Last week the Fed announced it intends to hike rates another two times this year, with three more hikes next year. The Fed also announced that it will continue to increase its QT program with the goal of eventually withdrawing $50 billion in liquidity per month, or some $600 billion per year.

The market didn’t like this announcement, with stocks in a sea of red. This has raised the question: Is the Fed going to trigger a market meltdown?

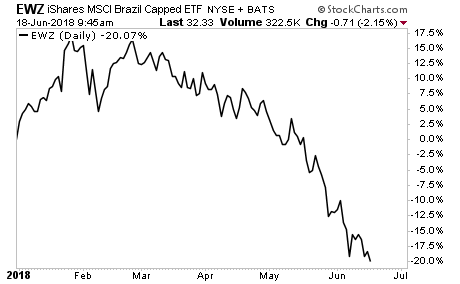

How you answer that depends on who you ask. If you ask an investor in many of the emerging markets, the answer is, “The Fed already has.” The Emerging Market ETF is down 15% from its recent peak, while other specific emerging markets such as Brazil are down 20% year to date.

That Makes NINE Straight Double Digit Winners!

Our options trading system is on a HOT streak, having locked in NINE double digit winners in the last four weeks.

Don’t believe me?

All of this can be squarely set on the Fed’s shoulders. Both the ECB and the BoJ are tapering their QE programs. The former will end its QE program in December, the latter… who knows? The point is, both are easing, while the Fed is hiking rates 3-4 times per year AND withdrawing liquidity to the tune of $30 billion per month.

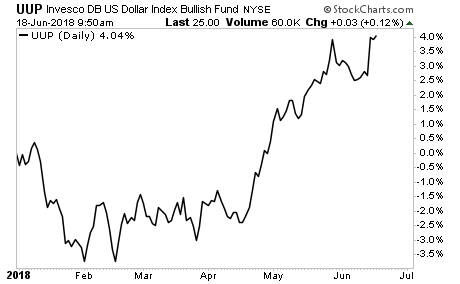

My point is that while most Central Banks are easing, the Fed is TIGHTENING as if it’s dealing with runaway inflation. This is forcing the US dollar higher which in turn is putting the highly USD leveraged system under duress.

PowerShares DB US Dollar Bullish (NYSE:UUP)

If the Fed doesn’t figure this out soon, we could very well see the carnage of the Emerging Markets space spread into the S&P 500. I remain VERY bullish in the intermediate term, but the Fed could make things NASTY in the short-term if it doesn’t fix this,

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI