Very quietly and with only a very few people noticing, the total amount of computing power being used to mine Bitcoin reached a new all-time on Monday.

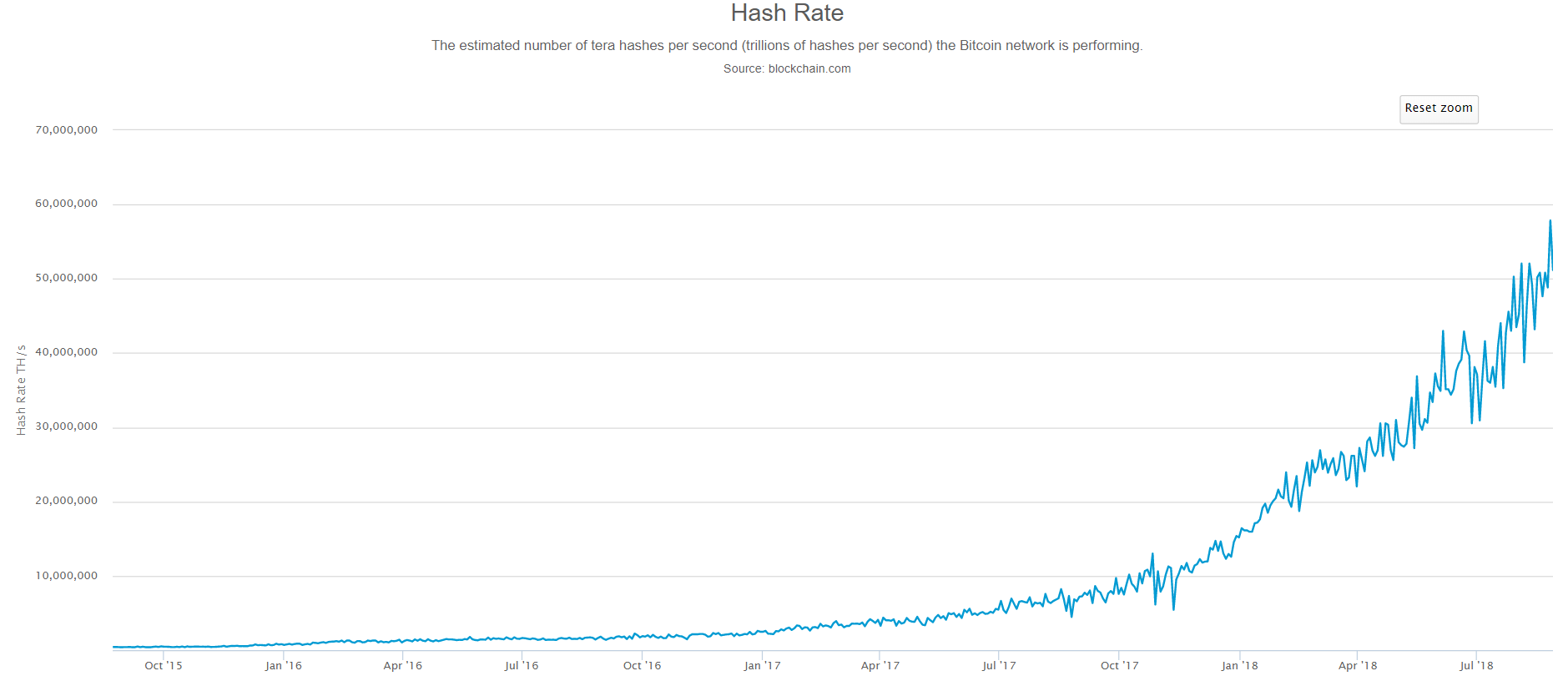

Here we can see the beautiful hockey stick graph of the Bitcoin blockchain's hashrate over the last three years. A figure that has topped 61 quintillion hashes per second this week.

What this shows is a surge of new miners coming online. As more computers join the network the more difficult it gets to produce new coins, and the more expensive too.

This hash-powered arms race might be good for hodlers because higher mining costs tend to lead to higher price per coin but it certainly has other consequences as well.

