Generating solid returns with a globally diversified portfolio strategy has been a breeze this year. Short of making extreme bets in the handful of losers among the major asset classes, the tail wind of beta has otherwise been kind – especially for US-oriented strategies.

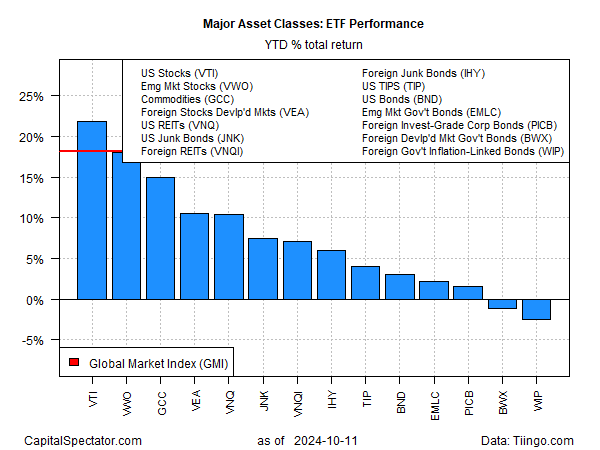

Using a set of ETF proxies, nearly all slices of global markets are posting gains year to date through Friday’s close (Oct. 11). US stocks (VTI) are still leading the way with a 21.8% rally this year. If the current performance for the year merely holds steady through Dec. 31, VTI is set to post its second 20%-plus calendar-year advance in a row. Underweighting US shares, in other words, continues to take a hefty toll portfolio strategies.

In fact, most of the major asset classes are up on the year. The outliers: two flavors of foreign bonds: government securities issued in developed markets (BWX) and inflation-indexed government bonds (BWX). Otherwise, across-the-board gains apply.

Simply buying and hold a passive mix of the markets listed above, and weighting based on market value, has been a winning proposition again this year. The Global Market Index (GMI) is up a strong 18.1% year to date.

The trend has enabled relatively aggressive postures to excel in 2024. Consider the hefty degree of results in a pair of quasi-passive global asset allocation ETFs. The aggressive version (AOA) is up 15.4% so far this year, far above the 8.0% rise for its conservative counterpart (AOK).

In addition to overweighting US stocks, winning portfolios in 2024 are likely to have robust holdings of foreign stocks and commodities – the next-strongest winners after US shares year to date.

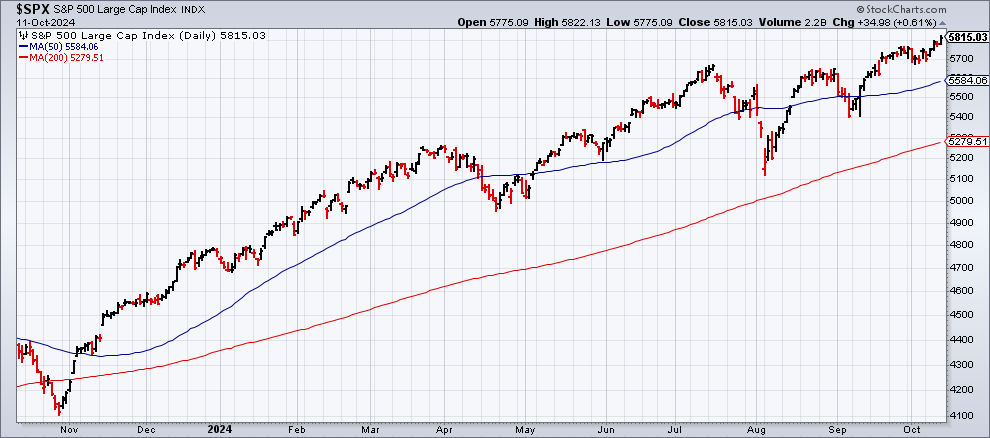

From a US stock market perspective, the bull run is celebrating its two-year anniversary, according to some calculations. Although there’s concern that the market is vulnerable after a stellar run, the technical profile for the S&P 500 Index remains firmly skewed to the upside.

Perhaps that’s a factor that persuaded Goldman Sachs to raise its year-end S&P 500 target to 6,000.

Yahoo Finance reports, based on interviews with Wall Street strategists:

“Barring any unexpected shocks, the path higher appears to be clear, with earnings growth expected to keep accelerating and the economy on seemingly solid footing as the Federal Reserve cuts interest rates,”

But the market’s high valuation worries some observers. Charles Schwab senior investment strategist Kevin Gordon tells Yahoo that the trailing 12-month price-to-earnings ratio is stretched.

“This would tell you that the bull is much older or somewhat near the end of this life.”

Perhaps, but if that’s the case, it’s not obvious by looking at the S&P’s trend history of late.