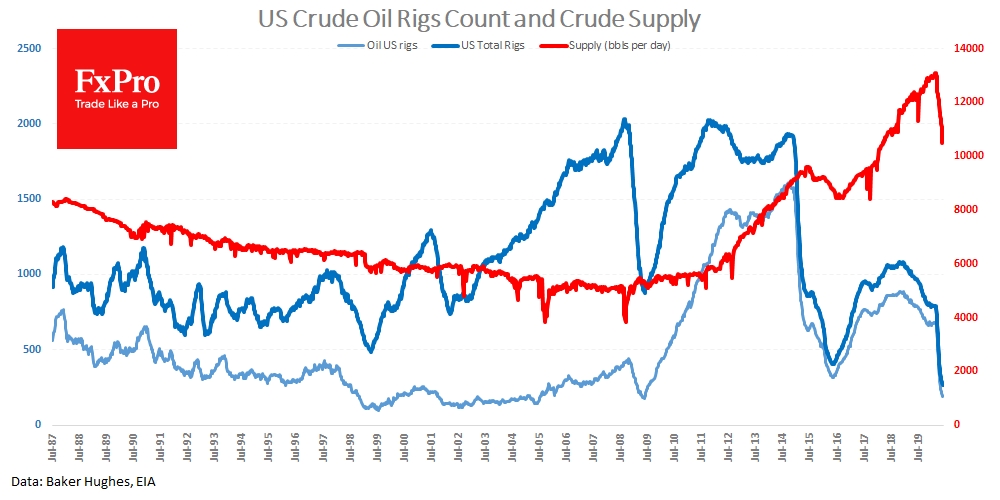

US companies continue to cut production and drilling activity despite the rise in oil prices. Rig-count data published on Friday showed the number of oil rigs fell to 189 (-10 per week).The number of oil rigs has fallen to levels seen at least a decade ago. The situation with natural gas is even worse. At the beginning of the century, the share of gas production drilling rigs exceeded 60%. Now it has more than halved to 28.2%. On the whole, all this is turning into a very alarming picture for the US energy industry.

The total number of drilling rigs (oil + gas) fell by 16 to 266 last week to a new historic low.

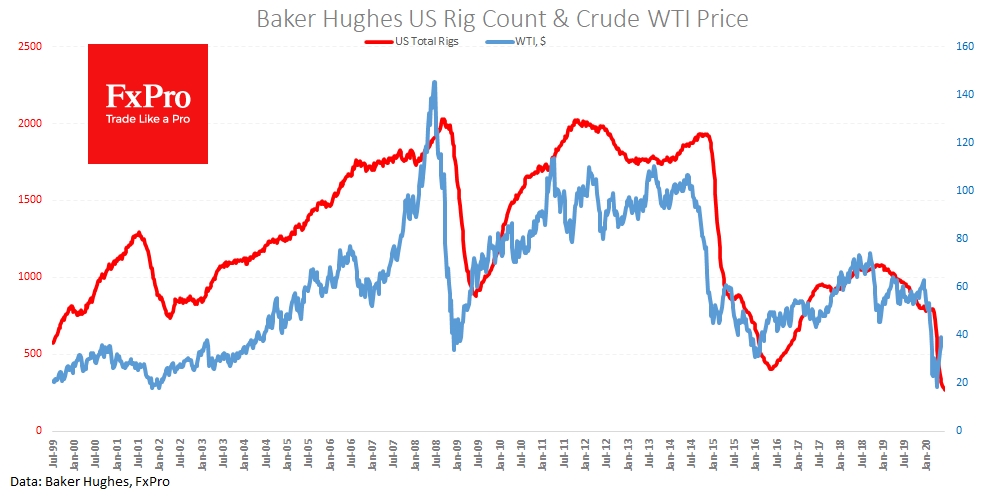

Despite the dramatic decline in drilling activity this year, US oil production has steadily increased since 2016, reflecting a fundamental shift in well productivity. However, the drop in rigs in early 2020 may also well be a legacy of 2010-2016, when oil was closer to $100, meaning many facilities cannot afford to pump crude at current price levels.

Chronic underinvestment also stops companies from using a recovery in the price to boost drilling activity, as was the case in 2016. At that time, the number of operating drilling rigs quickly shifted to growth, as did production.

This is not happening now. Moreover, new data showed a drop in production in the U.S. by 0.6 mln to 10.5Mbblpd the lowest since March 2018.

Separately, US oil producers have other problems, aside from weaker crude prices. On Friday, ratings agency Fitch reported growth in the default rates for US companies is approaching 4%, while in the energy sector, this is 17%. The energy-sector default rate is expected to rise to 18% by the end of the year, while the rate for other businesses will reach 15%.

All this suggests that shale producers may be sidelined, even as oil prices rise. Higher prices will likely slow the wave of defaults, but won't stop them. The existing debt load of shale producers makes it less likely that banks will simply extend new credit to finance a resurgence in the industry, having felt the pinch of losses.

The situation is further complicated by the fact that in addition to the energy sector, creditors will see defaults across many industries, which was not the case in 2016, when only oil suffered. This will severely reduce the demand for risk from investors in US energy markets.