Today's Highlights

Trudeau Thinking to Join

Watch the Dollar

Bitcoin Spike Venezuela

Please note: All data, figures & graphs are valid as of August 30th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Optimism was seen in the US stock markets yesterday as the North American segment of Trump's trade war is finally seeing the light at the end of the tunnel.

The tech-heavy NASDAQ flew 1.26% further into all-time high territory showing a marvellous marubozu candle on Wednesday (purple circle).

Despite the steady pace in the US, Asian and European stocks are underwhelming this morning.

Here we can see the China50 falling throughout the day while the DAX and the CAC show a terrible opening.

Eye on the Buck

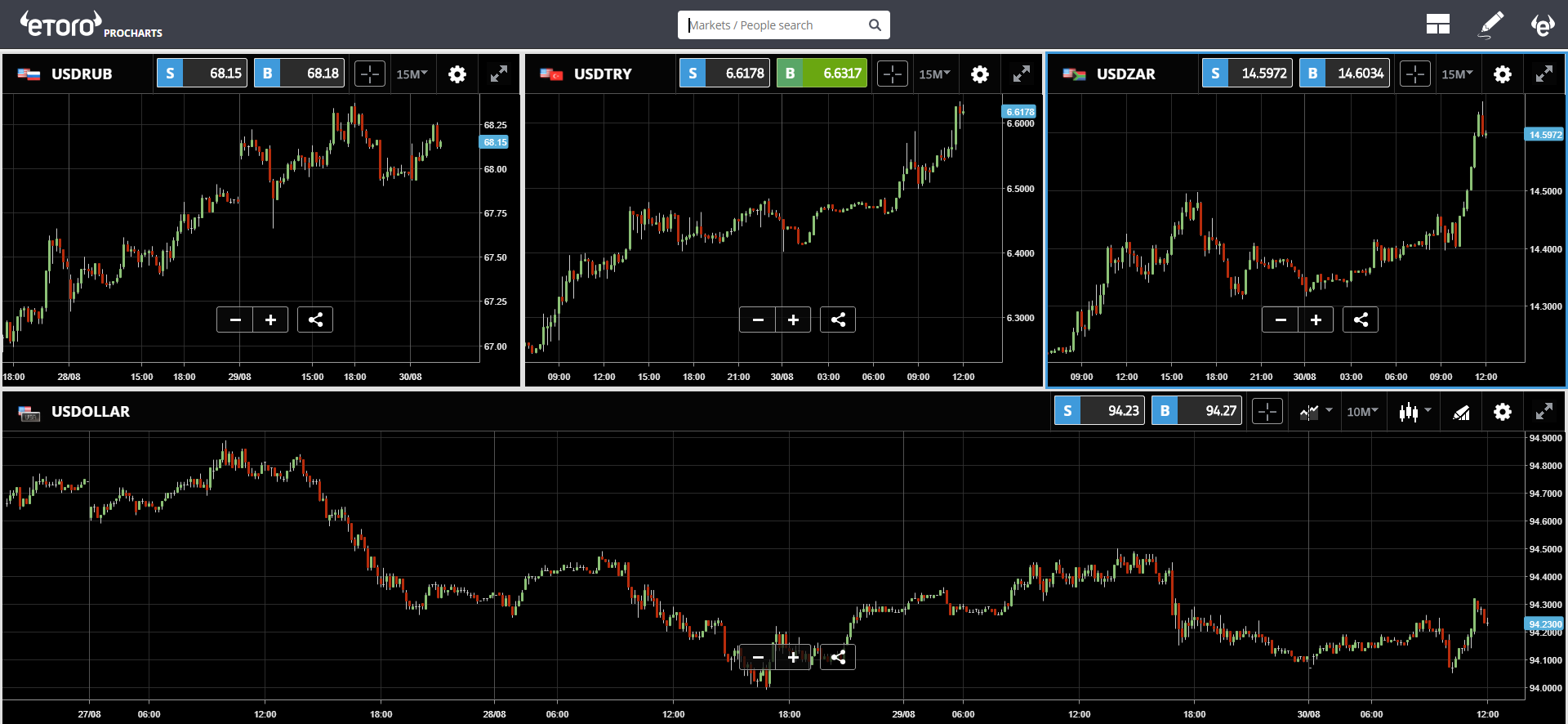

The US Dollar isn't doing great but it is holding steady at the lows (bottom chart). However, the emerging markets currencies are taking another hit today.

