Iron ore surge – bullish signal or warning signal?

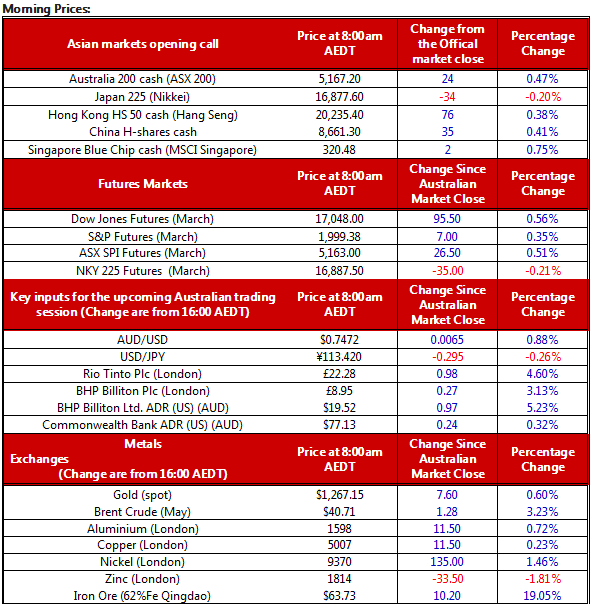

Huge moves in the commodities space overnight have not translated well into the equities markets striking a note of caution that this current rally may be running out of steam. The 19% jump in iron ore overnight - the biggest ever one-day increase - looks far more like a warning signal than a bullish market turn. There was little within the National Party Congress announcements that warranted such a move, nor was it replicated in Chinese equities. More it raises concerns about the ability for major Chinese hedgefunds to pile into relatively illiquid parts of the commodities market to make outsized gains, as we’ve seen time and again in the copper market over the past year. Nonetheless, these moves are all fairly positive for the Aussie dollar, commodity-related equities and the banks, and we are calling the ASX up 0.5% today. Fortescue Metals Group Ltd (AX:FMG) had a stormer yesterday and has today announced a joint-venture with VALE SA (NYSE:VALE) alongside the potential purchase of a minority stake, while BHP Billiton Ltd (AX:BHP)'s ADR is pointing to a 5.1% open today, which all points to more positivity in the materials space.

It is lucky that the market cap weighting of the banks and materials are so high in the ASX, because the rest of the market has not been faring very well at all. Utilities, telcos, industrials, consumer discretionary and healthcare (in order of worst performers) have all seen declines over the past week. A lot of these stocks by-and-large are impacted by the rise in the Aussie dollar.

The Aussie dollar is not far from the US$0.7500 level, but it seems unlikely to continue at these levels. Particularly, with the upcoming Fed meeting on 16 March, there is a high likelihood that the big improvement in US data warrants a far more hawkish statement from the Fed, putting rate hikes back on the table and seeing a corresponding strengthening of the US dollar. Such a scenario is likely to drive a pullback in commodity prices and the Aussie dollar.

China

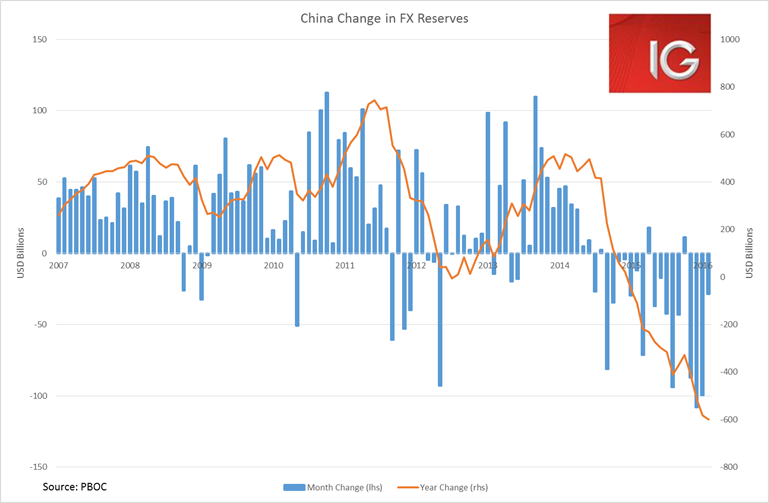

China released their February FX reserves data overnight with reserves declining by USD 28.6 billion, far less than expected. Clearly, Chinese reserve valuations benefitted from the fall in the US dollar in February, and there seems to be little evidence that expectations for the CNY to devalue have eased.

Month-to-month variance in FX reserves is common, trend is still clearly for more declines:

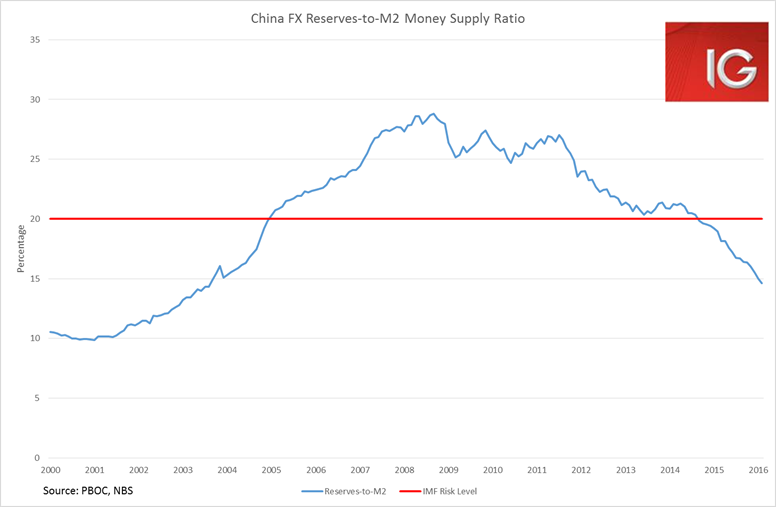

In M2 ratio terms, FX reserves are now at 14.6% - their lowest level since August 2003:

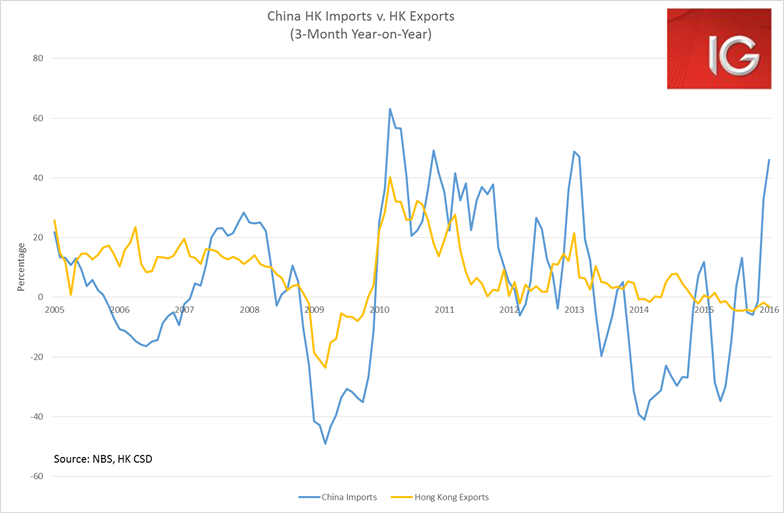

Money is still clearly leaving China. Capital flows through the trade account are plaintively obvious when one compares China’s reported imports from Hong Kong with Hong Kong’s reported exports to China:

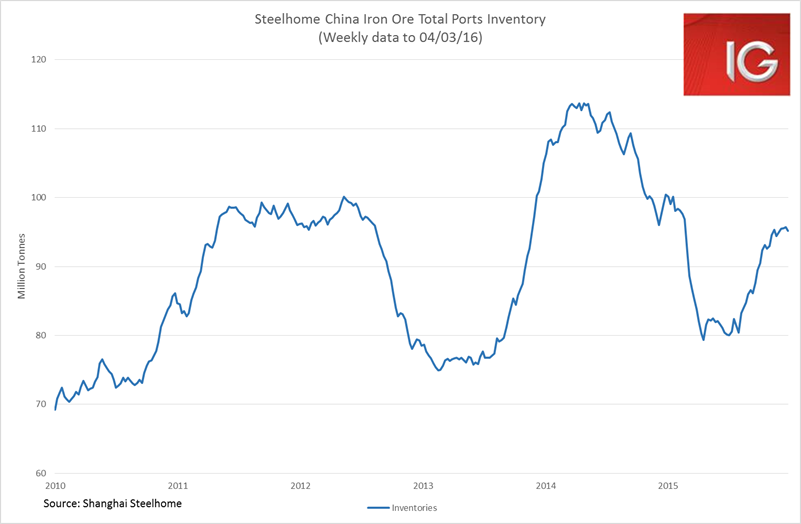

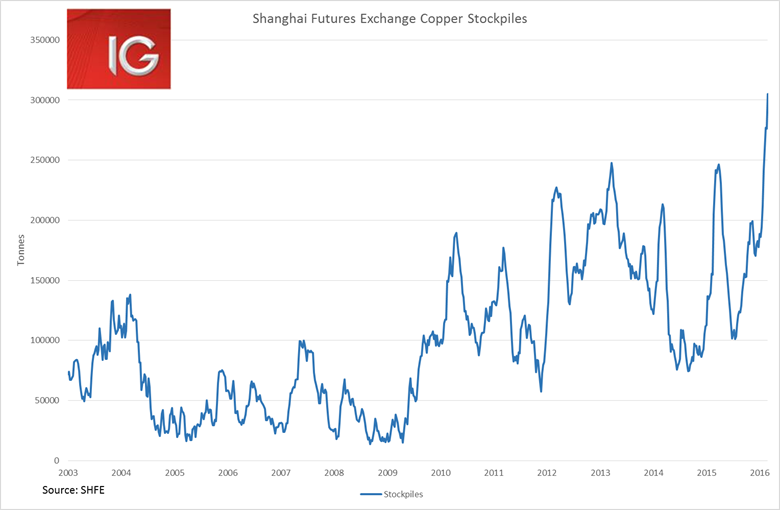

CNY devaluation concerns may also be behind some of the massive moves in industrial metals’ prices. It seems no coincidence that stock piling in iron ore and copper began to pick up pace around August 2015 when China first devalued the currency. Some the stock piling may well be related to CNY devaluation expectations as investors look to physical assets to store their wealth. This would seemingly make the case that the big rally we are seeing in industrial metals is based on shaky ground that has little to do with fundamental supply and demand dynamics.

Shanghai Futures Exchange copper stockpiles are at their highest levels on record, with numbers increasing dramatically from August:

August also sticks out as the pickup in iron ore inventories as well: