After a strong showing in 2014, the Consumer Discretionary ETF (ARCA:XLY) has churned sideways into early 2015. This type of price action would typically indicate consolidation, but considering the wide swings in 2014 and recent retail sales numbers for December -- not good -- it’s clear that the XLY is looking for direction. And whichever direction it takes, the stock market may follow.

Here’s a few reasons why I have XLY on my radar as a critical market ‘tell’ for the market's next move.

- Big week for economic data – The Consumer is at the heart of the US economy. And ever since the poor retail sales number came out for December, the economic “story” has changed: from cautiously optimistic to “making ends meet”. This week likely won’t provide as much clarity as investors would like, but it will add some texture to the terrain. Is this just a blip, or will the consumer (and economy) struggle into the first half of the year?

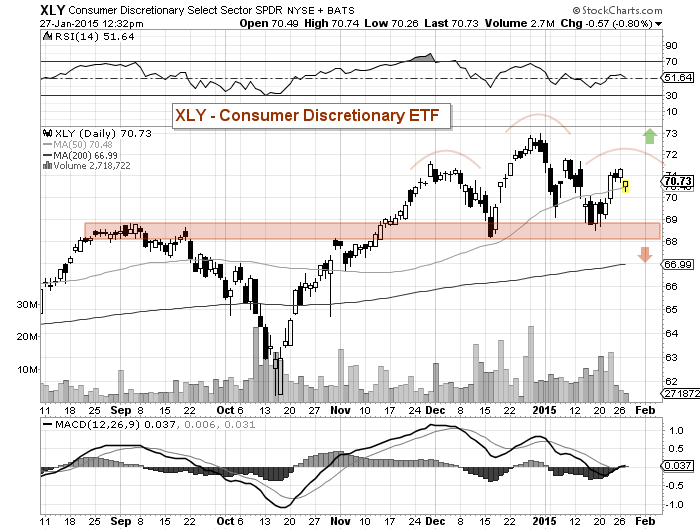

- The Price Action and Chart for XLY – The Consumer Discretionary ETF has traded in a range of $68-$73 over the past 2 months. $68 also represents the September 2014 highs, so that level is a must hold for XLY (and the stock market). It also represents the neckline of a potential bearish head-and-shoulders pattern. In order to turn the ETF bullish again, price will need to breakout above $71.75 (constructive), then above $72.97 (52-week highs).

Low interest rates and stronger home sales have buffered the consumer, but the economy is still mixed and the consumer still seems to be finding his/her way. This likely has a hand in the recent choppy, sideways movement on the SPDR S&P 500 (ARCA:SPY) and XLY. While Apple (NASDAQ:AAPL) may have a short-term headline impact on the consumer, the verdict will show up in price action of the Consumer Discretionary ETF.