Here we can see the Dollar rising against the Ruble, the Lira, and the Rand.

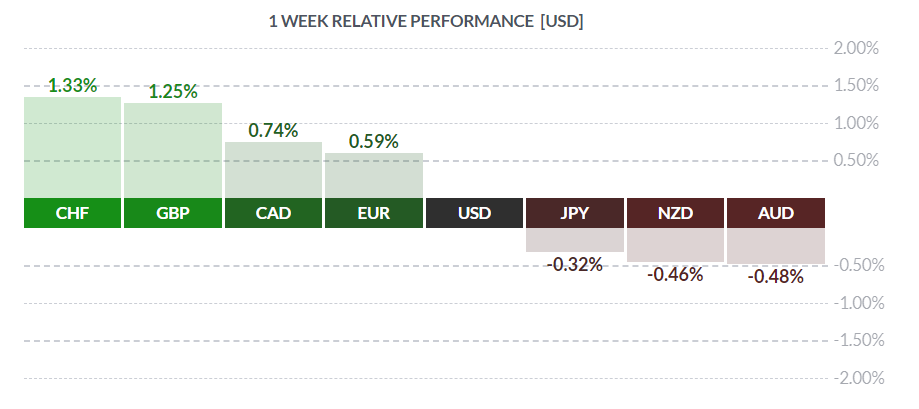

However, even though the EM currencies are showing a particular vulnerability, the Dollar's performance is actually quite average compared to other major currencies this week.

