Let’s go ahead and grab a slice of AI’s furious growth and get ourselves a nice 6% dividend (paid monthly), too.

Better still, we’re going to get in at an unheard-of 13% discount. Plus we’re going to do it safely—not tying up our cash in profitless tech or miserly blue chips dribbling out paltry 1% to 3% dividends.

Like Buying Microsoft, But With a 6% Dividend (Paid Monthly)

When someone mentions AI, the first stock that likely pops to mind is Microsoft (NASDAQ:MSFT) and its flashy move to integrate the ChatGPT AI into its Bing search engine.

That came straight from the company’s $10-billion investment in OpenAI, ChatGPT’s developer—a move that paid off: Microsoft has its search-engine game back after Bing spent the last decade in the dumpster with ’90s throwbacks like AskJeeves and Yahoo.

Now Bing is back, and Google’s taken note—rushing to introduce its own AI search feature. Even so, this is now Microsoft’s game to lose. But we’re not going to just roll our cash into Microsoft for AI-powered gains.

For one thing, the stock yields just 1%! And even though the company grows its payout fast, with such a low base yield, it’ll be a long time before the yield on an investment made today gets anywhere near what we need to retire on dividends alone.

Worse, Microsoft is a crowded trade because, well, everyone knows it’s a great stock. Even after last year’s pullback, MSFT still trades at just under 29 times forward earnings. That puts our cash at too big of a risk, especially when there’s a way to tap Microsoft and Alphabet (NASDAQ:GOOGL) for 13% below their regular prices.

That way would be through high-yield closed-end funds (CEFs).

We don’t have to get into the weeds here, but CEFs give off a crystal-clear signal when they’re oversold. You’ll find it in the discount to NAV, which is the percentage by which the fund’s market price trails the market value of all the assets in its portfolio (known as the net asset value, or NAV).

This number is easy to spot and available on almost any CEF screener, and it makes our plan simple: wait for the discount to get excessively wide and then make our move.

1 Click to Tap AI for 6% Dividends—at 87 Cents on the Dollar

Our CEF play on the AI trend is the Gabelli Dividend & Income Fund (GDV), which yields 6% today (with a payout that rolls your way monthly) and trades at a 13% discount to NAV. In other words, we can pick up GDV for just 87 cents on the dollar!

Run by legendary value investor Mario Gabelli, GDV holds mainly blue-chip stocks, including Microsoft (MSFT), its fourth-biggest holding. We also get some exposure to Alphabet (GOOGL), its No. 8 holding, plus some nice diversification into other parts of the economy through dividend growers like Mastercard (NYSE:MA), JPMorgan Chase & Co. (NYSE:JPM) and Honeywell (NASDAQ:HON).

That’s another nice thing about investing through CEFs: you can buy without having to change investments because a CEF like GDV holds many of the same stocks you likely already own—but with a 6% (monthly) payout.

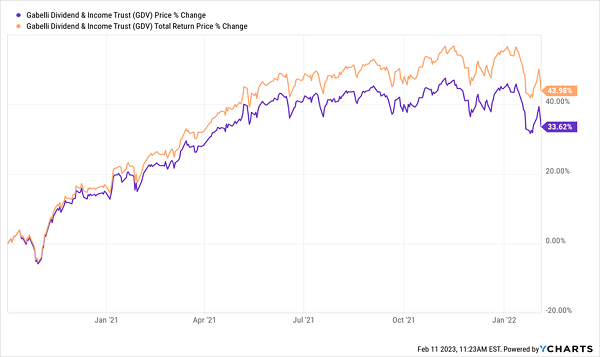

Over the next 15 months, we collected GDV’s generous payout and enjoyed a 34% price increase as its discount narrowed from 16% to 10%, effectively catapulting the price higher. Add in the dividend, and our “discount-driven” total return came in at 44%—or a gaudy 31.1% on an annualized basis.

GDV’s Dividend Boosts Our Return

By February 2022, however, the Fed was in tightening mode, and Jay Powell was taking away the cheap money to Mr. Market had become addicted to. That, plus GDV’s now-10% discount gave us a nice spot to step out, so we did, taking our 44% return with us.

A Recession-Resistant 6% Dividend

Now GDV is giving us a nice “in” on the AI trend, thanks to its 13% discount, safe blue-chip exposure to AI, and its 6% monthly dividend, which has grown 38% in the last decade. (Plus Gabelli drops the odd special dividend on his investors, too.)

All of the above points to a better discount for GDV than the 10% it hit last time we held it—and the potential for strong price upside as this 13%-off deal fades.

These Huge Dividends Could Fund Your Retirement for Decades

Of course, the best thing about GDV is that it not only lets us invest in AI through Google and Microsoft—it also gives us instant diversification, with access to dozens of other stout dividend growers from across the economy.

And like many CEFs, GDV pays dividends monthly, too. Try finding that among S&P 500 stocks.

You can’t—almost all the popular names pay quarterly.

That’s why we love CEFs. And we can do better than GDV’s 6% payout, which is actually low for these funds.

***

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."