dow's 0.45% loss. With a new bearish stochastic crossover in place, indicators still overbought but clearly having topped, and a new steep descending RTC, this chart just looks flat-out bearish tonight.

All the bearish forces we saw last night are still in play tonight only more so as the downward momentum continues building. So I can't really make a case for a call of anything other than Thursday lower.

YM Futures Trader

No trade tonight..