Investing.com’s stocks of the week

This post was written exclusively for Investing.com

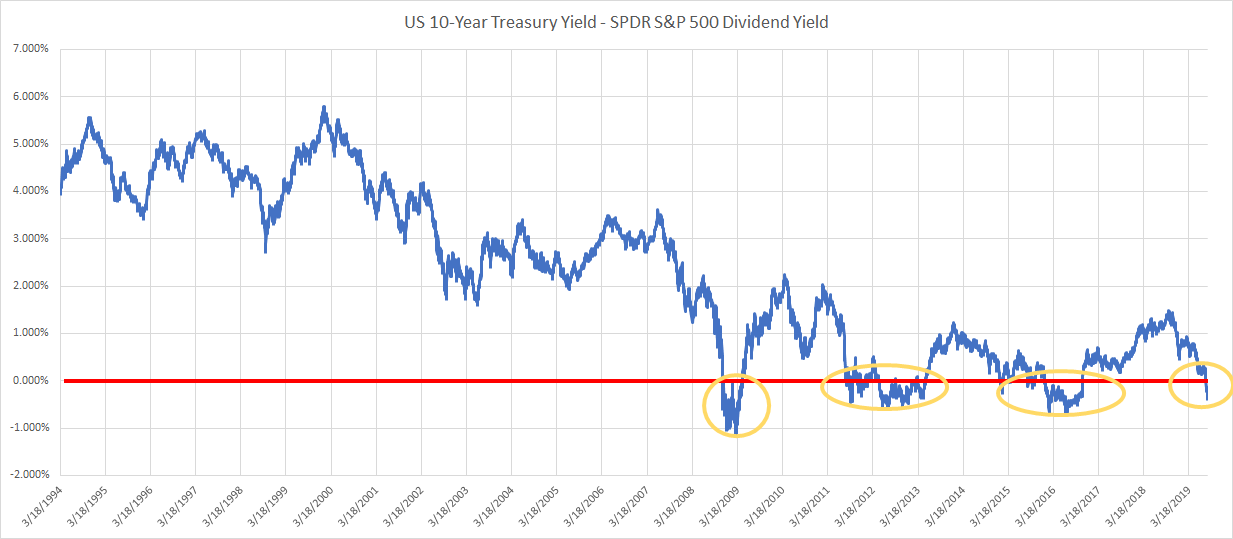

Is the future about to get brighter for stocks? With inversion mania taking hold across the investing landscape, there's one important example that appears to be escaping everyone’s attention: the inversion between the S&P 500 dividend yield and the 10-year U.S. Treasury yield.

Recently, the yield on the 10-year note fell below that of the S&P 500. If history repeats itself, stocks could be about to get a powerful boost.

Using the dividend yields of the SPDR S&P 500 ETF (NYSE:SPY) as a proxy for the S&P 500, and the 10-year Treasury yield have inverted just three times since 1994. Those inversions occurred during the periods of 2009, 2012 to 2013, and 2015 to 2016.

