Import/export prices were a wash, retail sales were solid

In the end, today's economic news wasn't anything to write home about, but more importantly, it wasn't reason for stock traders to sell into resistance levels. In fact, the S&P was able to maintain yesterday's bullish trade in the face of swift down-trend-line resistance. We see this as a sign of short-term strength...or at least a catalyst for more short covering.

Tomorrow, we'll hear about producer price pressures and consumer sentiment. We doubt that either will be a market mover; instead, the coming sessions will most likely be dominated by preparation for next week's Fed meeting (on the 17th), and the triple witch (on the 19th). These two events tend to be supportive for equities (at least going into the event), so the bears will most likely be fighting the tide.

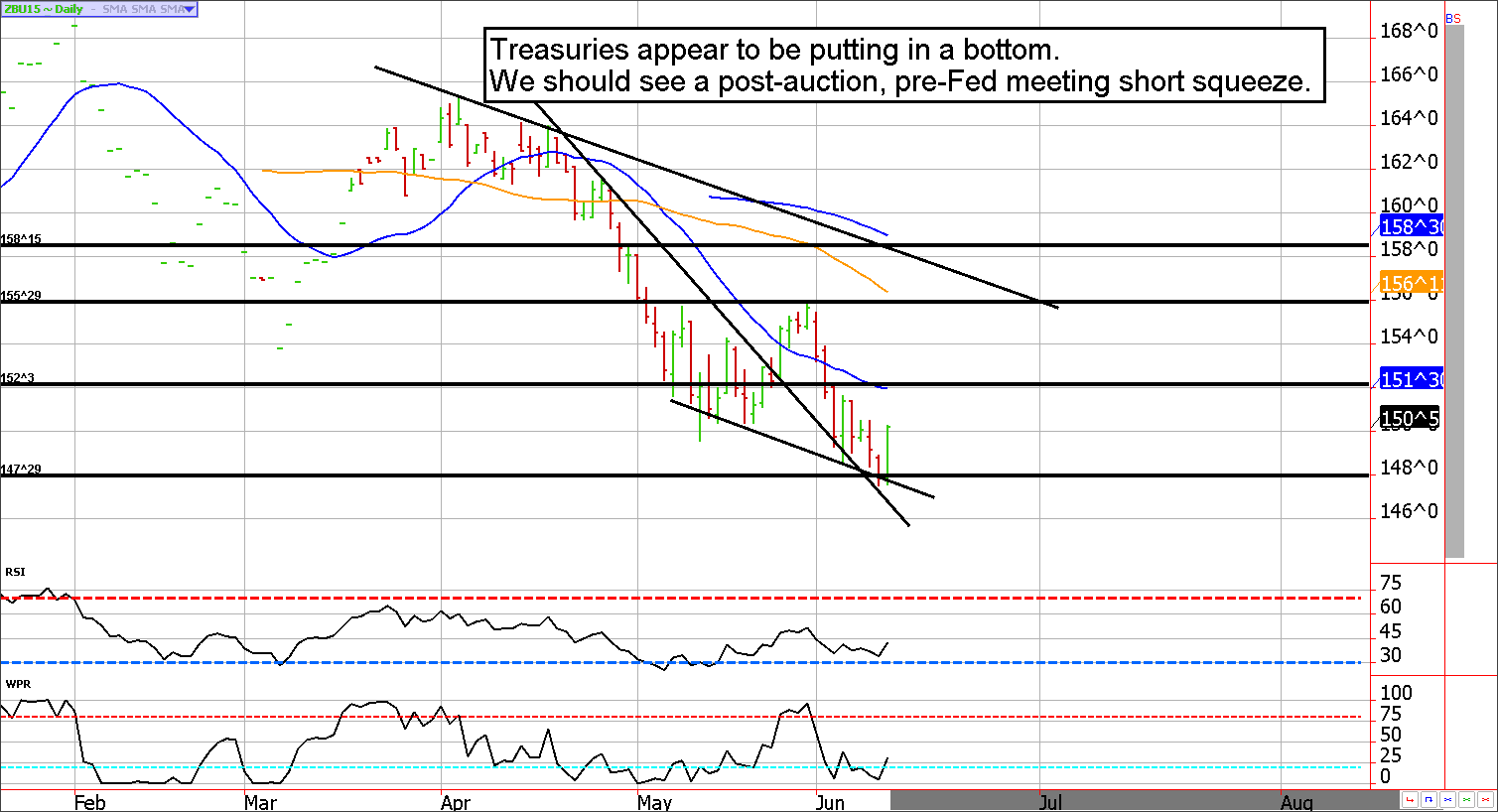

Post-auction buying in Treasuries, a bottom is likely forming

Now that the 30-year bond auction is out of the way, the bulls should feel free to step in. After all, the market has absorbed the supply and, even better, the World Bank recommended that the U.S. Treasury hold off on rate hikes until later in the year. In light of this, we doubt the bearish theme will be able to return in full force, but of course there will be substantial market volatility while prices digest the Fed comments next week.

Generally speaking, the Fed and Janet Yellen have maintained an overall dovish tone that should keep bond bulls interested, and could shake the confidence of the bears. In our view, if the lows weren't seen yesterday, they are probably close. Any large dip is likely an opportunity for the bulls.

Keep in mind that seasonal pressures are supportive this time of year. It sometimes doesn't materialize until July, but the probabilities suggest firm Treasury prices from here.

Treasury Market Ideas

**Consensus:** Bottoms are a process; it will be a rocky ride, but we feel the lows are in, or near. Large dips in Treasuries are likely opportunities for the bulls.

