Believe it or not, we now have the best window to buy dividend stocks that we’ve had in decades. Two proven 100%-return indicators just flipped to “green.”

The conditions we’re about to see are rocket fuel for companies growing their dividends like weeds. As usual, we’re going to zig while like-minded money managers (you know, those that outperform a mere index) zag.

Our 100% Proven Contrarian Play

The first factor that points to more upside for stocks is the foul mood among the so-called “smart money.”

According to a June survey by Bank of America Merrill Lynch (NYSE:BAC), fund managers expectations of global growth sank the most since November 1994. What’s more, the pros haven’t been this pouty since, you guessed it, 2008.

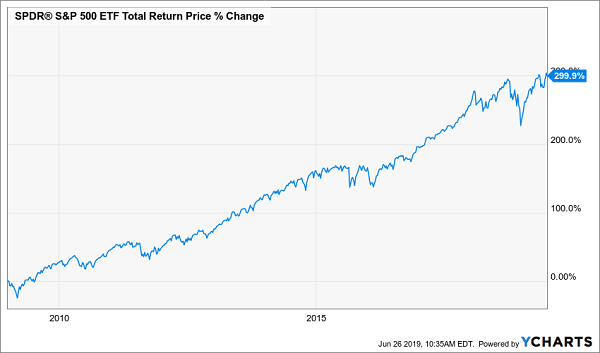

So why is this pessimism a bullish indicator? Because the Wall Street whizzes have almost always been dead wrong! 2008 is a great example: if you bought the pros’ sob story then, you’d have missed out on 300% in gains and dividends!

Contrarian Move Pays Off Big

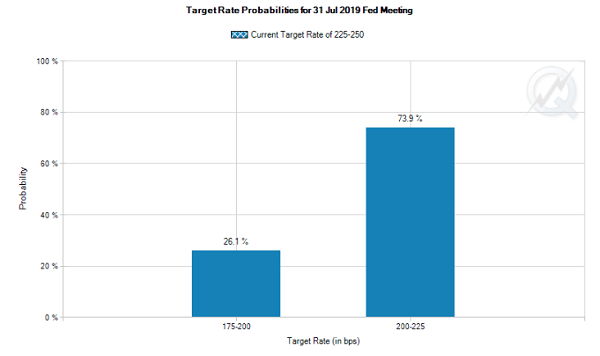

That’s one half of this golden buying opportunity. Here’s the other: the Fed is racing toward a rate cut (and likely more than one).

As I write, 100% of investors betting through the Fed futures market see a rate cut at the Fed’s July 31 meeting, with at least one more likely before New Year’s:

Source: CME Group (NASDAQ:CME)

Like July 1995 All Over Again

Here too, history points to a big gain ahead.

Troy Bombardia over at bullmarkets.co, wrote last week the last time the Fed cut rates while markets soared (which he defines as up 15% or more in the preceding six months), the market caught a further updraft and popped 21.4% one year after the July 1995 cut.

With stocks up 24% in the last six months and rates on the precipice, history looks set to repeat. Which brings me back the three dividend growers I mentioned earlier.

Let’s dive into those now.

Falling-Rate Play No. 1: Crown Castle International (NYSE:CCI)

Lower rates are a big plus for real estate investment trusts (REITs), for a couple reasons:

- REITs’ costs fall, because they carry considerable debt, in the form of mortgages on their properties), plus …

- REITs pay big dividends—the Vanguard Real Estate ETF (NYSE:VNQ) yields 4%, way more than so-called “safe” investments like Treasuries and CDs. And you can bet those dividends will be in high demand as rates fall.

