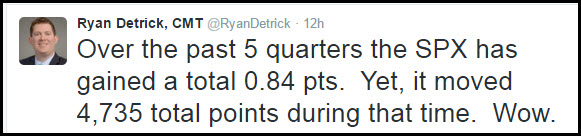

Does a “comeback” mean that the buy-and-hold community made money? Even though the rally was historic, the Dow's net return was 1.49%. And while the quarterly gain was small -- +1.49% -- the S&P 500 is up just .84 points over the last 5 quarters. Ryan Detrick points out an interesting stat below.

Ryan’s stat really caught my eye: 15-month gain for the S&P is a whopping .84 points. For sure, little gains for the buy-and-holder, yet opportunity took place in the 4,735-point movement during this time frame. So how do you take advantage of the movement when the broad market has been static over the past 15 months?

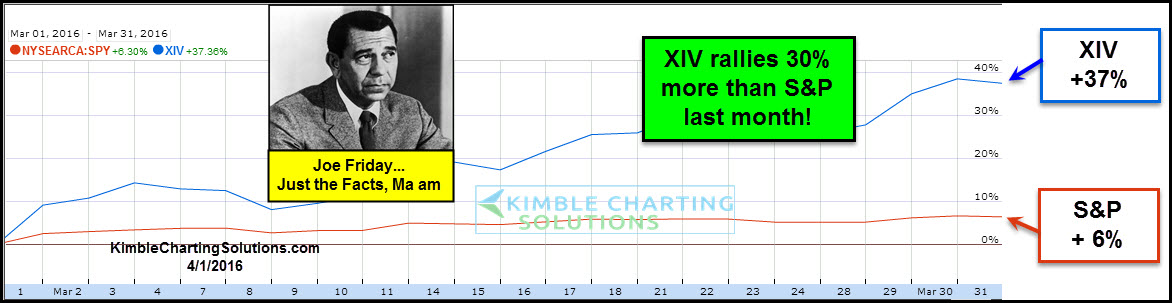

On March 1 our members bought Inverse Fear ETF XIV) as fear was lofty -- pushing XIV down 60% in the prior 9 months. That was the worst 9-month performance for XIV since the 2011 lows. Check out how XIV and SPY (NYSE:SPY) did in March.

Although the broad market has little to brag about, excess fear and movement can be taken advantage of -- as our members did this past month!

A majority of global stock markets remain in a down trend (lower highs and lower lows) over the past year. Despite this trend, opportunities remain huge for investors around the world in a variety of places.