Most dividend stocks make their payouts to shareholders on a quarterly schedule. But some companies choose to pay dividends once per year, or semi-annually. In rarer cases, companies pay dividends each month. Receiving 12 dividends per year provides investors a boost, as monthly payouts allow shareholders to compound their dividends slightly faster than with quarterly, semi-annual, or annual payouts.

However, not all monthly dividend stocks are automatic buys. Investors looking to add a monthly dividend stock to their portfolio should still perform thorough research on the company, to make sure it is worthy of investment.

STAG Industrial Inc (NYSE:STAG) is a REIT with a high dividend yield of 5.5%, and it also pays dividends each month. STAG is a high-quality company that could be an attractive dividend stock for income investors.

This STAG Can Run

STAG Industrial is a Real Estate Investment Trust, or REIT, that became publicly-traded in 2011 after its initial public offering. Today, the company primarily owns single-tenant, industrial real estate properties such as warehouses, distribution, and manufacturing facilities. It owns approximately 370 properties in 37 states. It has a diverse lineup of properties, across the automotive, industrial, packaging, food and beverage, and retail industries.

REITs are typically known as slow-growth companies, but STAG has generated strong growth over the past year. For example, STAG’s rental revenue increased 17% in the most recent quarter. Growth was due to increased occupancy, rent increases, and contributions from recent property acquisitions. Funds from operation, a commonly-used financial metric for REITs as a proxy for earnings-per-share, increased 10% year-over-year. STAG is off to a good start to 2018. Adjusted EBITDA and funds from operation, or FFO, increased 16.9% and 19.2%, respectively, in the first six months.

STAG’s above-average growth for a REIT is a result of its property acquisition strategy. The company has primarily focused on industrial properties because it believes the industrial market offers unique advantages. The U.S. industrial real estate industry is a large and stable market. It is also highly fragmented, which is prone to frequent pricing inefficiencies, which gives large owners like STAG to find attractive acquisitions at discounted values. Lastly, according to STAG, industrial real estate properties have low capital expenditure requirements and high retention rates, relative to other forms of real estate.

Specifically, warehouses are an emerging area of growth for STAG, largely the result of the e-commerce boom in the United States. As consumers increasingly shift shopping to online, e-commerce retail platforms like Amazon (NASDAQ:AMZN) need greater amounts of warehouse space. A recent report from real estate brokerage firm CBRE Group Inc. (NYSE:CBRE) found that warehouse availability in the third quarter of 2018 fell to its lowest level since 2000, indicating a shortage of properties. Combined with rising demand for warehouse space, this should create a significant tailwind for occupancy and rents for STAG going forward.

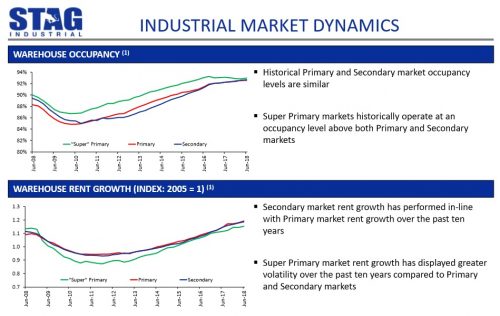

As you can see in the image below, STAG has benefited from rising occupancy and rents over the past several years.

Source: Investor Presentation, page 6

STAG has a positive growth outlook moving forward. Acquisitions are a major part of STAG’s growth strategy. In 2017, STAG invested over $600 million in new property acquisitions. Last quarter, the company acquired 15 buildings for $185 million. New property acquisitions provide additional cash flow over time, which allow the company to purchase additional buildings, and so on. This creates as snowball effect of sorts, that can provide long-term growth to STAG. The company is expected to grow FFO by roughly 5% in 2018, and could grow at a 6% annual rate over the next five years. This growth will fuel STAG’s rising dividends.

Growth And Dividends Fuel High Expected Returns

STAG currently pays a monthly dividend of $0.1183 per share. On an annual basis, STAG’s dividends total $1.42 per share. With a recent share price of $25.96 per share, STAG has a current dividend yield of 5.5%. This is a very attractive dividend yield, as the S&P 500 Index has an average dividend yield below 2% right now.

Importantly, the dividend appears to be secure. STAG is expected to generate FFO-per-share of $1.75 in 2018. Based on this, the stock is likely to have a dividend payout ratio of 81% this year. This is a manageable payout ratio, as REITs are accustomed to paying out a high percentage of FFO to shareholders. Future FFO growth will allow the company to raise its dividend each year.

In addition, STAG has a strong enough financial position to maintain and even grow the dividend over time. STAG has a net debt-to-EBITDA ratio of 4.7x; a ratio below 5.0x indicates an acceptable leverage ratio for a REIT. STAG also has an investment-grade credit rating, which will help contain the cost of debt financing for future acquisitions. This will be especially valuable in a rising interest rate environment.

STAG is also attractive on a valuation basis. Using expected FFO-per-share of $1.75 for 2018, shares of the company trade for a price-to-FFO ratio of 14.8. In the past 10 years, the stock has held an average price-to-FFO ratio of 14.9. The 10-year average is a reasonable estimate of fair value, which indicates that STAG is fairly valued today.

Going forward, STAG’s shareholder returns will be comprised mostly of FFO growth and dividends. Assuming a relatively flat valuation, the combination of 6% annual FFO growth along with the 5.5% dividend yield, result in expected annual returns of 11.5% per year over the next five years. This is a strong rate of return, especially for a high-quality business.

Final Thoughts

The REIT asset class is a great source of stock picks for investors interested mainly in generating dividend income from their portfolios. STAG has durable competitive advantages, a diversified property portfolio, and strong growth prospects moving forward thanks to the e-commerce boom. The company has a 5.5% current dividend yield, and opportunities to raise the dividend going forward. Investors looking for higher dividend income today, as well as dividend growth down the road, should see a lot to like about this company. STAG checks all the boxes of a high-quality REIT with a high dividend yield, and an added bonus—monthly dividend payouts.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.