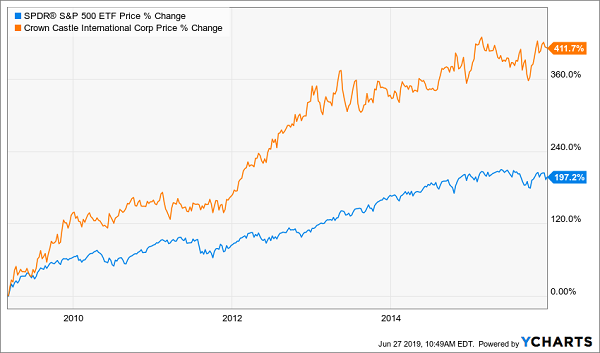

No wonder CCI doubled the market’s gain, with a 411% rise, when rates were at rock bottom following the Great Recession:

Rates Tank, CCI Soars

CCI pays a 3.4% dividend, well beyond the stream of nickels our safety-obsessed Treasury owners get. But the real story is dividend growth.

When it comes to REIT performance (and dividend safety), we need to look at funds from operations (FFO), a better indicator of profitability than earnings per share (EPS). Right now, CCI’s dividend has lots of room to grow, at just 77% of forecast 2019 adjusted FFO.

“Wait,” you’re probably thinking, “Isn’t 77% a high ratio?”

Not with REITs. Thanks to their steady rental income, any ratio below 90% is just fine. Plus, CCI’s FFO has been surging, and management sees that continuing, with the midpoint of forecast 2019 FFO up 7% from last year’s total.

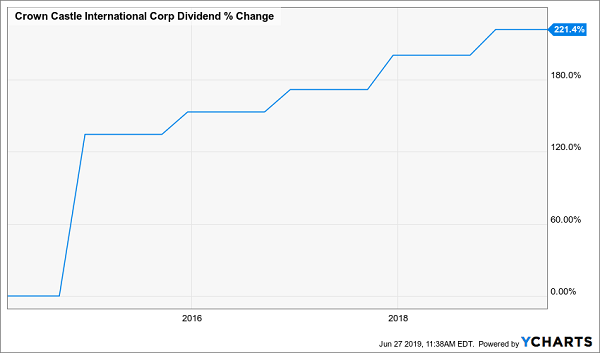

And this management team isn’t afraid to pull the trigger on a payout hike: they’ve openly stated that their goal is 7% to 8% dividend growth every year. And they’ve more than delivered since the ’09 market bottom:

A Megatrend-Powered Cash Machine

The upshot here is that CCI will gain no matter what the Fed does: its 40,000 cell towers and 70,000 route miles of fiber-optic cable put it at the forefront of just about every tech megatrend you can name: surging data use, artificial intelligence, connected cars, smart homes—pretty well anything that needs an Internet connection.

That gives CCI the leverage it needs to raise rents on its tenants as current leases expire—and send those increases straight on to you as higher dividends. With the next hike likely in October, CCI is a great stock to add to your summer buy list.

Falling-Rate Play No. 2: Discover Financial Services

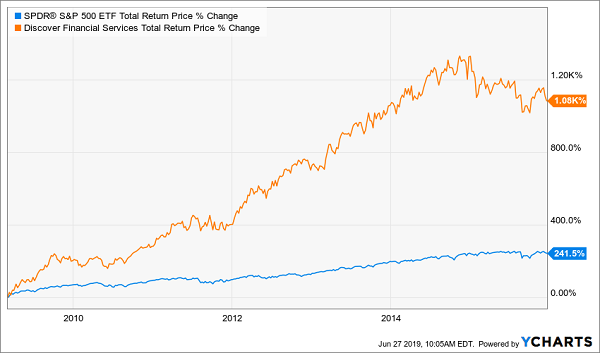

Discover may seem an odd pick, given the common “wisdom” that lower rates hurt lenders. So let’s take another look at history—this time from the March 2009 market bottom to mid-December 2015.

I know I don’t have to tell you that rates were locked at zero in this period, which should have been a nightmare for Discover shareholders. But they missed that particular memo and banked a 1,000%+ gain instead!

“Going Contrarian” Pays Off Big

Why? Because (NYSE:DFS) is a volume business, and lower rates give the company a tailwind, tempting more people to borrow and spend—and that retail therapy more than offsets a few rate cuts.

The acid test here is that even at today’s rates, Discover’s loan portfolio is ballooning, posting 7% growth in the first quarter, to $88.7 billion. That expansion drove net interest income up a whopping 10%, to $205 million.

