Investing.com’s stocks of the week

The U.S. stock market has struggled recently, with the major market indexes testing key support levels. As such, Wall Street's "fear index" -- the Cboe Volatility Index (VIX) -- jumped nearly 28% from last Wednesday's close at 11.61 to Friday's settlement at 14.82. This is the fifth time this year the VIX has surged more than 25% over a two-day time span, according to Schaeffer's Quantitative Analyst Chris Prybal, and could signal short-term outperformance for the S&P 500 Index (SPX).

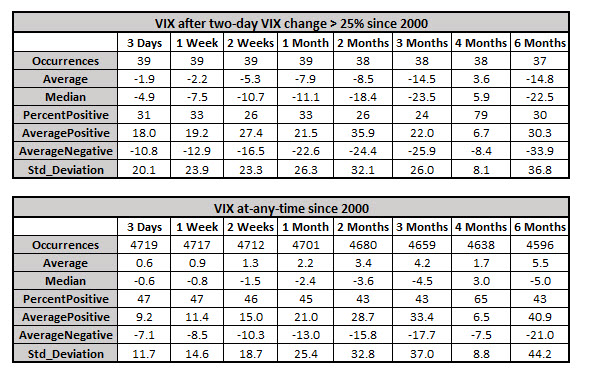

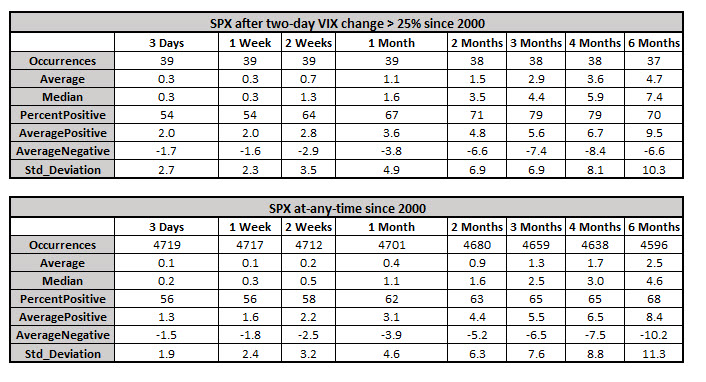

Widening the scope, this is the 40th time this signal has flashed going back to 2000, though this year has had more than any other. Following the 39 previous occurrences, the SPX averaged higher returns across all time frames going out to six months compared to the index's anytime returns. Plus, positive returns were more frequent post-signal versus anytime at the two-week, one-, two-, three-, and four-month markers.

VIX, meanwhile, tends to underperform its anytime returns after a rallying more than 25% over a two-day period. Most notably, perhaps, are an average two-month loss of 8.5% and an average six-month drop of 14.8%, compared to respective anytime gains of 3.4% and 5.5%. Additionally, the percentage of positive returns is much lower post-signal versus anytime across all time frames going out to six months.