Gold is dominating headlines... and with the recent market volatility, it’s easy to see why.

Compared to the broader market, the yellow metal has sported some of the strongest returns this year - nearly 17%.

This is great news for precious metal investors. But this week’s chart uncovers an opportunity that headlines and analysts have overlooked...

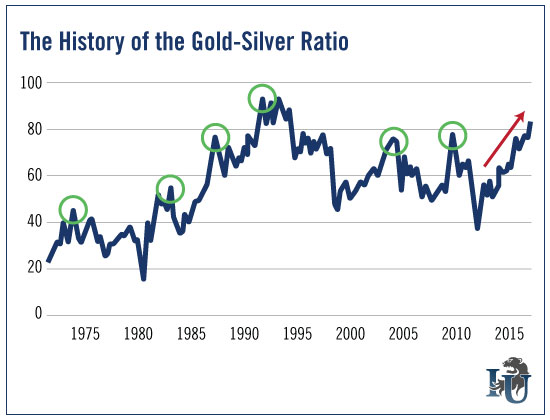

It looks at the historic ratio of the price of gold compared to the price of silver.

Peaks in the gold-silver ratio mean that silver prices are underpriced when compared to gold. Over the last 45 years, they’ve proven to be the ultimate “Buy” signal, leading to returns as high as 151.29%.

The ratio has significantly peaked six times since 1973... and it’s about to do it again.

Right now, the ratio is sitting at around 83.5. This means it takes 83.5 ounces of silver to buy one ounce of gold.

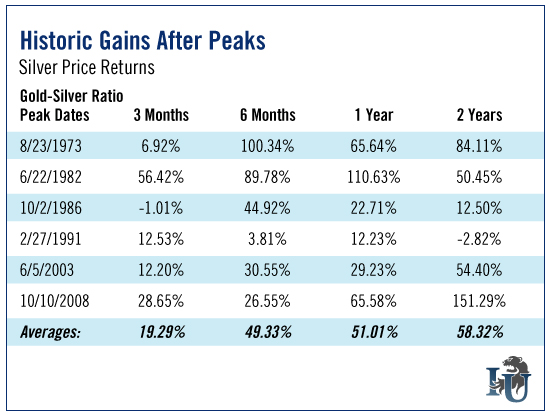

That number could still move higher, but we’re clearly nearing another peak. Here’s how similar situations have played out for silver investors in the past:

As you can see, the average return on silver two years after a peak in the gold-silver ratio is 58.32%.

When the last peak was hit in 2008, the ratio was close to where it is today - 83.79. Three months later, silver had surged by 28.65%.

The best part is, while silver is up nearly 8% this year, it’s still down more than 70% from its high in April 2011. So new investors can not only get in ahead of a potentially massive run-up... but do so at bargain-bin prices.

This isn’t a new trend, mind you. In October 2015, Resource Strategist Sean Brodrick wrote, “[Silver] prices have been in a downtrend since 2011. But you can also see that bearish momentum is running out of steam. In fact, there is a disconnect between price action and momentum... this is the kind of disconnect you often see before a reversal or breakout.”

Boy, did he call it.

With the S&P down more than 3% this year, investors should be watching those peaks in the gold-silver ratio with hungry eyes.