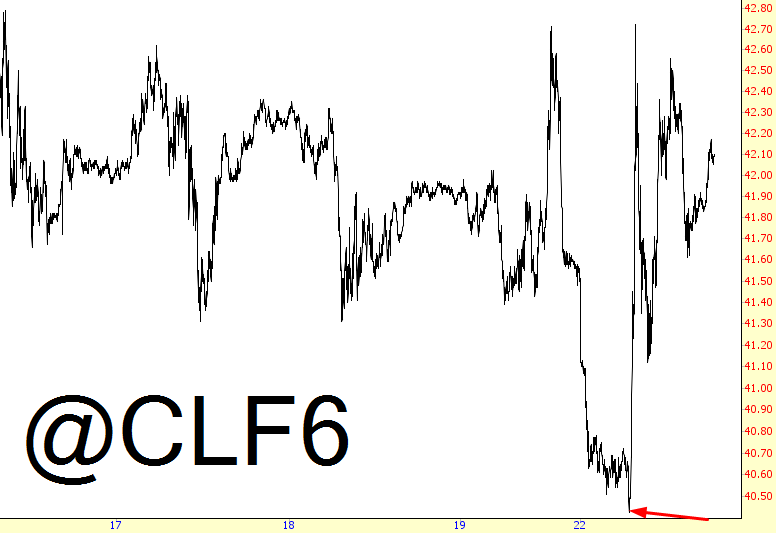

Monday was an odd combination of boring and annoying, but I managed to eke out a small profit by day’s end. The centerpiece of the lunacy early on was crude oil, which I was excitedly watching crumble last night. In the early morning hours, I glanced at my iPad, and I had a total WTF moment when I saw crude was rocketing higher based on the fact that Saudi Arabia, which apparently has joined the rest of the world in believing descending markets should be forbidden, stated they would do everything in their power to reverse oil’s price slide (see arrow mark). Most of that gain unraveled not long after, but then crude gyrated aimlessly the entire day. Oil’s muddy water is even less clear now.

Equities continue to be held aloft by leprechauns, faerie dust, and wishful thinking. It seems August 21 and 24 represent the only crack where sanity was permitted to enter. The equity markets, to me, are sort of like having O.J. Simpson stand up for his verdict every day and be found Not Guilty. Every sensible person knows he’s guilty (and that the market is wildly overvalued), but, miracle of miracles, he’s let free (and the market stays aloft).

Thus, we have the Dow Jones Composite that, for the third time, is just kind of hanging out at the upper reaches where, so far, it has simply limped lower.

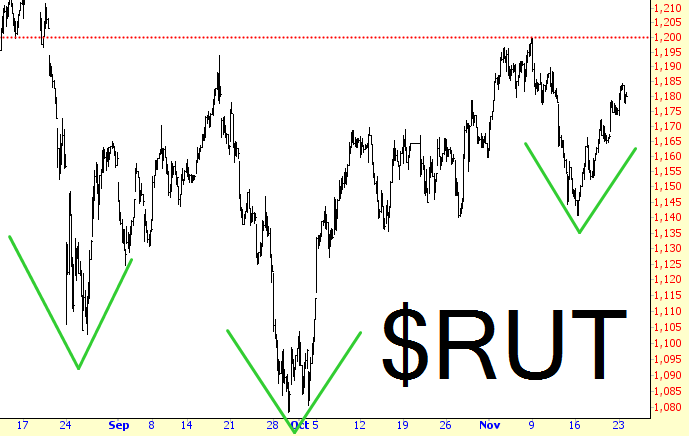

The risk to the bears, I think, is best illustrated by the Russell 2000 (which, as an index, was stronger today than, say, the NASDAQ). The potential inverted head and shoulders is shown below, and a break above 1200 would pretty much put a knife through the heart of the bear (for the 527nd time) for the foreseeable future. I don’t take the year-end strength lightly, because that’s been the norm.

If there’s one sector I remained focused on with my positions, it’s still oil/commodities, nicely expressed with the oil and gas sector index shown below. Just like 1200 is a key level for the Russell 2000 shown above, so too that number is important (although not as important) to the XOI. There’s no other sector better-poised for meaningful downside that this one.

I can only hope that, as with O.J., if justice isn’t served for the first crime, then stocks will just get tripped up later by something stupid like trying to rob a memorabilia dealer in Las Vegas at gunpoint. Just sayin’.