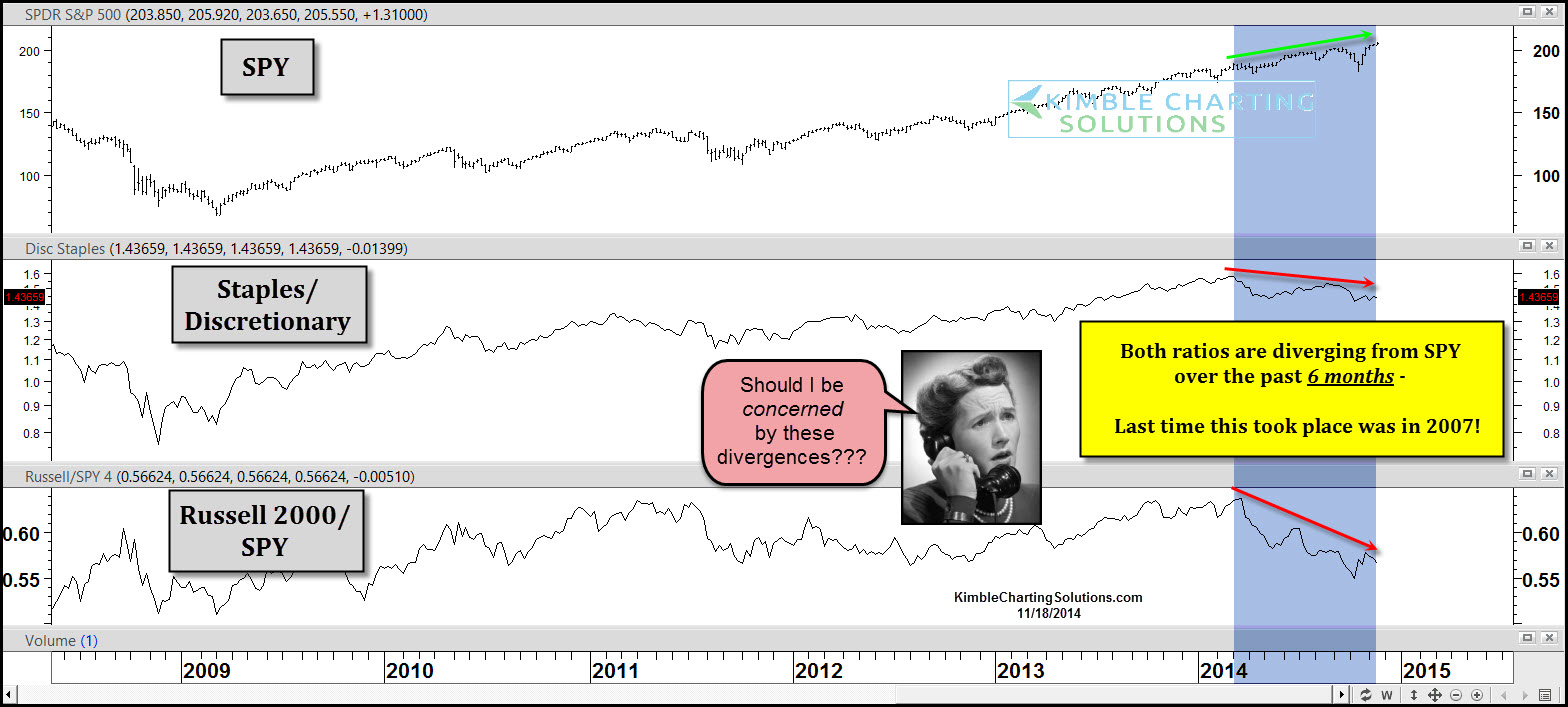

Looking back at 2006/2007, several key market indicators started diverging from the S&P 500, before the large decline in 2007/2008 took place. The above chart compares the Staples/Discretionary and Russell 2000/SPY) ratios against the S&P 500 over the past 5 years.

The blue shaded areas show that both ratios started falling and diverging from the S&P 500 for the majority of the past 6 months. This is the first time that both of these have been heading down together while diverging for this long against the S&P 500, since the 2007 highs.

These ratios can been really important to your portfolio performance and the overall performance of the S&P 500. One day before the October low, the Power of the Pattern shared that Small Caps were poised for a rally. (See why here). After that posting, the markets have experienced the strongest short-term rally this year and one of the bigger surprise rallies in years.

Is this a bearish sign for the S&P 500 going forward? This divergence should be respected and it could matter. At this time until our Shoe Box indicator, High Yields and Advance/Decline start heading down together, it "doesn't matter, until it matters!"

When these indicators do start turning weak, I believe these divergences will matter a good deal.