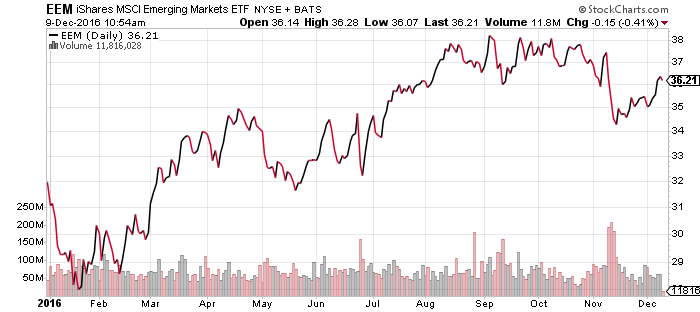

The iShares MSCI Emerging Markets Index (NYSE:EEM) has recovered partially from its post-Trump purge, but now it faces a big technical hurdle to overcome.

From Bespoke:

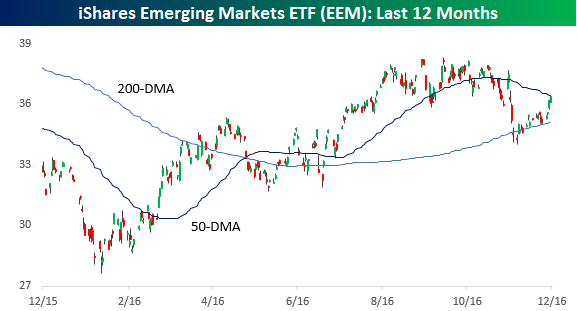

In the immediate aftermath of the election, emerging market equities were one of the biggest losers, swiftly falling over 9%. However, after more or less holding support at the 200-DMA the iShares Emerging Markets ETF (EEM) has rallied back close to 7%. At yesterday’s close, though, the ETF finished the day right below its downward sloping 50-day moving average.

The technical reasoning is fairly simple: if EEM can break through its 50-day moving average, it would likely surge to new highs. If it fails to break above that key level, however, it could give up all of its recent gains, and then some.

Chart courtesy of Bespoke

At least one major analyst is very bullish that emerging markets will in fact break out to the upside. S&P recently wrote:

“We believe it may no longer be possible to separate advanced economies from emerging markets by describing their political systems as displaying superior levels of stability, effectiveness, and predictability of policy making and political institutions,” wrote Moritz Kraemer, chief sovereign ratings officer, in a 2017 outlook report entitled “A Spotlight On Rising Political Risks.”

In short, Kraemer is saying that the historical premium that developed markets like the U.S. has always enjoyed versus those of many foreign markets may be ending. That would mean lower valuations coming for U.S. stocks and higher ones for emerging markets. That’s a very bold call, and only time will tell which way EM begins to turn.

EEM shares fell $0.13 (-0.36%) to $36.23 per share in Friday morning trading. Year-to-date, the largest emerging markets ETF has gained 12.47%, versus a 10.83% return from the benchmark S&P 500 during the same period.