With three days of sideways action on the S&P 500, I am focusing on stocks that have either bull-flagged its price action or pulled back to a key support level following a massive move higher.

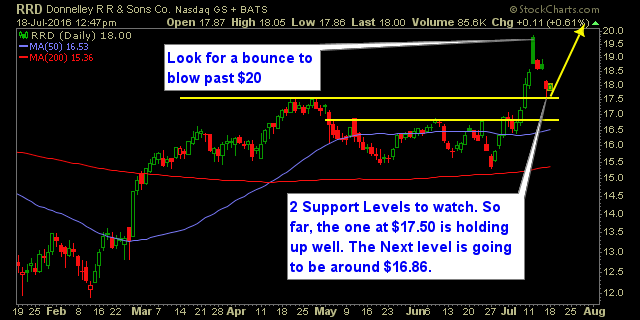

RR Donnelley & Sons (NASDAQ:RRD) caught my eye on a stiff pullback to the breakout level it soared through just a little over a week ago. Now it's testing support at the $17.50-80 level, while holding the 10-day moving average.

If this bounce holds, I think there's a strong chance that RRD will blow past the $20 price point.

There is support under $17.50 if that support level doesn't hold, at the $16.80 level. If it doesn't hold, then get out and get out fast.

Managing risk is key to successful trading and when it cannot hold key price levels, you have no reason to stay in the trade.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.