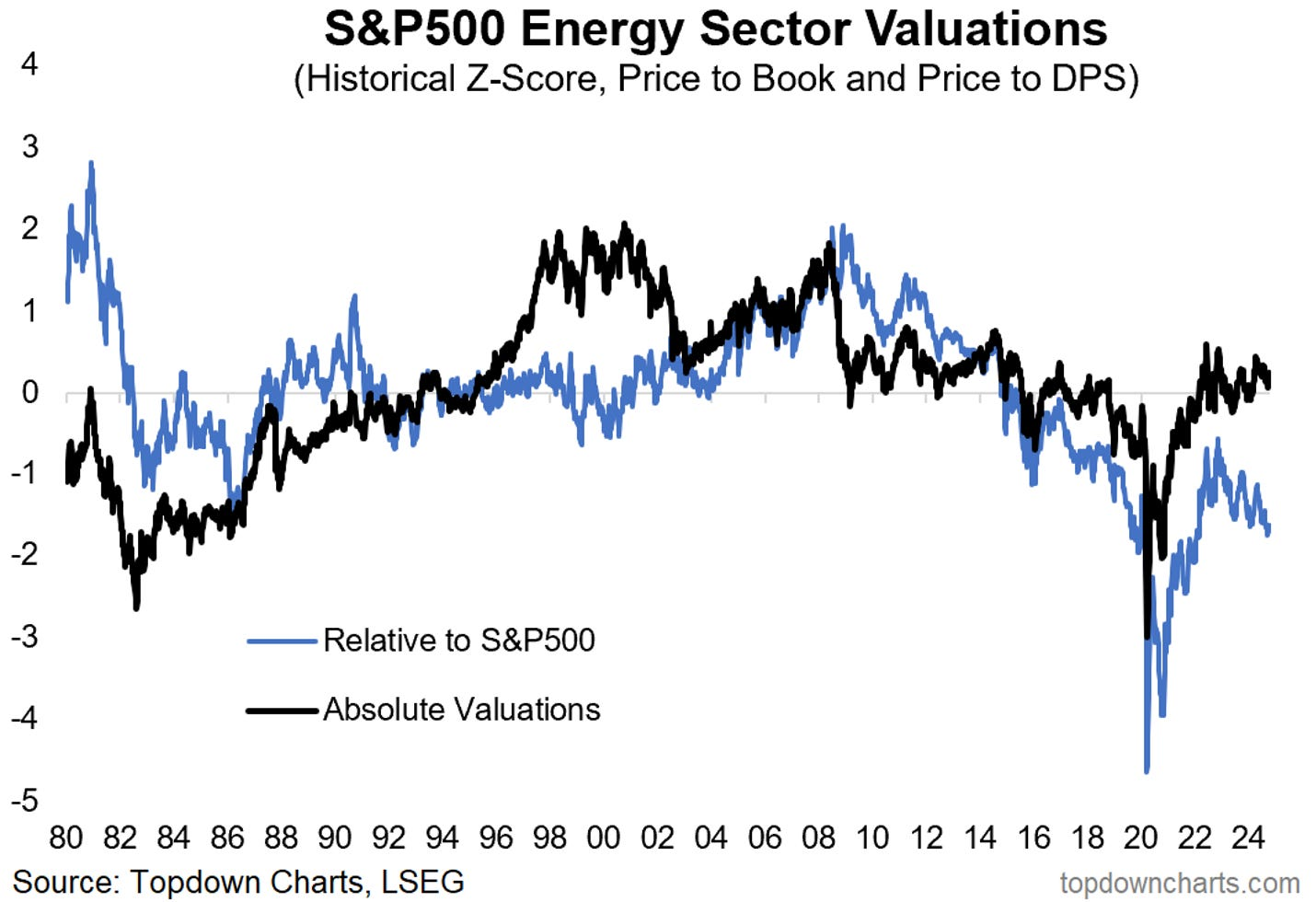

US Energy Sector (Oil & Gas) relative valuations have reached their second cheapest level vs the S&P 500 in the past 40+ years. This also comes at a time where portfolio allocations by investors to this sector have dropped back toward record lows as fossil fuels remain out of favor.

Basically, this makes the sector an undervalued and underappreciated alternative hedge (against geopolitical risk, oil shocks, energy-driven inflation resurgence) — and implies that pretty much no one expects energy to outperform.

This comes at a time where geopolitical risk is on the rise and central banks are pivoting back to rate cuts and stimulus (taking a gamble in preference of inflation resurgence vs recession risk). Indeed, as highlighted in the bonus chart below, crude oil prices are primed for upside surprise, and that’s precisely the catalyst that would give energy stocks a boost and present headwinds to the rest of the market.

