There has been much debate lately on whether the current bull market is really the longest ever, as the definitions of a bull market vary. While one camp believes the rally that led up to the dot-com bubble bursting in 2000 began in 1990, others say it started in 1987 -- meaning it's longer than the current bull market, which began in March 2009. While we aren't here to argue either case in this space right now, something that isn't up for debate is the last time the S&P 500 Index (SPX) touched a new 52-week low: more than 630 sessions ago, marking the longest such stretch since 2014.

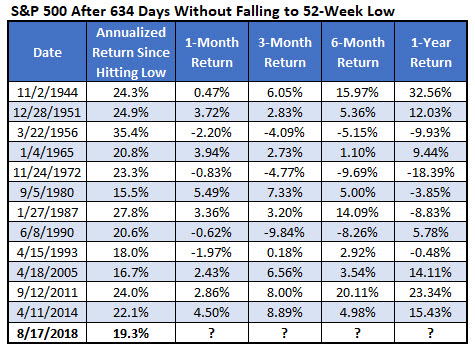

Specifically, the last time the S&P hit a 12-month low was Jan. 20, 2016 -- 634 trading days ago, as of Aug. 17. The last time the index went that long without a new low was April 2014, and prior to that you'd have to go back to September 2011, according to Schaeffer's Senior Quantitative Analyst Rocky White. In fact, there have been just a dozen other times the S&P achieved this feat, going back to 1944 (the first signal). The longest stretch on record ended in November 2000, after more than 2,500 trading days.

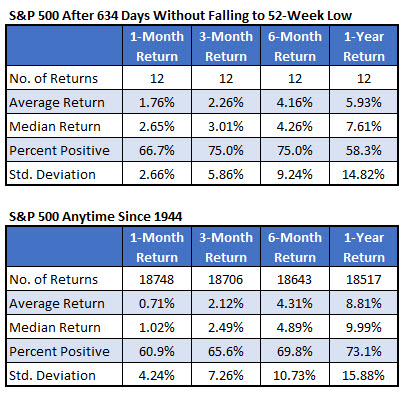

If past is prologue, strength could beget strength for the S&P in the near term. One month after going this long without a new 12-month low, the SPX was up 1.76%, on average, and higher two-thirds of the time. That's more than double the index's average anytime one-month gain of just 0.71%, with a win rate of 60.9%, per White. Plus, as Schaeffer's Senior V.P. of Research Todd Salamone noted earlier this week, "On the heels of a solid earnings season and the Fed holding rates steady earlier this month, I think there is enough buying power to push stocks through resistance before the Fed meets in late September."

From a longer-term standpoint, though, the SPX could underperform. One year after these signals, the stock market barometer averaged a gain of 5.93%, and was higher just 58.3% of the time. That's compared to an average anytime one-year gain of 8.81%, with a win rate of 73.1%, looking at anytime data since 1944.