America is changing its diet.

Consumers are demanding healthier options over traditional fatty fast food. And as a result, “fast casual” restaurants are eating traditional fast food’s market share for lunch.

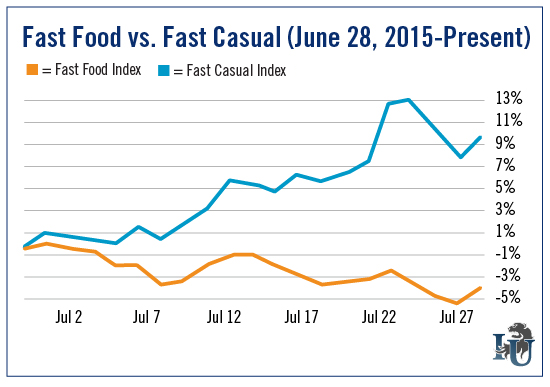

For today’s chart, we have plotted this monumental transfer of power. We created two separate indexes, the “Fast Casual Index” and the “Fast Food Index.”

As you can see, the winner is clear... fast casual stocks are booming while traditional fast food is struggling to keep up.

We kept the indexing simple. We took the top three (publicly traded) companies for each group and equally weighted their returns.

The Fast Casual Index is made up of:

- Popular burrito chain Chipotle Mexican Grill (NYSE:CMG)

- Bakery-café operator Panera Bread (NASDAQ:PNRA) Company

- Mediterranean cuisine outfit Zoes Kitchn (NYSE:ZOES)

And the Fast Food Index includes:

- Fast food and burger titan McDonald`s Corporation (NYSE:MCD)

- Taco Bell, Pizza Hut and KFC operator Yum! Brands Inc. (NYSE:YUM)

- Quick-service burger chain The Wendy`s Co (NASDAQ:WEN)

As you can see, the Fast Casual Index is up almost 10% in just the last month. Meanwhile, the Fast Food Index is down about 4%. And the overall market, measured by the S&P 500, is up just 1.9%.

Earlier this year, Emerging Trends Strategist Matthew Carr took an in-depth look at this sector for Investment U. Here’s an excerpt from his piece:

“Among the millennial generation, the largest and most financially powerful generation, Chipotle is the No. 1 fast food restaurant... Panera is No. 2... Subway is No. 3...

“McDonald's (NYSE:MCD) was able to maintain dominance over Burger King and Wendy's for decades and declare a victory in the great Burger Wars of the 1980s and '90s. But now there are too many options. Too many fronts to fight.”

For investors, this trend is as clear as it gets. Healthier fast casual stocks are in - and greasy fast food companies are in the trash bin.

If your portfolio isn’t already filling up on these market-beating returns, it’s not too late to join the party. Let the trend be your friend.