For example, back in 2022 when oil prices surged over 70% in the wake of the Russian invasion of Ukraine it sent the S&P 500 into a bear market, while energy sector stocks rallied more than 50% — outperforming in relative terms and turning in solid absolute performance. While I wouldn’t try to predict a repeat of that, it goes to show how useful this sector can be in boosting returns and/or simply hedging risks in other parts of the portfolio (e.g. energy sector stocks turned out to be a much better hedge or diversifier than bonds in 2022!).

Overall, it’s fair to say the energy sector is an overlooked and undervalued part of the market with macro catalysts in waiting, and hence worth a second look for smart diversifiers and the risk management minded.

Key point: Energy sector stocks are a cheap alternative hedge against geopolitical risk and energy-related inflation resurgence risk.

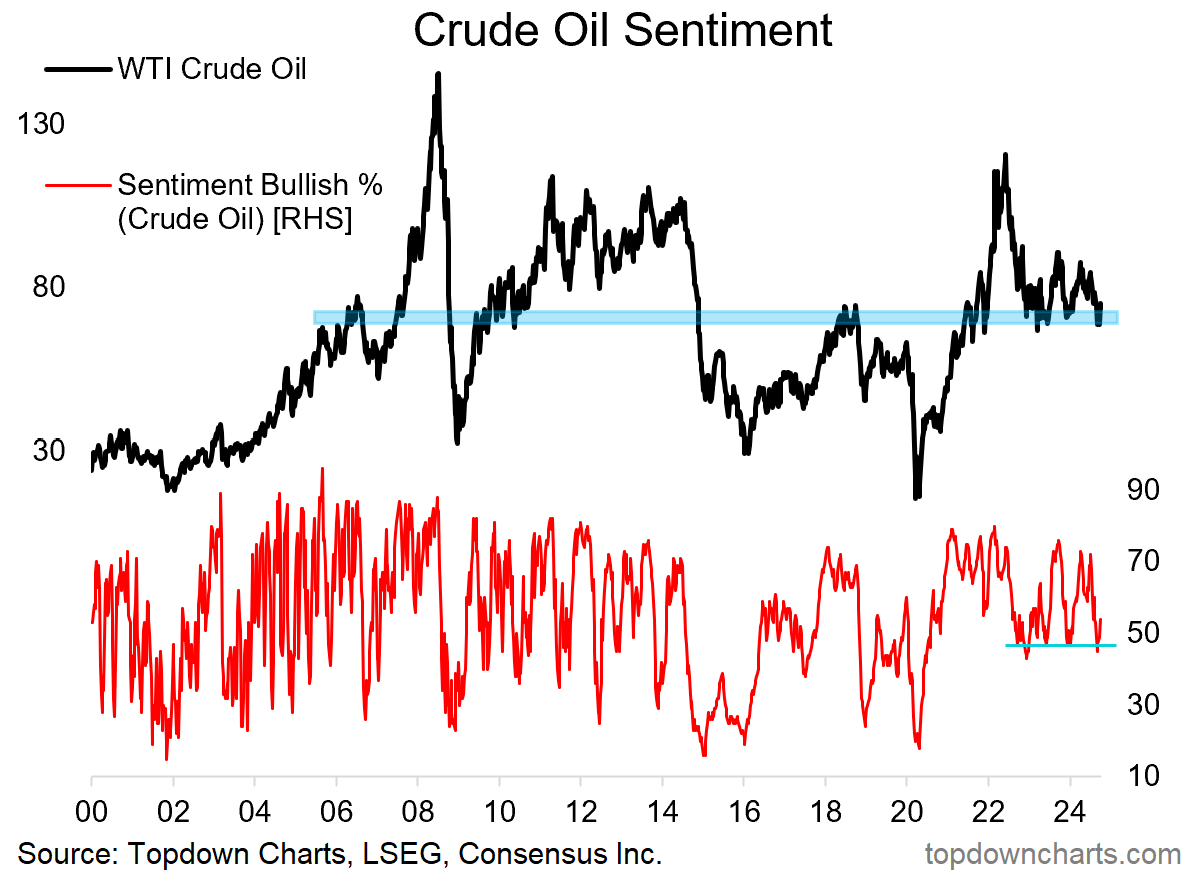

Bonus Chart — Crude Oil Cusp [Updated]

Here’s a quick update to a chart I discussed a few weeks ago: crude oil prices have come back from the brink after failing to break down through a major long-term support level. This also comes after a significant reset in sentiment and a major washout in speculative futures positioning.

Oil market implied volatility has moved higher in recent sessions which suggests a key driver of the renewed strength (aside from the positive cyclical demand effects of the global policy pivot to rate cuts) is geopolitical risk — with further escalation in the Iran-Israel war seemingly imminent.

But even simply from a technical analysis standpoint, WTI crude is precisely primed and ready for any potential upside catalysts or shocks (i.e. if you ignore everything else and study the technicals; it just looks and feels ready to rally).