Long-term bond yields are rising with the 2-year rising more than the 30-year Treasury bill. So not only is this a boost for rising nominal yields, it is also a boost for the flattening yield curve. The 3rd factor? It's stocks vs. gold.

Here are US yields and a couple of associated bonds.

Factor #1: Here’s the weekly view of the 10-year yield. We are looking for 2.9%.

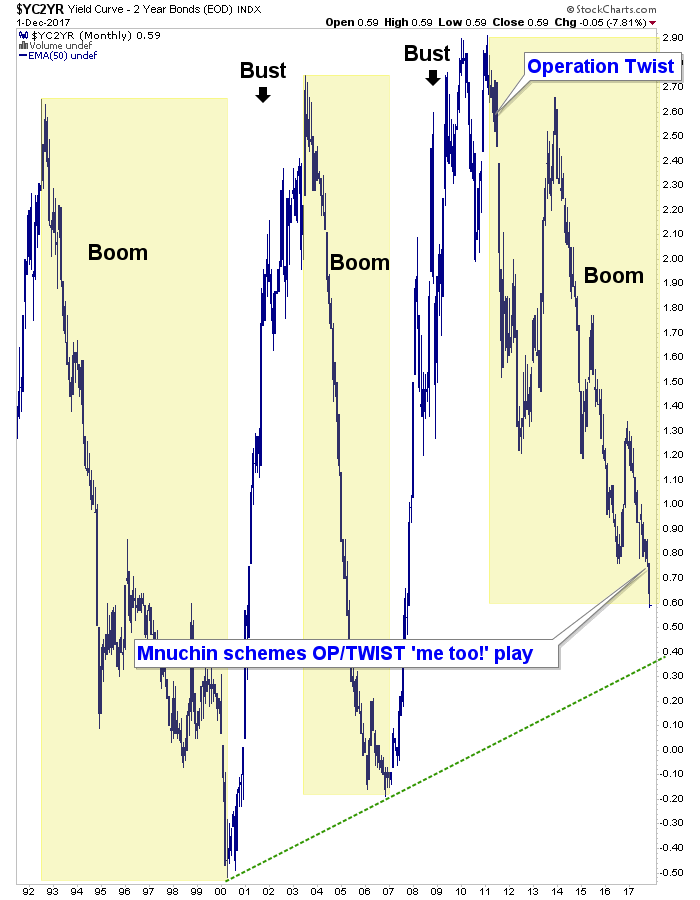

Factor #2: Here is the big-picture yield curve. We are looking for the trend line, flat or inversion.

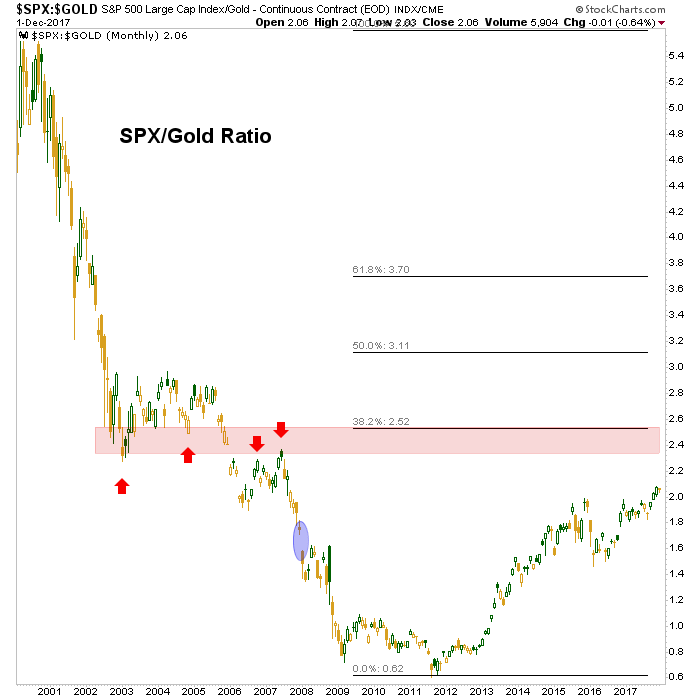

Factor #3: And finally, stocks vs. gold. We are seeking the lateral resistance area and a 38% Fib retrace.

Bottom Line

The confluence of the above can be looked at as bullish for as long as they seek their destinations.

The confluence of the above will be viewed as bearish – very bearish – when target acquisitions are at hand.