China is playing Trump's game...start the discussion with a bazooka before eventually pulling out the bb gun to negotiate.

US equity and commodity markets were reeling last night on news of new Chinese tariffs. Not surprisingly, the markets overreacted. China's tariff threats don't go into effect immediately, and there is plenty of time for negotiations to take place. Further, it is important to remember that China exports much more to the US than the US does to China. Thus, an immediate fifty handle collapse in the ES on the news probably wasn't justified. As the day wore on, traders began to realize this and put their money where their mouths were by buying into the dip.

We saw similar action in the commodity markets, namely soybeans and the meats. We had previously recommended bullish trades in Corn, Soybean Meal, Cattle and Hogs that caused some stress during today's session but appear to be on the right track. In any case, there is no logical reason to see a market such as live cattle go from being nearly limit down to limit up within the span of hours.

There is no room for complacency, nor panic, in these markets. The goal should be to stay hedged and grounded.

Treasury Futures Market Analysis

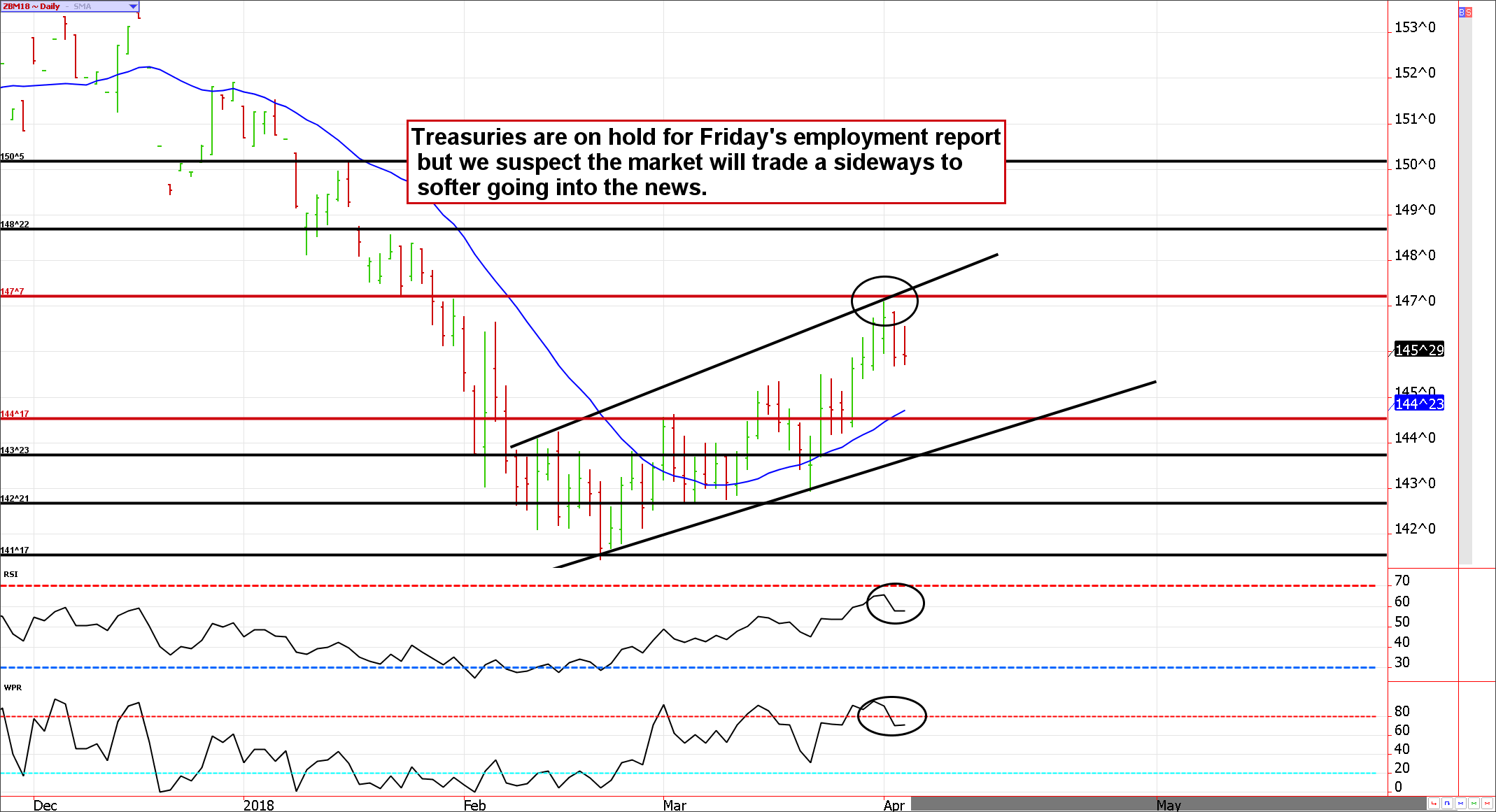

WE HAVE THE SAME TAKE AS WE HAD IN THE PREVIOUS NEWSLETTER: Treasuries had every reason to short-squeeze, but failed to do so.