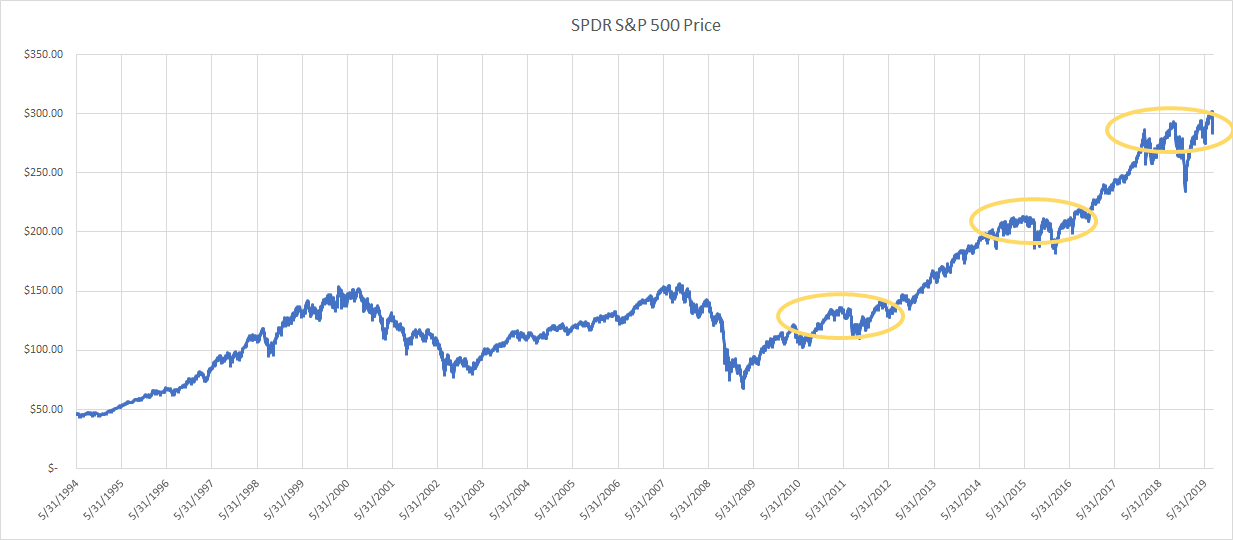

Now, that same type of inversion is taking place again. Additionally, during the 2012 and 2015 periods, the equity market also went through a nearly two-year period of consolidation. In those instances, once the inversion reversed, stocks took off, leading to a significant rise in the equity market.

10-Year/2-Year Inversion

While worries about the 10-year yield and the 2-year yield inversion have been hogging the headlines, few have been paying attention to what was happening with the SPY (NYSE:SPY) dividend yield. Since the end of July, the 10-year Treasury yield has plunged to around 1.55% from approximately 2.1%. That deep dive led to the Treasury rate falling below the SPY ETF dividend yield of 1.88% and resulted in the spread falling to a negative 0.33%. The difference between the two rates is now at its lowest level since November 2016.

Deja Vu?

The inversions in the past also took place during periods of equity market stagnation. During the inversion of 2015 and 2016 the equity market was moving sideways, from March 2015 until November 2016, with the S&P increasing by just 0.34%—an equity market consolidation that lasted for nearly 18 months.

That was followed by the post-presidential election rally in the equity market, with the S&P 500 increasing by around 35% through January 2018.

A similar thing also happened from April 2011 through July 2013 when the S&P 500 increased by just 0.2%, while the 10-year yield also traded below the S&P 500 ETF dividend yield. The S&P 500 then went on to advance by a stunning 55% from July 2012 to March 2015.

Amazingly, the past 18 months have seen several similarities to the prior periods mentioned above, including a period of equity market stagnation. Since the end of January 2018 through today, the S&P 500 has increased by just 0.85%, mirroring what occurred in both the 2012 and the 2015 doldrums.

If history repeats itself, then the equity market may be getting ready for its next major leg higher.

History Repeating Itself?

It certainly seems possible that the equity market will soon see its next significant advance. Given the option between owning stocks or bonds in this low rate environment, the choice seems to favor that of owning stocks.

As well, stocks offer the added advantage of earnings growth and stand to benefit as the global economy begins to improve from its recent slowdown.

The reason history seems to be repeating itself appears fairly clear: during both the 2012 and 2015 periods, investors were confronted with concerns over global growth. From 2011 through 2013 there was a high degree of uncertainty around problems taking place in the European banking system, while in 2015 and 2016 deflationary forces were taking hold around the world.

Today’s situation doesn’t seem that different. Currently, investors worrying about how a U.S./China trade war may slow growth and push the global economy into recession.

Should the problems of the present be resolved as were those of the past, rates on the 10-year yield should begin to rise again. Additionally, as the world starts to show signs of improvement, the equity market should also start moving higher.

Though the phrase “history repeating itself” is often used in a negative context, in this case, it would be something for equity investors to hope for: a brighter future for their stocks.