The markets have changed and many are going to get “taken to the cleaners.”

Last year, 2017, was not a normal year for stocks. Stocks as an asset class are not meant to go straight up without even a 1% pullback. But that is precisely what happened for nearly an entire year.

Now that massive market rig is over. And anyone who continues to invest as though it’s 2017 is going to get annihilated in the coming weeks. The only thing that stop an all out crash in stocks was clear and obvious intervention in the markets by central banks.

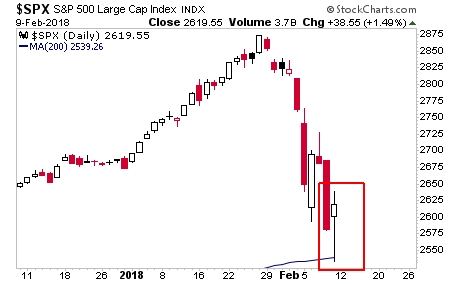

Take Friday’s action for example. The S&P 500 briefly broke its 200-DMA. At that point the Plunge Protection Team (a colloquial name given to the Fed's Working Group on Financial Markets) stepped in and ramped stocks over 3% in the span of an hour.

This was intervention, plain and simple. No real investors “panic buy” stocks in this kind of rapid frenzy.

This raises the question…

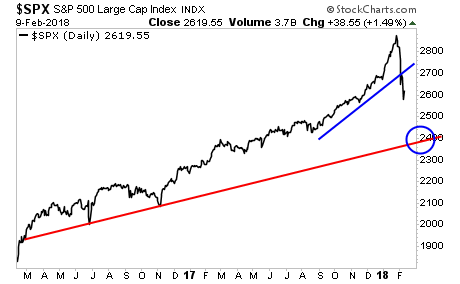

What would have happened if the PPT had not stepped in? Where would stocks fall to?

Buckle up, it’s about to get nasty. The PPT can trigger bounces, but it requires REAL buyers for stocks to enter a prolonged rally.

Put in another way, we’re still going to that circle in the next few weeks.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline how the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.