The bond and note markets have yet to fully price in the new-found volatility in stocks. In our view, it is hard to fathom the lack of buying interest in Treasuries at a time in which there is severe stock market liquidation. As mentioned above, we believe this is because the proceeds of stock liquidation is going toward tax obligations and probably even mortgage pay-downs, rather than Treasuries.

Perhaps the bond market has already experienced most of this rally. If the selling dries up in the ES as we suspect, the buying in the ZB and ZN will also.

Treasury futures market consensus:

Treasuries are probably running out of steam. We are leaning slightly lower to sideways.

**Technical Support:** ZB : 144'17, 143'23, 142'21, 141'17 and 140'19 ZN: 120'04, 119'26, 119'16 and 119'08

**Technical Resistance:** ZB: 147'07, 148'22, and 150'2 ZN: 121'15, and 122'01

Stock Index Futures Market Analysis

Thus far, 2550/2560 has held like a charm...but eventually the well will go dry if trade continues to test it.

Significant technical levels, such as trend line support near 2550/2560 which we have been focusing on for weeks, tend to lose credibility as time goes on. They often successfully turn the market's momentum on the first test and usually on the second, but the more the market visits the level the less reliable it becomes. In other words, three times is not always the charm. We happen to believe the lows are behind us, leaving the path of least resistance higher. Yet, if we are wrong and the E-mini S&P 500 tests 2550ish again, we have a feeling the outcome won't be as favorable to the bulls. In fact, the third trip down would likely trigger stop running that could bring the market into the 2500 area. Let's hope that doesn't happen (unless of course, you are short).

In the meantime, the ES is poised for a "rip-your-face-off" rally; I wouldn't want to be in its way. If you made money on the downside be sure to lock-in/protect profits. 2700 is in play by the end of the week!

Stock Index Futures Market Ideas

**E-mini S&P Futures Market Consensus:**

We are looking for a run toward 2700 by early next week.

**Technical Support:** 2595, 2550, 2530, and 2504

**Technical Resistance:** 2705, 2744, 2799, 2830, and 2882

E-mini S&P Futures Day Trading Ideas

**These are counter-trend entry ideas, the more distant the level the more reliable but the less likely to get filled**

ES Day Trade Sell Levels: 2639, 2671, 2702, and 2744

ES Day Trade Buy Levels: 2565, 2546, 2531, and 2504

In other commodity futures and options markets....

January 30 - Buy June ZN near 121'09, sell an April 121 call and buy a March 120 put as catastrophic insurance.

February 15 - Sell May ZN 121 call to refresh bullish ZN position hedge.

February 20 - Buy back April 121 ZN call to lock in gain, sell March ZN put near breakeven.

February 21 - Sell long June ED 98 put to lock in a profit of anywhere from $550 to $600. This leaves our long futures contract underwater and "naked".

March 2 - Sell May soybean meal future near 3.95, sell a May 3.95 put then buy an April 4.30 call for insurance.

March 8 - Sell a June 121 10-year note call against the long futures position (hold short May 121 call).

March 15 - Exit covered put in May soybean meal to lock in a gain of about $850 prior to transaction costs.

March 20 - Go long June soybean meal futures near 363 and sell a June 360 call against it. Purchase a May 340 put for catastrophic insurance.

March 20 - Buy back May ZN 121 call to lock in the profit (roughly $250 per lot before transaction costs) and sell the June 121 call for about 30 ticks to freshen up the hedge going into the Fed meeting (this leaves the position with a long June 10-year note futures contract and 2 short 121 calls).

March 21 - Sell the June live cattle 102 put and purchase the April cattle 113 put for insurance (the April cattle is trading much higher than June).

March 23 - Go long July corn future, buy a July 3.80 put and sell a July 4.10 call. The net out of pocket expense and risk is roughly 7.5 cents or $375,

max profit potential is about $1,050 before commissions and fees.

March 27 - Go long July sugar 13.50 calls near 27 ticks or roughly $300.

March 28 - Go long July lean hogs near 75.70, sell a July 76 call for about 4.00 ($1600), then purchase a 64 put near 50 ($200).

April 2 - Sell long April cattle 113 put at a moderate profit. Use the proceeds to purchase a May 97 put as insurance against our short June 102 put.

**There is substantial risk of loss in trading futures and options.** These recommendations are a solicitation for entering into derivatives transactions. All known news and events have already been factored into the price of the underlying derivatives discussed. From time to time persons affiliated with Zaner, or its associated companies, may have positions in recommended and other derivatives. Past performance is not indicative of future results. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. Seasonal tendencies are a composite of some of the more consistent commodity futures seasonals that have occurred over the past 15 or more years. There are usually underlying, fundamental circumstances that occur annually that tend to cause the futures markets to react in a similar directional manner during a certain calendar year. While seasonal trends may potentially impact supply and demand in certain commodities, seasonal aspects of supply and demand have been factored into futures & options market pricing. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past, or will in the future, achieve profits using these recommendations. No representation is being made that price patterns will recur in the future.