Bitcoin Volumes Spike

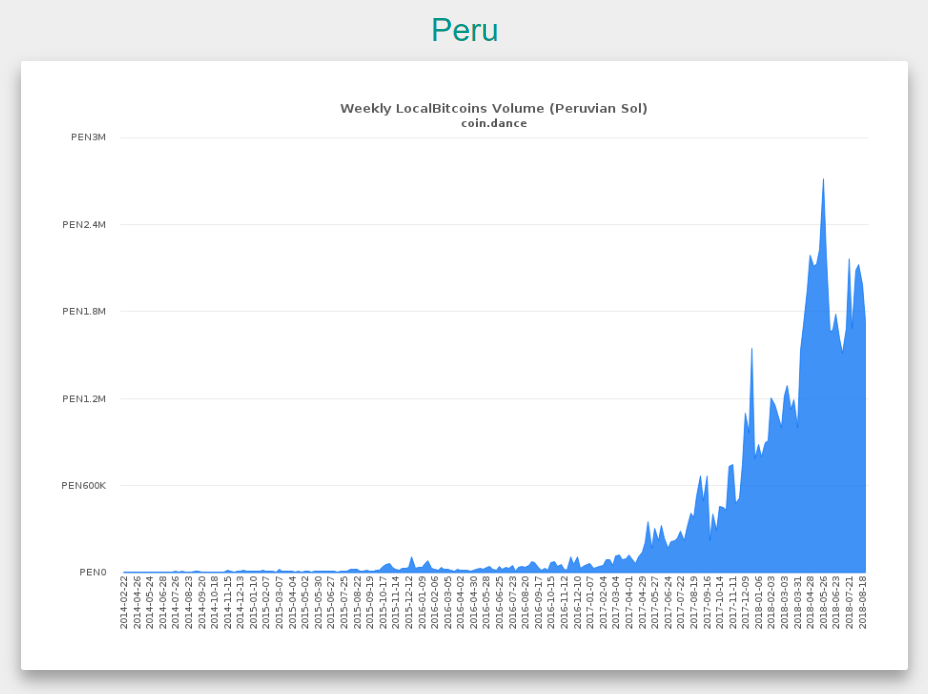

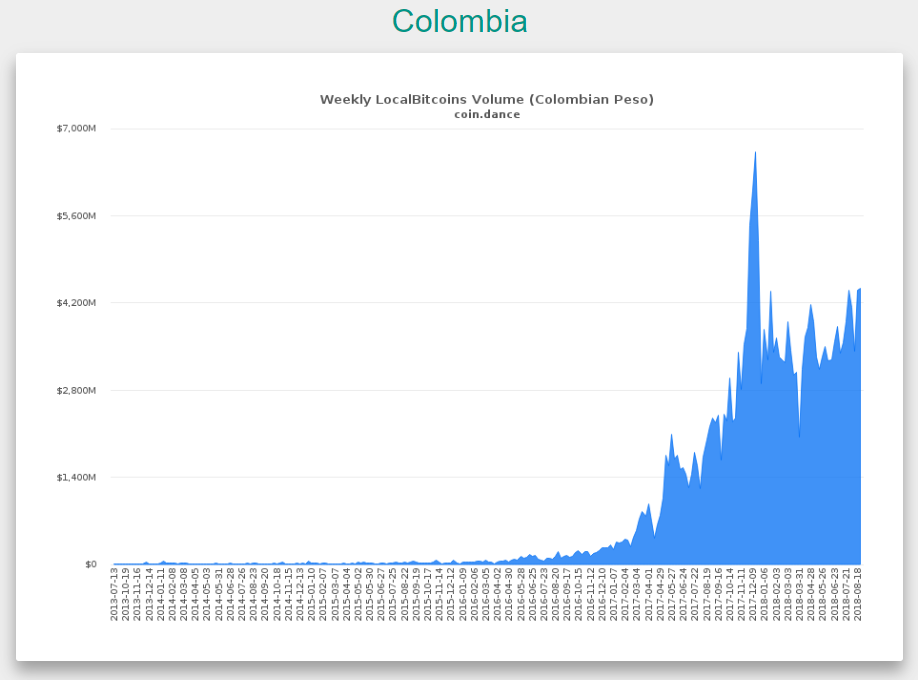

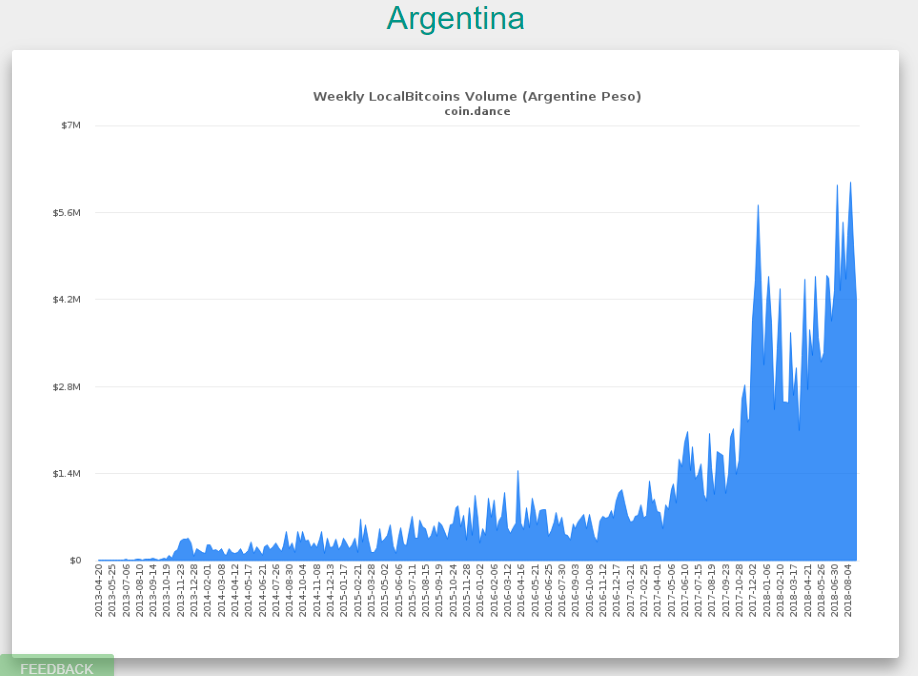

As Bitcoin's price remains stable, what's interesting to watch are the volumes across the globe.