**Support:** ZB : 147'12 and 146'21 ZN: 124'15, and 123'18

**Resistance:** ZB : 152'14, 155'23, and 158'15 ZN: 126'21, 128'08, and 129.

Position Trading Recommendations

*There is unlimited risk in option selling

Flat

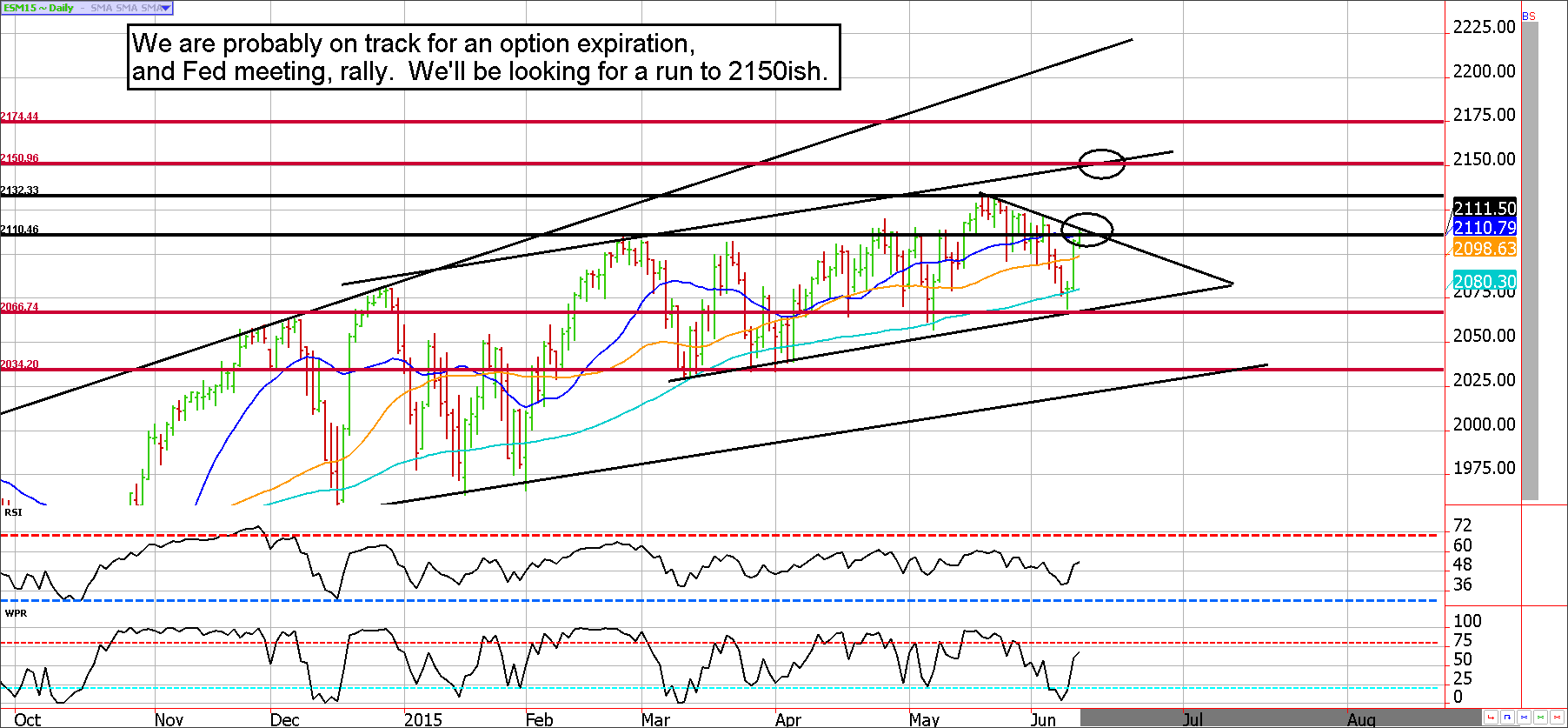

Things should get more exciting in the ES from here

The S&P 500 has been dreadfully boring, but that could be changing sooner than many expect. The quiet nature of the market has a lulling effect; however, this is when traders need to be on their toes the most.

Some of our friends in the pits on the CME trading floor have always said, when going into options expiration (particularly the triple witch), look for a Thursday or Friday low. There has been a strong tendency for prices to rise into expiration. In fact, when the quarterly futures contracts expire there is often a large short squeeze going right into the morning of the expiration (in this case, Friday the 19th).

In addition, a generous client of ours shared some stats he had compiled regarding the S&P futures on Fed meeting days. Over the previous 19 Fed days, the ES has returned an average of .42. However, on the five days before the announcement the average gain was roughly 1.65 and the S&P had settled higher 5 of the last 6. In the five days after the meeting, the average gain was 2.83. While these figures don't paint a picture of "easy and significant riches," it is clear the Fed has had a positive impact on the market overall.

Despite significant resistance near 2111, we can't be bears ahead of two historically bullish events next week. We are looking for 2150.

Stock Index Futures Market Ideas

