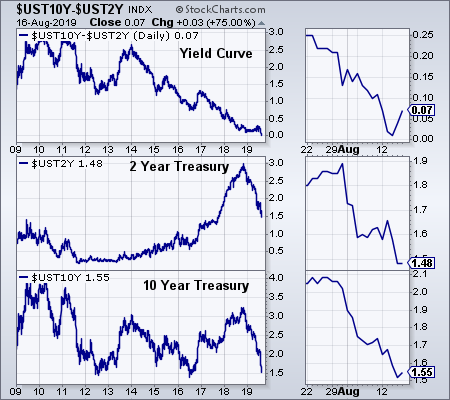

On Wednesday the financial media would have one believe the world and market's would fall apart as a result of the 2-Year/10-Year U.S. Treasury yield curve inverting, i.e., the 2-year yield moved to a higher level than the 10-year yield. The S&P 500 Index fell 2.93% on the day. The importance of the inversion is the fact the yield curve has some predictive power in recession forecasting. From a technical perspective though, the yield curve inverted on an intra-day basis but not on a closing basis. At the close Wednesday, the curve was positive, even if only by 1 basis point and has since steepened to 7 basis points.

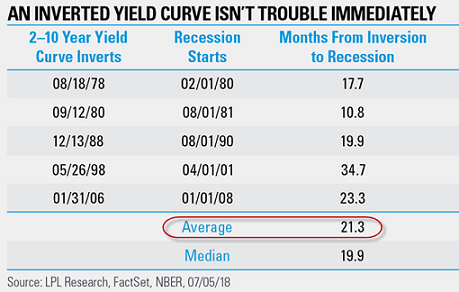

A flat to inverted yield curve is one signal that economic growth may slow in the future. However, as Ryan Detrick, CMT, Senior Market Strategist at LPL Financial, noted recently, the slowdown or recession historically has occurred ten months to nearly three years following an inversion. Also, in a number of instances, the S&P 500 Index does not peak until sometime after the inversion and in several cases, nearly two years after the inversion.

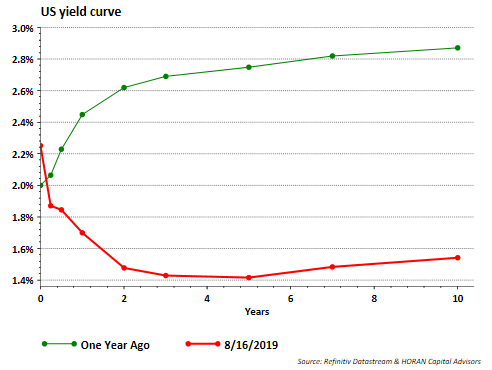

Our firm does find significance to the economic implications when the yield curve (2y/10y) does invert. It is not the only metric used to determine the future direction of the economy though. And technically, the curve did not invert on a closing basis and technicals do matter. However, the current shape of the yield curve does warrant evaluating the potential implications the bond market is projecting.