One of the best ways to see this is by looking at the charts from coin.dance, which show the transaction volume on the popular P2P bitcoin trading site LocalBitcoins.com.

From this, it becomes immediately clear that several South American countries are ramping up their purchases. Peru, Columbia, and Argentina are increasing their volumes steadily.

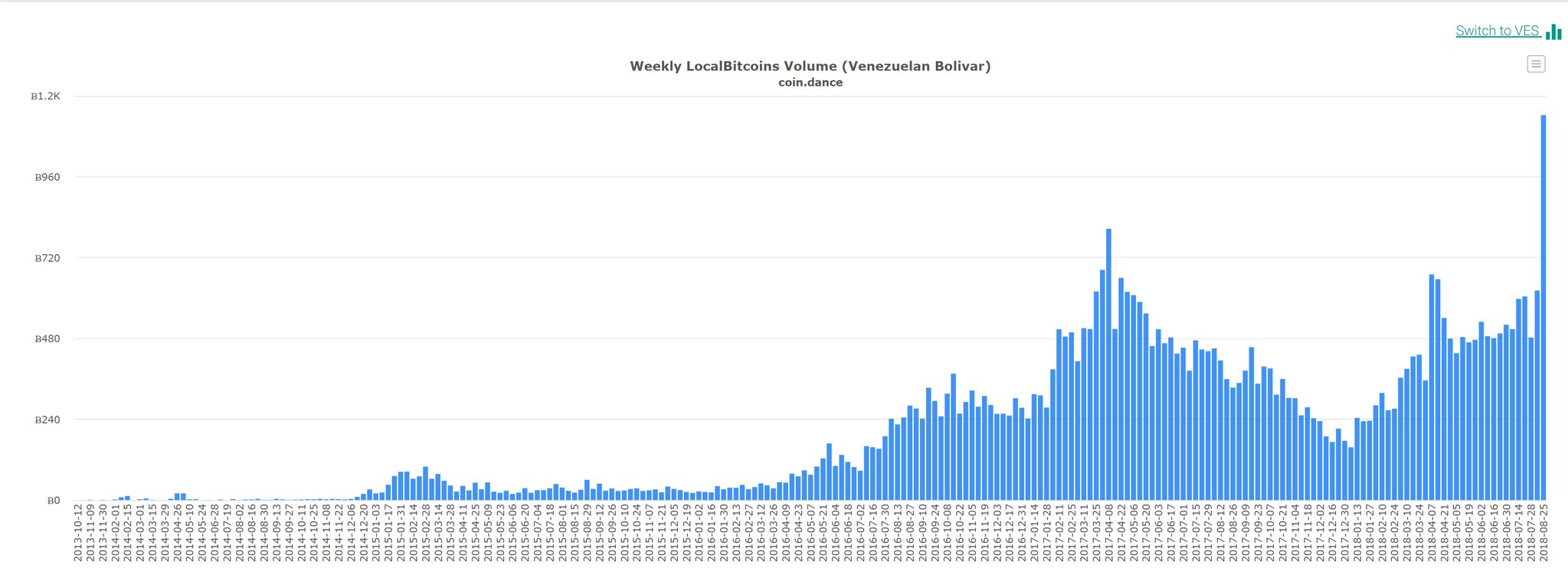

The real outlier though is Venezuela. As we know the economic crisis there has been pushing citizens to find refuge in many places. When it comes to storing value, Venezuelan citizen are increasingly turning to crypto.

Here we can see that the number of BTC traded in Venezuela last week has nearly doubled the already high levels that it saw the previous week.

Wishing you and yours a wonderful day ahead. As always, let me know if you have any questions, comments, or feedback.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.