Macau - an autonomous region on the south coast of China - is nicknamed the “Las Vegas of Asia.”

Its giant casinos and malls on the Cotai Strip make it a huge tourist attraction for Asian gambling.

And for investors, Macau’s gambling revenue is one to watch. It can signal emerging market moves.

Emerging Markets have struggled this year due to global macro forces like trade wars and a stronger dollar, as well as local issues.

And today’s chart signals the pain could continue.

What’s great about the Macau indicator - the year-over-year growth of gambling revenue - is that it’s a consumer sentiment barometer.

Forget investor and consumer sentiment surveys and the latest data from central banks. If people are spending their hard-earned cash at the casino, they probably think their next paychecks are safe.

The data measures optimism, risk appetite and - for Macau in particular - China’s willingness to let capital leak out of its borders.

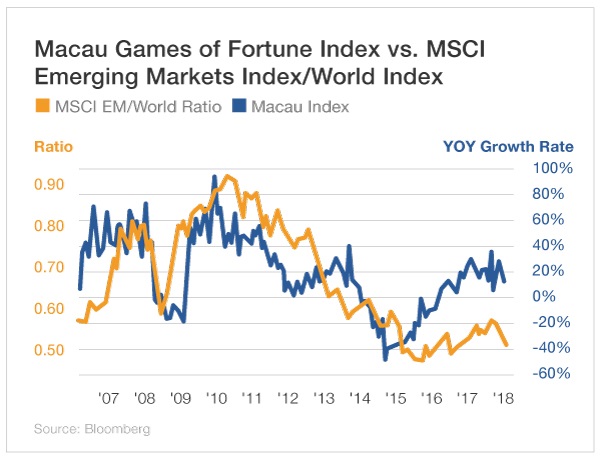

As you can see, over the last decade, the Emerging Markets Index has moved practically in lockstep with the Macau indicator. Back in January, when global optimism peaked, Macau’s gambling revenue was up 36% year over year.

But since then, it’s pulled back significantly to 12% year-over-year growth, coming in below expectations. Simultaneously, emerging markets also sold off.

And China - which makes up 31.7% of the MSCI Emerging Markets Index - has really taken it on the chin.

Earlier this week, my colleague and The Oxford Club’s ETF Strategist Nicholas Vardy covered China’s tumble of 20% from its peak.

The Shanghai Composite - China’s main stock market index - has officially entered bear market territory.

While U.S. interest rates, tighter domestic policy on the mainland and a trade war spitting contest have contributed to the drawdown, Nicholas declares that China has been dead money for the past decade.

He notes that while GDP growth in China has outpaced U.S. growth, it hasn’t translated into gains in Chinese stocks.

For example, money invested in the iShares China Large-Cap (NYSE:FXI) would have handed you a negative 5.9% return over the last decade.

You can’t argue with the data - it’s been a bad bet.

And with the Macau indicator down a third from its January high, I wouldn’t bet on the Red Dragon turning around anytime soon.