“Be fearful when others are greedy and greedy when others are fearful.” - Warren Buffett

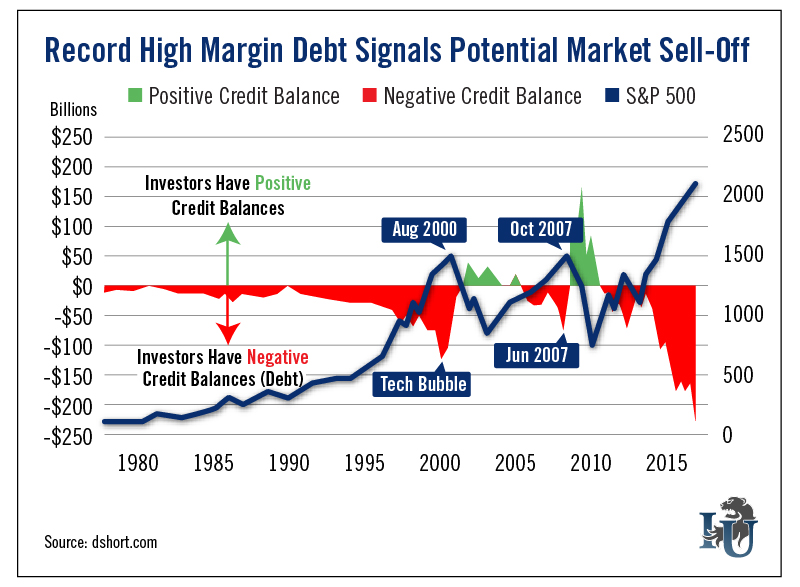

Today’s chart looks at one of our favorite indicators, the correlation between margin debt and market highs. As you can see, credit balances in the past have hit extreme lows - meaning debt was high - around the same time the S&P 500 hit new highs.

The tech bubble that burst in 2000 and the housing bubble that popped in 2007 coincided with top levels in margin debt. So what we’re seeing today is downright scary.

Margin debt has reached an all-time high as investor greed levels have surged. Which suggests the market could be due for a correction.

I’ll explain...

Greed and margin debt tend to go hand-in-hand. Not every investor buys stocks with just the cash they have available. Some will borrow funds from their broker to purchase stocks. This is known as “buying on margin.”

Why would someone borrow money to invest in stocks? Two reasons.

First, they are bullish on a particular stock - or on the overall market. Second, because they are bullish, they get greedy and try to boost their returns by borrowing money to invest. After all, when they trade on margin, they multiply their returns if share prices head higher.

But many forget that it is a two-way street. Losses can also multiply quickly. And when the market pulls back, large amounts of margin calls come due. This magnifies selling pressure.

Next thing you know, you have a market sell-off in hyperdrive - 2000 and 2007 are perfect examples. Of course, margin buying isn’t just about greed. It is also a useful way to gauge investor outlook on stocks. When margin debt levels are high, investor sentiment also tends to be high. And as you can see in the chart, when markets bottom out - and pessimism is rampant - cash balances are at their highest.

The high investor sentiment and margin debt we see today is a clear indication that greed is back. It’s time to be cautious.

The Oxford Club recommends trailing stops as a way to protect your principal investment and your profits. It’s a simple discipline that will protect big gains from becoming losses, and small losses from becoming big ones.

With both the market and margin debt peaking, now is a great time to keep an eye on your stops... or put some in place if you haven’t set any.

Editorial Note: Even if the market dips in the short term, the long-term trajectory is always the same: up. (Permabears always seem to ignore the fact that the S&P 500 has risen 180% since 2009.) To help Investment U readers make the most of this undeniable trend, Alexander Green has compiled the six steps necessary to build a $2.3 million portfolio.