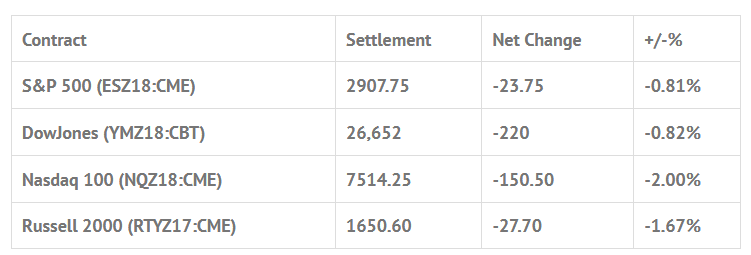

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed lower: Shanghai Comp +1.06%, Hang Seng -0.19%, Nikkei -0.80%

- In Europe 13 out of 13 markets are trading lower: CAC -0.33%, DAX -0.67%, FTSE %

- Fair Value: S&P +4.18, NASDAQ +24.67, Dow +12.36

- Total Volume: 2.15mil ESZ & 390 SPZ traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Employment Situation 8:30 AM ET, International Trade 8:30 AM ET, Robert Kaplan Speaks 12:30 PM ET, Raphael Bostic Speaks 12:30 PM ET, Baker-Hughes Rig Count 1:00 PM ET, and Consumer Credit 3:00 PM ET.

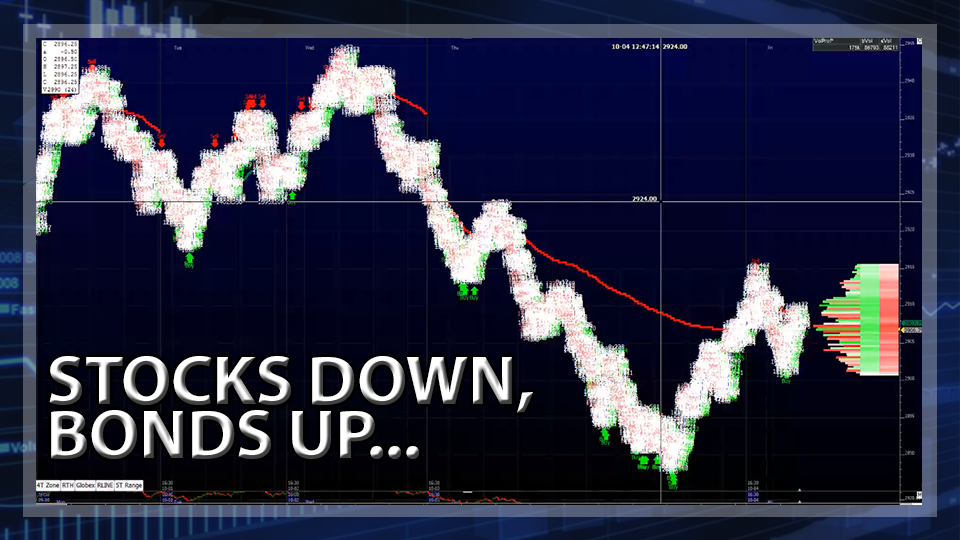

S&P 500 Futures: Stocks Crumble As Treasury Yields Hit Multi Year Highs

I knew Wednesday night that the S7P 500 futures didn’t look good. While the Dow was making record highs the S&P could not hold the rallies. If we have learned anything in 2018 it’s that it has been the year of the great ‘rotation’, and after several days of watching the big institutions sell the Russell 2000, my gut was saying something didn’t look right.

After making a high at 2926.25 on Globex, the ES sold off down to 2913.25, with 280,000 contracts traded. The first print off the 8:30 open was 2923.50, followed by an up tick to 2924.00, then a sequence of lower lows down to 2905.50. From there, the ES short covered up to 2913.25 at 10:10 am, and then in came another round of sell programs that pulled the futures down to 2893.75. The ES then popped up 2904.50 before going through another series of down moves to 2887.50 at 1:20.

Once the 2887.50 low was in, the ES got hit by a few buy programs that pushed the futures back up 2902.50. After a small pullback the ES traded up to 2905.50 just after 2:00 as the MiM started to show buy $133 million. The futures then sold back off down to 2897.25, as the MiM flipped from $185 million to buy to $30 million to sell, bottomed there, and rose into the MiM reveal which came out flat at $28 million to buy. The ES then rose up to 2908.00 and printed 2906.25 at 3:00, and settled the day at 2907.50, down -24.00 handles, or -0.82%.

In the end, I am not surprised at all by yesterday’s selloff, it was a long time coming. Elsewhere, stocks around the world sold off too. The Stoxx 600 lost 1.1%, its biggest one-day percentage decline since Sept. 5, while major indexes in Hong Kong and South Korea continued their losses for the year. While it was a bad day for the U.S. markets the decline also highlighted the recurring theme of the outperformance of the U.S. economy. In terms of the markets overall tone the markets looked bad, but the late bounce was another example of how resilient our markets are. In terms of the days overall trade volume, it was one of the highest in several months.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.