**Consensus:** Today was a small victory for the bulls - a break above 2111 will confirm an attempt at new highs. We'll be looking for a possible swing to 2150ish.

**Support:** 2080, 2066 and 2034

**Resistance:** 2111, 2132, 2150, and 2174

Position Trading Ideas

Flat

Day Trading Ideas

**These are counter-trend entry ideas. The more distant the level, the more reliable, but the less likely to get filled**

Sell Levels: 2115 (minor), 2127, and 2134

Buy Levels: 2101 (minor), 2092, and 2073

In other futures markets....

April 1 - Buy a July soybean $11.10 call for 5 cents ($250).

May 14 - Buy an October sugar 1325 call, sell a 1425 call, and then sell a 1225 put. This should be an even money spread, or free trade, but involves margin and unlimited risk below 1225. The max profit is about $1100 before transaction costs.

May 20 - Sell a July euro strangle using the 116.50 call and the 105.50 put for about 70 ticks ($875).

May 26 - Buy back July euro 116.50 call near 12 ticks to lock in profit of $250 to $275 for most per contract, before transaction costs.

June 2 - Sell July euro 116 calls for about 28 ticks to re-strangle the market and collect more premium. This brings the position back to neutral.

June 4 - Roll the euro 105.50 puts up to the 108 puts. This locks in a profit on the 105.50 puts and collects an extra $375 in premium, as well as rebalances the position ahead of the employment report.

Disclaimer: Due to time constraints and our fiduciary duty to put clients first, the charts provided in this newsletter may not reflect the current session data.

**Seasonality is already factored into current prices, any references to such does not indicate future market action.

**There is substantial risk of loss in trading futures and options.**