Discover yields 2.1%, just above the S&P 500 average, but it pays a minuscule 9.1% of free cash flow as dividends. In other words, management could boost the dividend fivefold tomorrow and still be under the 50% margin of safety I demand in a dividend stock.

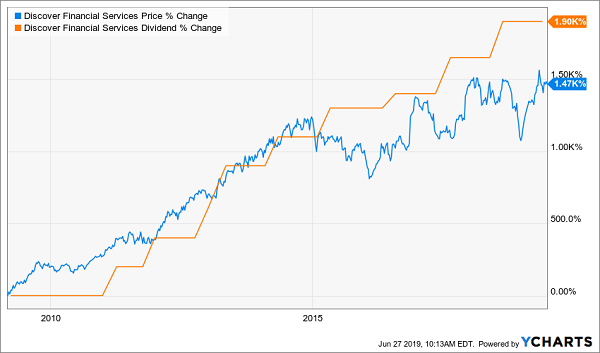

And look at this chart:

Buy Window Opens

Two things stand out: first, DFS is a serial dividend hiker, growing its payout 1,900% since the financial crisis! Second, the stock has paced that payout every single step of the way, until the last year or two, when the dividend pulled ahead.

As I’ve written before, dividend growth is the No. 1 driver of share prices (in fact, as I showed you in my May 28 article, dividend and share price hikes often match each other down to the percentage point in the long haul). So this gap is a great time to move into DFS, before first-level investors realize rate cuts won’t hurt this company one little bit—and bid the stock back up.

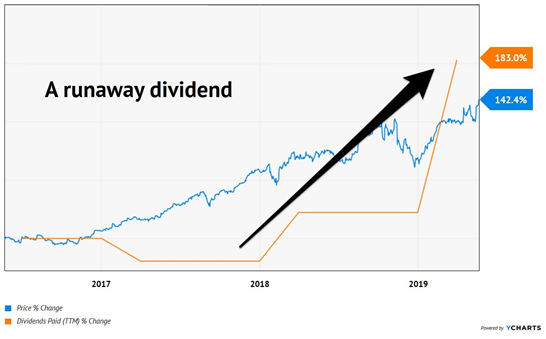

My Third Pick’s “Runaway” Dividend Could Double Your Nest Egg

My third pick just did something neither CCI nor DFS have ever done—dropped a big special dividend on its lucky shareholders!

Here’s the funny thing: Wall Street constantly disrespects these special payouts—but they shouldn’t, and neither should you.

Here’s why: since special dividends are technically one-time payouts, they don’t show up in the stated yield you’ll see on screeners like Yahoo (NASDAQ:AABA) Finance.

As a result, most people look at my No. 3 pick’s current yield—a sleepy 0.5%—and move on. But thanks to the big special dividend management pushed out the door a few months ago, its real dividend is 3.3%!

But because so few people take the time to stop and think about that, you and I get a chance to buy cheap!

Add in my pick’s regular payout, and you get a cash stream that’s quietly soaring. The share price can’t keep up!

And before you ask, this is no one-off.

This management team is practically begging us to take cash off its hands, having issued a special dividend for each of the last five years (on or around February 1, which has become Special Dividend Day for this company’s shareholders).

The dividend (and price) upside waiting for you here are obvious.

But there is one small snag—and it actually works in your favor.

You see, I just released the name of this stock to paying members of my Hidden Yields service, so it wouldn’t be fair of me to give its identity away here.

But there’s an easy way for us to get around that: I’m going to set you up with a 60-day no-risk trial to Hidden Yields. That will get you instant access to the latest issue, released just days ago, with this incredible dividend play right on page one.

7 More Dividend Doublers Ripe for Buying Now

That’s not all: I’ll also reveal 7 “recession-proof” dividend growers poised to hand you reliable 15% gains year in and year out—enough to double your retirement savings every 5 years!

These are the very same types of stocks I invest in personally—the ones I used to turn a measly $2,000 into a $154,000 nest egg in just 48 months.

I can’t wait to share these 7 picks with you, too.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."