A reader asked me today what I thought of the energy sector and if I would look at it using Stage Analysis. I have been noticing some energy stocks appearing on my stock scans, and that hasn’t happened in quite a long time so that’s a positive. But here’s what I’m not seeing that hasn’t made me want to load up on energy stocks yet:

- Large number of energy stocks across the sector breaking out to new highs on big increases in volume

- Energy stocks outperforming the S&P 500 and other sectors

- Crude oil in an uptrend

- Commodities as a group in an uptrend (I tend to use the WisdomTree Continuous Commodity (NYSE:GCC) ETF to view that)

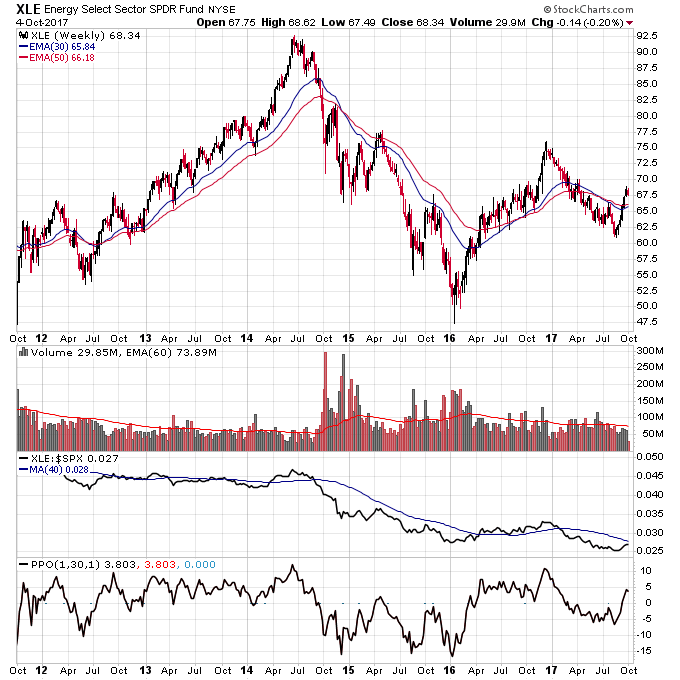

Here’s a longer term chart of XLE (NYSE:XLE). A couple of things to note on this chart. I’d rather see a nice long base here to launch into a new bull market, but all we have so far is a bounce higher from the 2016 bottom. I could see energy stocks basing for a while longer here and digesting the previous bear market. I want to see XLE outperforming the S&P 500 on the middle section of the chart too, and that’s clearly not the case. If you look at semiconductors or biotech (VanEck Vectors Semiconductor (NYSE:SMH) or SPDR S&P Biotech (NYSE:XBI)) you’ll see the exact opposite of what you see here and that’s why I like those sectors right now.

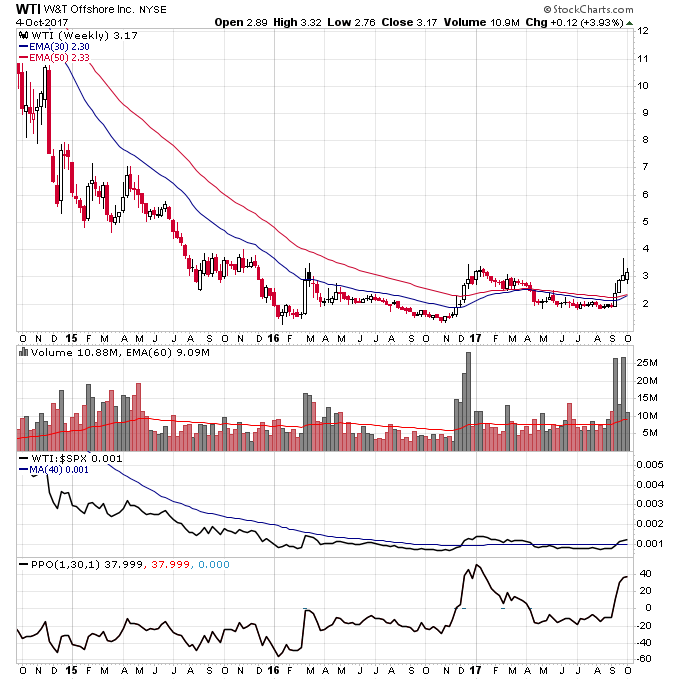

I actually did recently trade one energy stock Crude Oil WTI Futures because I liked the chart but I didn’t trade it as a sustainable uptrend. Maybe I’ll be wrong and energy stocks have bottomed here but I don’t see that yet in the charts. On this chart of WTI though you can see how we have a nice Stage 1 base that it exploded higher off from on massive volume. But notice how it did the same thing in late 2016 only to turn out to be a fake rally that failed. I wouldn’t be surprised if the same thing happens here unless we see more strength across the sector.

I see the same thing in energy in other commodity sectors like gold stocks. A few stocks breaking out higher but that tends to be the exception more than the rule. That was why I didn’t think the August to September rally in gold was going to lead to a new rally as well, I saw a lot of gold stocks acting terribly when they should have been gearing up for a big move.